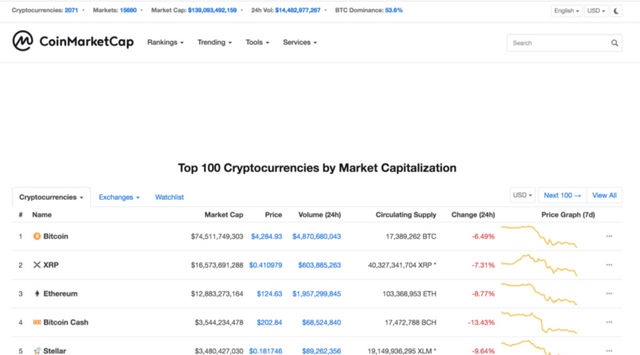

Figures released by the Coinbase Digital Exchange show that the world’s most popular ‘virtual currency’ lost 12.5% of its value against November 16 to stand at $ $4,284.93 per bitcoin.

The selloff began Nov. 14 when bitcoins opened at $ 6,326, after which the market capitalization of the electronic currency fell below $ 90 million for the first time in more than a year. last year.

This fledgeling sector is not yet fully transparent, and analysts are struggling to understand exactly what caused Bitcoin’s latest runoff, as well as forecasts for the ‘ virtual ‘in the future.

Except for the downtrend of bitcoin, most of the major electronic currencies including ethereum, bitcoin cash, litecoin and ripple have also lost about 10–30% of their value for nearly a week.

Since mid-week, the electronic money market has lost $ 41 billion in value, when bitcoins fell from $ 6,400 to below $ 5,000.

Some observers argue that the main reason for the slump was that the smaller electronic money-grabbing competition that bitcoin last summer was bitcoin.

Last week, bitcoin cash was ‘hard fork’ into two virtual currencies: bitcoin cash ABC and bitcoin cash SV (Satoshi’s Vision).

Experts warn that the two new currencies will compete fiercely with each other by attracting computer resources to invest in them. And this race can drain the computer resources from the bitcoin itself, thus reducing the demand for this electronic currency.

There is a comment about the bitcoin situation:

“Lightning can strike me when saying this in the Basel Tower, but Bitcoin is a very smart idea. Sadly, a not very smart idea is a good idea. The chances of blockchain are many, but the outstanding issues of Bitcoin are also numerous.

I agree with Agustín Carstens in summarizing Bitcoin’s issues and concluding that Bitcoin is ‘a combination of a bubble, a Ponzi scheme, and an environmental disaster.”

Confidence for crypto

Those interested in the blockchain industry and the cryptographic market, who have watched the price fluctuations of Bitcoin or other Altcoins and who have invested in those currencies, are excited and excited about the profits. unexpectedly, or was even disappointed when the market fell sharply.

Twogap provides stop loss solutions to anchor prices. Cryptobonds, Cryptostocks are not as volatile as the cryptocurrency, the stability of which when invested in will stop the loss, so-called loss-loss. Avoid copper being swept into the bloodstream today.

The total market cap was 210 billion hours ago, only 139 billion. So that, this time for me to think this is certainly the natural time for the Twogap. Because this time the product boom to help players in the market to avoid falling short of the current time. And one thing is that when the sale of this TGT of the twogap token sales season will certainly anchor the price advantage for investors.

And of course, when you choose the right one, at the right time to take refuge, this is definitely a big step for you in keeping up the vision and hope in the virtual currency market.

====================

For more information, please visit our sites at https://twogap.com

And don’t forget to reach the news on https://twitter.com/twogap_official and send us your questions on https://www.facebook.com/twogapofficial