I don’t mean to to be an alarmist, but this week my concerns about Tether have reached critical mass.

Before I get into it, I’d like to point out that what follows is a somewhat informed rant. I’m no stranger to cryptocurrency, or accounting. I’ve done some writing and speaking on the topics, and also founded a Bitcoin payment service called Bylls back in 2014. In the accounting world, I served as the first Treasurer of the Blockchain Association of Canada, and have worked on audits of public and private businesses for nearly 5 years at a public accounting firm.

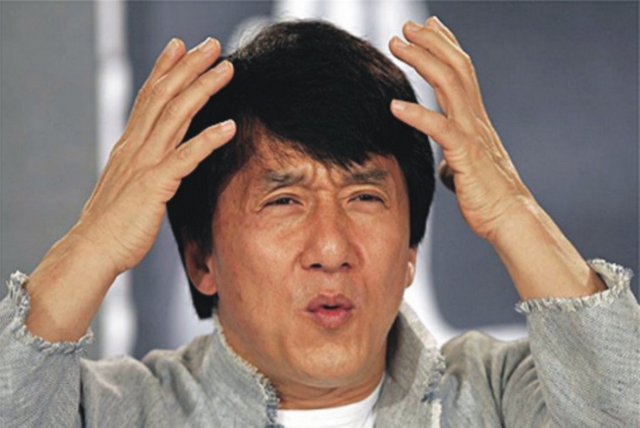

I think Bitcoin and many other crypto projects are fascinating. Decentralized technology is at the intersection of economics, politics, finance, technology and society, making it difficult to ignore. As with any multidisciplinary field, the learning curve may be steep, but luckily there are many helpful resources to get you started. While many believe cryptocurrencies will someday change the world, even the most knowledgable in the space know that the recent speculative frenzy is not necessarily an indicator of success, and that we shouldn’t get ahead of ourselves quite yet:

This brings us back to Tether.

In theory, there is nothing wrong with a cryptocurrency backed by the US dollar. It could act as a tool to reduce your exposure to volatility, and make transferring funds between exchanges much easier (hooray for arbitrage!). There’s clearly demand for such a concept, and Tether isn’t the only “stablecoin” in the game (see: TrueUSD and Maker).

My issues are directly related to the execution of this concept by Tether’s management team. Their public statements and operating style make for an interesting yet troubling read, as detailed in posts by the anonymous blogger Bitfinex’ed.

tl;dr: Tether has suffered from banking constraints, lied about being regularly audited, misrepresented consulting work performed by Friedman LLP and most probably don’t have ~$2.2 billion in US dollars to maintain the 1:1 reserve ratio that they so proudly claim to.

I’ve tried to ignore the red flags, dismissing the evidence against Tether as circumstantial and hyperbolic. The work of half-baked conspiracy theorists. How could a company so shamelessly mislead the public and issue tokens without actually having the US dollars to back them? There must be a reasonable explanation for why they haven’t proven it yet…

Needless to say, the cognitive dissonance has made itself harder to ignore.

Case in point: over the weekend, CoinDesk’s Marc Hochstein finally shed some light into Tether’s relationship with its supposed auditor. According to Marc’s article, a Tether spokesman had this to say about the company’s relationship with the accounting firm Friedman LLP:

“We confirm that the relationship with Friedman is dissolved. Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame. As Tether is the first company in the space to undergo this process and pursue this level of transparency, there is no precedent set to guide the process nor any benchmark against which to measure its success.”

Now, I believe in due process and the presumption of innocence, so I’m not here to say definitively whether Tether has all the money that it claims to, or whether its management team is competent and has been acting in good faith.

I’m also not going to make conjectures based on circumstantial evidence.

Instead, I’d like to point out a few reasons why this statement is so problematic that it hurts my brain.

#1: Auditing cash balances is not complicated or time consuming

I would love to know what kind of excruciatingly detailed procedures Friedman LLP was engaged to perform. If you’re not an auditor, here are a couple of things you should know about auditing cash balances:

Cash is usually one of the least risky and quickest financial statement items to audit, especially for companies like Tether with only a few bank accounts in two currencies (US dollar and Euros)

Generally, procedures performed on cash balances are performed by the most junior person on the team (and later reviewed by someone more senior). Said differently, the procedures are simple and non-technical that they’re usually performed by the same person making the afternoon coffee run

It is very straightforward to audit a bank account balance. Since Tether claims to hold fiat currency as reserves, it’s safe to assume that they don’t have many bank accounts and the activity/volume is likely quite low. To confirm Tether’s cash balances as at a given point in time, an auditor would need to:

Check that the amount on the bank statements match what Tether has in their books (or on their “Transparency” page)

Send a bank confirmation to Tether’s banks (read: fill out a template and email it to Tether’s bank so they can confirm that all the amounts and details and ownership rights are accurate)

Document in the working papers that the amounts confirmed by Tether’s bank exist, and that Tether does in fact have the rights and ownership of said accounts

That’s pretty much all that’s needed to get sufficient evidence to support a bank account balance.

If you wanted to be extra thorough, you could also perform some detailed testing. How do you do that? Pick and test a sample of transactions immediately before and after the audit date and make sure that the company didn’t just borrow funds so that they could appear to be solvent when the auditors show up. This type of testing also doesn’t take that much time.

Why Tether hasn’t been able to get this done yet is beyond me.

#2: Tether is not the first cryptocurrency company to go through the audit process

Tether also claims to be “the first company in the space to undergo this process” which is, unsurprisingly, not accurate.

They’re not even a close second…or third…

A shortlist of crypto-related companies that have undergone or facilitate the performance of a financial statement audit:

QuadrigaCX, a publicly-traded Canadian cryptocurrency exchange, has had quarterly and annual audits for a couple of years

New York’s BitLicense regulations require annual financial statement audits, which means all 3 licensed companies have also been audited (or at least still have relationships with auditors, or their licenses would be revoked)

The Greyscale Bitcoin Investment Trust is a publicly traded entity and has been producing audited financial statements since 2015. Oh yeah, their custodian is also subject to audits!

There’s a company called Libra that builds accounting, tax and audit software for companies in the blockchain/crypto space

There’s even an accounting firm that caters specifically to all the crypto hedge funds (which are much more complex to audit than a bank account, by the way)

There are probably more, so please post any that you know of in the comments

This is a strange thing to lie about, and the only rational explanation is that they actually believe that they’re the first.

Assuming that’s true, I still have a dumb question: why would you boast about being the first crypto company to go through the audit process without actually completing it first?

Is the bar so low for cryptocurrency companies that simply expressing the intent and desire to be audited is enough to satisfy people?

If so, Tether deserves a participation award for trying their best to hire an auditor, I guess.

¯_(ツ)_/¯

#3: Tether’s arrogance is painful

Another good one from the statement:“There is no precedent set to guide the process nor any benchmark against which to measure its success”

No precedent? Millions of bank accounts are audited every year.

Let’s recap: the well-defined process to audit bank account balances is intern level work, and a universally recognized benchmark to measure the success of an audit is whether it was completed in a reasonable time frame (or at all).

#4: There’s no good way to spin “the inability to complete an audit in a reasonable time frame”

I’m still not sure what Tether was hoping to achieve by releasing this statement. It’s unclear who is responsible for being the incomplete audit, so let’s think about what the causes could be.

At the beginning of every audit, an engagement letter is signed before any work begins. It’s a contract between the company’s management team and their audit firm, outlining the responsibilities of each party. The main deliverable agreed upon is the Auditor’s Report. Getting that signed report is pretty much the only reason you would perform an audit in the first place.

The best you could hope for is an unqualified opinion, which means that all of the numbers look good to the auditor based on the procedures they have performed and whatever accounting rules you’re supposed to be following.

Not being able to complete an audit in a reasonable timeframe could happen in a few situations:

when the auditor cannot obtain sufficient appropriate audit evidence

when there are significant uncertainties in the business of the client

when the auditor has a conflict of interest

If any of these were true, the auditor would instead issue a Disclaimer of Opinion, which means that they have decided not to issue an opinion on the financial statements even though they were hired to do so.

This is really bad, and incredibly rare. The financial statements are basically useless in this case, because the auditors didn’t get enough evidence to give an unqualified opinion (that’s the good one).

Did Friedman LLP perform their procedures, only to arrive at a Disclaimer of Opinion (which Tether obviously wouldn’t want to release)?

Were they even engaged to perform an audit in the first place (was an engagement letter signed)?

Maybe the audit partner had a few too many one night and lost the auditor’s report?

If Tether really wanted to be transparent, they could at least let everyone know why their audit couldn’t be completed in a reasonable time frame, instead of discussing the subjectivity of “success”.

So, what does this all mean? Sadly, we still don’t have any real answers.

For all we know, Tether is sitting on a ton of cash and we’ll all feel like idiots for doubting them. Wouldn’t be the first time I was wrong.

That being said, many important questions have gone unanswered, which does not inspire confidence in a company that’s supposed to have over $2B US dollars and counting.

There are a lot of simple ways for Tether to prove that they’ve been acting in good faith, and that their tokens are fully backed… but we have not seen anything other than a mostly useless consulting report, stall tactics and unfulfilled promises.

Yet somehow, most people still seem unfazed by the whole thing.Perhaps there have already been so many hacks, scams, ransomware attacks and ponzi schemes that we’ve become desensitized to it all? Another $2B isn’t exactly a drop in the bucket, but as we’ve already learned… life goes on.Or maybe it’s because we have more important things to worry about, like privacy, scaling and maintaining decentralization?

Whatever the reason, I guess it ultimately doesn’t really matter whether Tether has the money they claim to.If they don’t, I believe the short term pain will be a small price to pay for weeding out yet another group of bad actors from the community, and we’ll hopefully learn some valuable lessons in transparency and accountability.

And if they do actually have over $2B US dollars lying around somewhere, then you can all safely go back to deciding what color Versace suit best matches your new Lamborghini.