There has been a lot of FUD and bad news going around about bitcoin stating its crashing and it wil go down to zero. I think the chances of that happening is 0%. Facebook that banned cryptocurrency adds on facebook, ( I still see add on facebook) is a good and a bad thing. Its a bad thing because there are a lot of scam coins out there that uses social sites like facebook to market there scam coins. The good thing is for those really good ICOs that wants to advertise.

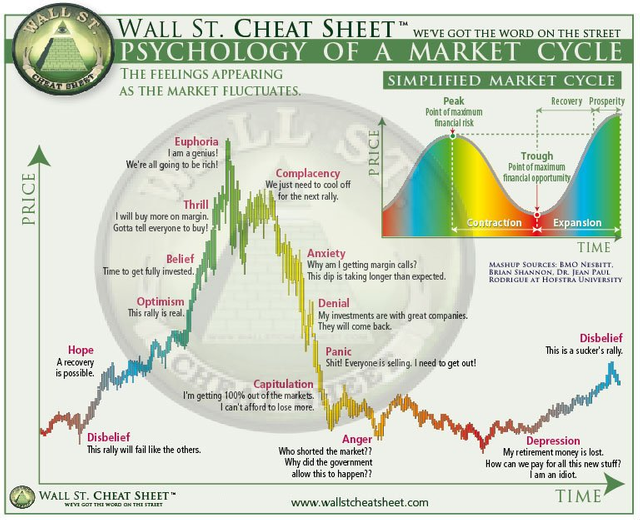

We went from a all time high just over $20 000 down to $8 500 because the market really did needed a correction after the crazy run we had and the correction did happen but it was just FUD and bad news on top of that. This isnt the first time the market dropped this much %. It happend a few times in the past and bitcoin recovered all the time and I am sure its going to this time aswell.

Most altcoins dropped more than bitcoin witch we would expect because bitcoin is like the daddy of all crypto with a market cap of $142 billion. When bitcoin has this drops it is normal for other altcoins to drop even more than bitcoin because bitcoin is a bit more stable in the market than other coins. Exception wouldbe etherium that did really well through this FUD and correction. But it also dipped.

If you do own cryptocurrency I do not recommend you to sell them.There is a saying (hodl). meaning, hold on for dear life.

Lets look at a bit of possitive news.

Insurance company's say that they see a big opportunity in unregulated cryptocurrency markets.

At the moment there isn't alot of cryptocurrency insurers. examples would be XL Catlin, Chubb, and Mitsui Sumitomo Insurance. That’s about to change, however, as various other insurance companies have expressed interest in safeguarding digital currencies.

This news comes in hot off the hack of Tokyo-based exchange Coincheck’s recent loss of around $534 million worth of cryptocurrency to hackers – which is hardly the first time criminals have made off with digital currencies.

In addition to digital theft, cryptocurrency investors are also subject to technical errors, fraudulent exchanges, and other dangers – and very little protection exists for those who find their holdings have unexpectedly disappeared.

According to Christopher Liu, head of the American International Group Inc’s North American cyber insurance practice for financial institutions, insuring cryptocurrency is still in the “exploratory phase” – and adapting an existing model is key.

I am not a financial advisor so still do your own research.

dont worry it will bounce bank it will cross 50000$ this year

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit