Historically, January has always been a weak month for Bitcoin and 2018 is no exception. Some believe that this is due to Chinese investors converting their Bitcoins to fiat currency in order to buy gifts and presents to celebrate the Chinese Lunar New Year, which falls in February. After all, the Chinese market is one of the major players in the crypto world.

However, the same behaviour does not hold true for stocks, because the Hong Kong and Chinese markets have been among the top performers. The equity markets are outperforming the crypto markets, at least in the first month of the year.

With only a couple of days more left in January, it remains to be seen if the fortunes of the large cryptocurrencies take a turn in February.

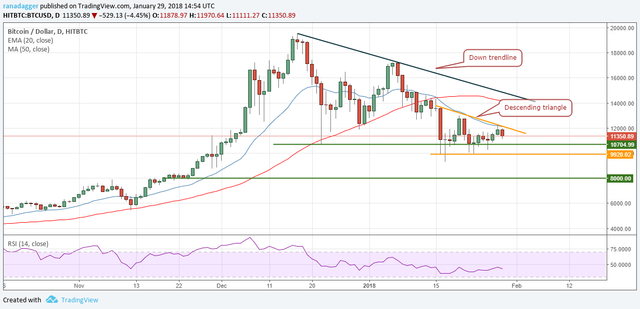

BTC/USD

Bitcoin turned down from the 20-day EMA on January 28. We had suggested a long position on a close above $12,200, which did not trigger.

In the very short-term, we find another descending triangle pattern as shown in the chart. The pattern will complete on a breakdown and close below $9,920 levels.

Below this level, we are likely to see further selling pressure by the bears and some long liquidation from the aggressive bulls who have accumulated close to the $10,000 to $12,000 levels expecting a spike up.

Panic selling can drag the BTC/USD pair to $8,000 and potentially even further down to $6,000 levels. These lower levels look scary, but please note, we are not trying to instill fear among traders. We are just giving the possible lower levels developing according to the chart patterns.

It is important to keep in mind that if Bitcoin breaks out of the $12,000 levels, it will invalidate a bearish pattern; and that is a bullish sign.

Therefore, our recommendation is a likely long position at $12250, with a stop loss of $9,900 and a target objective of $14,000. Within the range of $9,900 and $12,200, we don’t find any buy setups.

ETH/USD

We are holding long positions in Ethereum from $1,000 levels. We had recommended booking partial profits at $1,170 levels, in our previous analysis.

Yesterday, January 28, the Ethereum rallied to an intraday high of $1,265, which is close to 78.6 percent retracement levels of the recent fall from $1,424.3 to $770.

Traders can keep a stop loss of $1,000 on the remaining position because if the ETH/USD pair stays above $1,160, it is likely to again attempt a breakout above $1,284.28 levels.

If the $1,000 level breaks, Ethereum is likely to slide to the trendline.

BCH/USD

Yesterday, January 28, Bitcoin Cash broke out of the small overhead resistance at $1,700, but could not continue to build on the gain.

The cryptocurrency has again turned back down and has fallen below $1,700 levels. On any upwards movement, the bulls are likely to face strong resistance at the 20-day EMA, which is roughly at the same level as the down trendline. Above this, the next level of resistance is at $2,072.6853.

The BCH/USD pair will become positive in the short-term only after it sustains above $2,072.6853. Until then, all pullbacks are likely to be sold.

On the downside, a fall below $1,364.9657 will plunge the price to $1,141 levels. We don’t find any buy setups, so we do not recommend any long positions.

XRP/USD

Currently, Ripple is trading in the center of the range. It is likely to fall to the lower end of the range if it breaks down of the immediate support at $1.09.

We expect the XRP/USD pair to remain in the large range of $0.87 to $1.74 for the next few days. We are likely to wait for a dip in support levels or the range breakout to initiate fresh long positions.

XLM/USD

With general sentiment across the crypto community remaining weak, Stellar has turned down from the overhead resistance. It is now likely to fall to the trendline support, as we have forecasted in our previous analysis.

The 20-day EMA and the trendline support are close - that is why we expect the $0.55 levels to hold. We can initiate long positions once the XLM/USD pair breaks out of the $0.671 mark. We foresee a retest of the highs, with small resistance at $0.732 levels.

But if the trendline support breaks, a fall to the 50-day SMA is likely. We shall buy only on a strong rebound off the trendline.

LTC/USD

Yesterday, January 28, the attempt by the bulls to carry Litecoin higher faced resistance at the 20-day EMA. Now, we anticipate another round of selling by the bears to breakdown below the critical support of $175.

If the bears succeed in sustaining below $175, a fall to $140.001 and thereafter to $85 is likely.

Our bearish view will be invalidated if the LTC/USD pair breaks out of the down trendline of the descending triangle.

XEM/USD

We had forecast that NEM will face resistance at the $1 levels from both the moving averages and that is what happened.

If the bears fail to sink the cryptocurrency back below the down trendline, we anticipate a range bound trading between $0.8 on the lower end and $1.2 on the upper end.

The XEM/USD pair will become positive in the short-term on a breakout and close above $1.21. Currently, we are unable to find any reliable buy setups on it, so we do not have any recommendations for trading.

ADA/BTC

Cardano is currently trading inside a tight range of 0.00005 and 0.00006. If support of this range breaks, a fall to 0.00004730 and after that to the lower end of the larger range at 0.00004070 is likely.

However, if the bulls defend the 0.00005 levels again, the range bound trading action will continue for a few more days.

Within this tight range, we are unable to find any bullish pattern, so we do not advise any trading on the ADA/BTC pair.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://getbitcoinguide.com/bitcoin-ethereum-bitcoin-cash-ripple-stellar-litecoin-nem-cardano-price-analysis-jan-29/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @tradeer! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @tradeer! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit