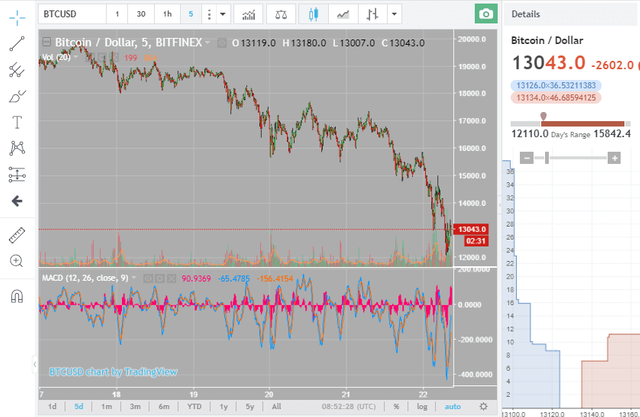

Earlier today, on December 22, the bitcoin price fell by more than 22 percent from $17,000 to $13,300. Analysts have attributed the fall to the rapid surge in the price of bitcoin over the past month.

Bitcoin Price Still Up 70% on Monthly Basis

Since November 22, within the past 30 days, the price of bitcoin increased by over 91 percent even with the price of bitcoin at $15,900. The price of bitcoin on November 22 was $8,000 and even with the consideration of the latest price correction to $13,300, the price of bitcoin is still up by 60 percent on a monthly basis.

In fact, on December 6, Bitfury vice chairman George Kikvadze emphasized the passage of an important milestone for bitcoin, surpassing the $10,000 mark. Kikvadze described the $10,000 threshold as a psychological level and told the community that anything is possible beyond $10,000.

“What a momentum. Buying up more at $13,000. As I said $10,000 psychological level was passed. Now anything is possible,” said Kikvadze.

The bitcoin price is still at the same level as it was on December 6. Hence, while the price of bitcoin has decreased by more than 22 percent, it is important to acknowledge that the price of bitcoin had increased by more than 91 percent over the past month and consequently, a 22 percent correction occured.

Moreover, the price of bitcoin decreased the least in contrast to other cryptocurrencies in the market. Ethereum, Bitcoin Cash, Litecoin, Dash, and Monero have all declined by more than 25 percent in value.

Optimistic Factors to Consider

With its strong network effect and support from leading financial institutions, bitcoin is still in an optimal position to penetrate into the traditional finance market. In addition to bitcoin futures listings by the Chicago Board Options Exchange (Cboe) and CME Group, $98 billion investment bank Goldman Sachs is preparing to launch a bitcoin and cryptocurrency trading desk.

According to Bloomberg, sources familiar with the Goldman Sachs cryptocurrency department stated that the company is currently assembling a team in New York to fully launch and operate a cryptocurrency trading desk.

Goldman Sachs spokesman Michael DuVally said:

“In response to client interest in digital currencies, we are exploring how best to serve them.”

Still, in the short-term, cryptocurrency analysts including Crypto Rand encouraged investors to be cautious about bitcoin’s price trend because of the lack of volume. CryptoRand emphasized that as of current, traders are not buying the dip.

ShapeShift CEO Erik Voorhees also noted that the transaction fees of bitcoin have surged to a point in which bitcoin fees have started to cost more than bank wires. Voorhees wrote:

“Fellow Bitcoiners, are you ever going to realize how problematic these fees are getting? Average fees now over $40 per transaction. A year ago avg fee was $4. A year prior, $0.40. Growing faster than price, and exponentially with usage. We just spent $4800 to move 15 BTC in one transaction.”

It’s a roll a coaster enjoy the ride !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit