Hello Reader,

Looking for capital or finance for a company is a difficult task and at the same time, such a technique requires a lot of paper work or endless days of moving around.

To cut these excessive rungs of ladder, SME Banking Platform came about as a breakthrough of one of its kind that is only about simple technique being put in to use. You would be in awe to know how SME has put across a simple set of structure through which you can easily go on and fulfil your dreams.

Service to the Micro and Small Business

As for the vision of SME platform, their aim is to provide capital for the small businesses spread across Africa. Moreover, from now on all the banking services would find their basis on technology. This step would without any doubt prove to be a fruitful one for the technological growth in the years to come.

Decentralized Money Remittance Service

Access to funds received from relatives abroad at times becomes a tiresome process. Therefore, keeping these views in mind, SME came up with a pocket friendly decentralised money remittance service. In order to turn it in to a reality, there is SME, the cryptographic token of SME Banking Platform.

This token has its links with the Blockchain based remittance service so everything will generally be in place and there would not be any issue later on!

Let Us Take a Look at the Market Trends

Change is the order of the day.

And some of you might have noticed that the Sub Saharan Africa witnesses an economic growth continuously. On an average 80 % of this economic growth is due to the backing of SMEs.

With such a stupendous amount of support, it becomes imperative to bring in technology so that every single thing is in order and there is nothing out of place. To add more power to the people, there is use of latest technology as well.

How does SME Work?

Vision and mission of the SME Banking Platform come together to have some of the following aspects -

Microfinance Bank

As the name says, it lends money or is a micro lender to both small and micro businesses. In addition, individuals can avail their services. This microfinance bank finds its basis on the Grameen Model or the Group Lending Structure from the Grameen Microfinance Bank of Bangladesh.

With an online crowd - funding portal, assistance would be given to the small businesses irrespective of the method being used.

Digital Banking

Clearing basic KYC requirements is the key to opening an account with the SME Banking Platform. This account shall be a bit different in terms of its use, as you can make use of it just like a regular account or a crypto currency wallet well choice is yours here! In case you use it as a cryptocurrency wallet then it is only for the SME Tokens.

At the end of the day, such a crypto currency account helps you to own an account, which is helpful in transferring fiat and the crypto currencies without any disturbance. It serves to be easy on your pocket as their budget give the impression of being quite less when compared to the rest of the other similar accounts.

Small Business Gets Micro - Payments Application

Online payments have now become a thing of the present as they make things quick than slow. Businesses small or micro, whoever associates themselves with SME will be left in awe because it is indeed a way too simple process to ensure that everything is set prior to them using the services.

Hence, basic accounting functions along with receiving online payments for their products are now possible by just a few clicks.

Decentralised Money Remittance

Another aspect that makes SME platform stand out is the decentralised money remittance service. By using this service, users will be able to send as well as receive money across the world. You do not have to spend a lot of money as well for this service. SME Tokens that are of ERC 20 standard will back this system hence making it all the more powerful.

As a result of which, more than 30 million residents of Africa would benefit while remittances are put at $ 50 billion and over that in a year.

Facts to know about the Loyalty Rewards Network

Loyalty Rewards Network turns out to be one of the best things to have taken place in recent times. It is so because it is a network which means a customer gets loyalty reward points. Usually, businesses reward customers with a set of reward points. As for the rewards, they come in SME Tokens only.

The reason for using this one token is that transfer of reward points takes place in a quick fashion between that of the merchants. While on the other hand, this transfer is usually in the Loyalty Network only.

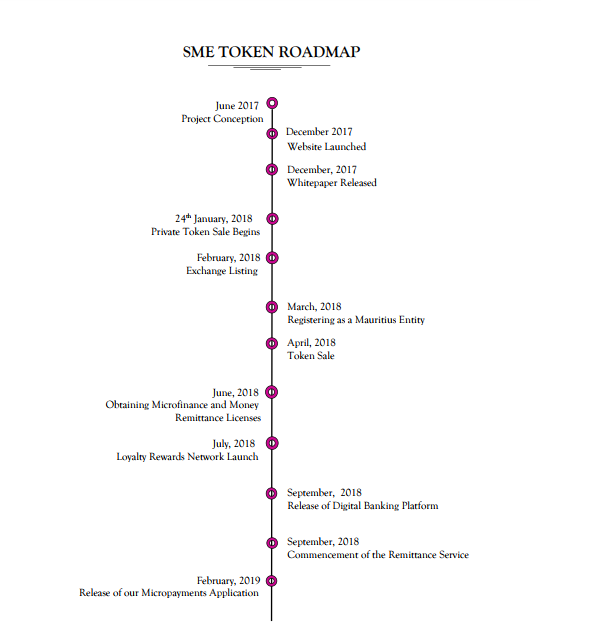

Roadmap of SME Tokens

~ June 2017 saw the genesis of the project.

~ SME website launched in December 2017.

~ In December 2017 only, the whitepaper was released.

~ 10th January 2018 was the day when the token airdrop began.

~ However, it will be only in February 2018 that exchange listing will take place.

~ In March 2018, SME will register itself as a Mauritius Entity while the token sale will be all set to begin in April of 2018.

~ Licenses of Microfinance and Money Remittance shall be obtained in June of 2018.

~ July 2018 is going to see launch of the Loyalty Rewards Network.

~ Plan has also been set to release the Digital Banking Platform in the month of September 2018.

~ Remittance Service shall begin in September 2018 itself!

~ February 2019 would witness the release of Micropayments Application from the house of SME.

Facts to know about the SME Token Metrics

~ A total of 150, 000, 000 tokens shall be supplied.

~ These tokens represent SME Banking Platform.

~ Therefore, they would be recognised as SME tokens with ERC 20 being the token type.

Distribution of the SME Tokens

~ From the total of 150, 000, 000 SME tokens, 0. 67 % will be allotted for the Initial Promotional Airdrop.

~ Therefore, total amount of SME is 1, 000, 000 SME for this airdrop.

~ Another 69 percent of tokens have been allotted for the token sale, onboarding initial users (for the digital marketing), marketing and other partnerships.

~ Thus, total number of tokens reserved for them are 103, 500, 000 SMEs.

~ 15, 495, 000 SME tokens that equal to 10. 33 % tokens have already been reserved for the token holders.

~ These tokens will however, be distributed once the business begins.

~ Another important aspect that you must remember is that these rewards are stated to be distributed in an orderly way and shall be spread over a period of time.

~ 30, 000, 000 SME or the 20 % of the tokens have been reserved for the current as well as the future team members.

~ Here, the list is inclusive of the advisors as well as the staff.

With such a schedule being planned, you can imagine on what scale is SME Banking Platform working on so as to assist people through their journey of economic growth.

For More Information Please Visit : -

Information Source-->Website, White Paper

All Image Source--> Website, White Paper

Regards,

@sudhakark

This post was resteemed by @steemvote and received a 37.87% Upvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit