The Swan Pacific Bitcoin festival recently hosted a panel discussion with the provocative title, "Are halving price cycles bullshit?" Led by Nik Bhatia, the founder of Bitcoin Layer, the panel featured insights from prominent figures in the cryptocurrency space. The focus of the discussion was to explore whether the upcoming Bitcoin (BTC) halving event, cheekily referred to by the crypto community as the ‘halvening’, is indeed a reliably bullish event or merely a narrative that attracts inexperienced investors.

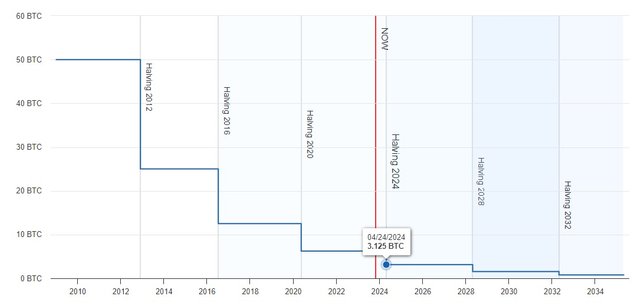

Bitcoin halving is an event that occurs approximately every four years, reducing the reward miners receive for confirming transactions by half. This process is programmed into the Bitcoin protocol to limit the total supply of Bitcoin, making it more scarce over time and potentially increasing its value.

Image source: coinwarz.com

The prevailing belief in the cryptocurrency space is that Bitcoin’s supply halving is a bullish phenomenon, leading to substantial price increases. Many in the industry eagerly anticipate this event, often mentioning it alongside the potential approval of a spot Bitcoin ETF as the next key catalyst of a BTC bull run.

However, it is crucial to challenge long-held assumptions, particularly in the context of the highly volatile world of cryptocurrency, given the numerous bearish events experienced over the past two years.

The panel, composed of C-level executives with interests in crypto mining, exchanges, and investments began by addressing the primary driver of Bitcoin’s price. Liquidity was brought up as the dominant factor as analysts argued that market flow was more important and that the halving’s impact on price was minimal. However, others on the panel argued that the halving remains a bullish event, even though the magnitude of its effect may be debatable. The panelists agreed that while the halving could impact the market, its significance may diminish over time.

Are all halvings equal?

Just because halvings have been bullish events in the past, they might not continue to have the same impact in the future. A key consideration is that halving primarily affects supply and this becomes less significant as time progresses-half of a half is less of a reduction in the amount of BTC than half of the original whole. Still, it may have a psychological impact on the market.

Investing isn’t only about mathematics, however, it’s also about emotion, especially in the cryptocurrency market, where pure sentiment can drive wild speculation and volatility. Despite their reservations about the impact of Bitcoin supply halvings on its price, all panelists expressed a positive long-term bullish outlook for Bitcoin, reaching a consensus that liquidity would be the driving force for Bitcoin’s future price and that the halving event could continue to be a powerful sentiment driver.

Bullish Predictions For The Halving

Market participants are divided on how Bitcoin's price will respond to the upcoming block subsidy halving, but bullish predictions come from crypto influencers CryptoCon and Rekt Capital. The former suggested that Bitcoin's price will likely gravitate toward $130,000 in the next cycle, with historical patterns indicating that 2025 could be the year for the next cycle peak, approximately double the previous record set in 2021. However, Rekt Capital cautioned that the pre-halving year of 2023 could bring new local lows and a potential protracted price downturn, historically seen around this time in Bitcoin's four-year halving cycles. Because prices tend to go up again around the actual halving event, Rekt advises treating these lows as opportunities for re-accumulation.

Image source: StormGain cryptocurrency exchange

Whether it's in anticipation of the launch of Bitcoin spot ETFs or pre-halving excitement, it’s a good time to accumulate BTC to profit from future price movements. Remember, StormGain offers the best conditions to buy and trade BTC and other digital assets, all with the convenience of a powerful, user-friendly app. Sign up now to trade crypto with StormGain’s exclusive perks!