Bitcoin community and developer's support remains strong despite global panics as Bitcoin dips to its baseline (Read more)

On average, bitcoin prices have lost 45 percent to 50 percent of their value in each bearish wave, which Shah said is similar to Nasdaq's behavior 18 years ago.

"The Nasdaq's bear market from 2000 had five price declines, averaging a surprisingly similar amount of 44 percent," Shah said.

Source: CNBC

Bull and Bear Markets are a common sight

Bull and Bear markets happen all the time in stock prices and historical records show rebounds of the stock markets after major 'crashes'. They are largely affected by global events such as War, Oil scarcity, Economic turmoil and the dot-com bubble. As cryptocurrencies and stock-based products gain more popularity mainstream, many are unaware of the volatility of such markets. If you are new to stock markets and trading, such "roller coaster" charts will shock the hell out of you. You are not buying bonds. You are not getting fixed interests from the bank. You are a small fish in the big sea and when two sharks fight, you might get collateral damage.

According to Jordan Hiscott, chief trader at Ayondo markets, a brokerage in The City of London, an individual known as the "Tokyo Whale", already sold around $400 million worth of both Bitcoin and Bitcoin Cash, he is likely the main catalyst for this year’s move down.”

Source: Forbes

HODLing and Beyond

Smart investment decisions take into account the risks and profits. When buying cryptocurrency, you should have already thought of what proportion of the investment will be lost if prices go down (risks)? Also how much gains are projected to be made. I feel that HODLing is a passive way to manage your cryptocurrencies. The active way is to constantly look out for new alternate coins and their value. Since Bitcoin and other cryptocurrencies are well correlated in terms of their market movements, look for alternative coins that are gaining or losing more value when compared to Bitcoin. In that way, we can actively minimize loses and maximize our gains.

Bitcoin's price fluctuations now are just the tip of the iceberg.

-tysler

All images used are under the CC0 license.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's why you profit take in intervals and cost average when buying :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's why people shouldn't be so quick to sell! If you want money but still want to keep your crypto, take a crypto-backed loan with us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bear market might not be over, but certainly i am buying these levels.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Everybody who use the Internet Need the BITCOINs because is it a Safety Money transfer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin's price will go up. Why? Because the world needs Bitcoin. This is explained in detail within this article on Bitcoin vs Bitcoin Cash. We must understand why Bitcoin was created if we are to grasp its value.

https://steemit.com/bitcoin/@workin2005/bitcoin-btc-vs-bitcoin-cash-bch-the-great-block-size-debate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes you are right!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The world does not need bitcoin, in fact the world doesn't even need humanity. Bitcoin with the difficulty going up and the mining pools created as result of it, the huge investments needed for mining and the early adopters hoarding tons of it it's effectively not as decentralized as you might think.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Could you please elaborate a little more with your consideration of proof of stake?

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry, I expressed myself wrongly. What I wanted to tell is that If you have a lot of bitcoins or computing power, you can influence the network significantly. There are a couple of influencers and they can basically do whatever they want to maximize their profits, and that is what the world already has and don't need anymore.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I noticed you editied your comment to remove "Proof of Stake". How does owning a lot of bitcoins "influence" the "network"? I can only assume you're talking about the technical aspect of the bitcoin blockchain and to the trading for profit part of it? no one if forced to "trade" bitcoin. With regards to minining pool centralization, are you for example, reffering to the chances of transaction mutability because of a 51% attack? what is the problem with a mining pool getting more rewards for making the network more secure? I would like you to be a little more detailed if possible rather than posting these comments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

By owning a lot of bitcoins you can influence the price of bitcoins and proof of stake rewards you proportionaly more. My concern was about plutocratic centralization and not a technical one, the effects can be the same though which I wrote, but edited it to prevent further misunderstandings. A monetary centralization can also lead to a 51% attack, imagine Satoshi selling a significant part of his stake, with one transaction he could drive a lot of miners out of business and buy up their infrastructure for cheap.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I get your point, your scenario is in a world where fiat is still king and bitcoin is a mere traded commodity. in your scenario, do you envision that miners will instantly stop mining the second that satoshi's address shows sign of movement that indicates liquidation? You really need to be more detailed rather than making brief open ended comments. There are a lot of people reading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was an example, there are a lot of people who can dump all their bitcoins at once and make bitcoin crash to a point when power costs will exceed the worth of the mined bitcoins. If someone offers you then a fraction of your investment for your infrastructure it could be seductice to cut your losses. I'm just pointing at a possible scenario. Of course its open ended, that is the nature of talking about theoretical future events, like your open ended comment about the mutability of a 51% attack and this whole article ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you....appreciate your feedback. I enjoy your articles as well. Very informative.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin has fallen more than 80% from peak to trough 5 seperate times. There will be a 6th and this is it. A full reset before the path to $500k begins...

https://steemit.com/bitcoin/@heyimsnuffles/bitcoin-has-worst-quarter-ever-lmao-asshats-from-cnbc

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is how I see it based on the insane profits that was generated by cryptocurrencies especially bitcoin between December and January.Investors would be looking for a repeat of the incidence so they are silently buying it up and hodling until there is an upward trend that is certain to come.As for Altcoins. am sticking with steem for now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why don't we all just forget the value in fiat and prepare for when the world is instead priced in crypto. Less worries.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wee should see better prices and bull run before Consensus 2018 in NYC.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin can only go down by so much until smart money and institutions come flooding in. They are most probably pushing price down in CME Futures to ensure they get a better entry price. The price of Bitcoin is also getting very close to it's cost of production so price should rise in the near future...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Look for price to retest $6000 which will be a key level. Price bounced off this level in Feb. and eventually went to $12K. Also back in Nov 2017, this level was the origin that caused price to go out to $20k. But we need to break daily trend line and buyers need to take out the sellers at $8000 & $8500 (green rectangles) before I'm convinced price wants to move higher.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Power

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The main thing is not to miss the rebound.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good articles go ahead to succeed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Litecoin not helping at all go a check https://litepal.io/ it should be ready 2 days ago now they even turn off website so litepay is a scam and litepal going to be scam so sad.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When you check who sells and who buys coins, then it is very clear that big wallet buys and small wallets sell...Choose your side!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@biplob0136

@biplob0136

@biplob0136

@biplob0136

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it will go up soon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

GOOD POST

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin Cryptocurrency T-Shirt Design For Men's : https://amazighmandesigner.threadless.com/designs/btc-cryptocurrency/mens/t-shirt

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

what will happen if bitcoin drops from here to 4k or less.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thankyou for the suggesstions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think this is the time to hodl onto your coins. About 1 Trillion of the paper money is about to go into the crypto-market. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting article! Subscribe! I hope for reciprocity!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypto crash coming in 2018 start... had already posted when markets were at all time highs.

Markets Hit "Double-Tripple Bottom".. No Celebrity Crypto Youtubers told you to exit at 800B$?

Markets will hit a new low? Better buying apportunities? Explained in a simple way.

CRYPTOS TO HIT NEW LOW? LETS SEE... (explained in a simple way as usual)

All the above posts were posted before things happened, and not after, unlike the majority..

Posted this a day ago:

Finally the level of 250 Billion U$D Market Cap Breaks. Best time to buy or still wait?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes we go up up up and beyond, go buy some, any

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really enjoyed this article, especially this part here "You are a small fish in the big sea and when two sharks fight, you might get collateral damage."

Good point.

Greetings from Berlin :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good articles go ahead to succeed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am a cute boy my mom says

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

for real? but that's more than 50 years ago, lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very nice article

plz follow me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @tysler!

Your post was mentioned in the Steemit Hit Parade in the following category:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 12.55% upvote from @postpromoter courtesy of @tysler!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will continue to average down, I am not worried about any movement down. I am in this for the long haul and spending what I can afford.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hahahahahaha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post.voted u

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When you copy/paste or repeatedly type the same comments you could be mistaken for a bot.

Tips to avoid being flagged

Thank You! ⚜

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hodl is a term for those that don't understand the fundamentals of making money . I'll explain yes people got rich from holding back then but the money is made now from the people marketing ICO's, Trading , Shorting and producing the mining equipment . Everybody now if they can do math know that if the price of most cc's go down mining equipment ROI makes it a bad investment compared to asking leveraging that money in the marketing in trading think of forex . Http://satoshipapi.io Http://satoshicash.io is for sale <

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People who liked this post also liked:

Iconic SteemBounty Logo Design by @podanrj

Cheering Up to My Favorite Football Club, Liverpool! "You'll Never Walk Alone" :D by @michaelcabiles

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hanging on

Shhhesh!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post! Only hodl bitcoin and trust in the blockchain !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm actually happy the price is lowering as I do not own enough

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The pice is stagnant, it could begin a downtrend too, but it seems like uptrend which is confusing...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin eased from session highs Monday amid profit taking following its rebound from a nearly two-month low a day earlier.

Bitcoin rose 3.13% to $6,986.8 on the Bitfinex exchange, easing from a session high of $7,132.0. Bitcoin rebounded from a low of $6,432.40 on Sunday, just shy of its Feb. 6 low of $6,000 which followed the so-called crypto bloodbath.

Yet, investors remained wary of yet another bull trap in bitcoin. A term describing a false signal indicating that a downward trend in a security has reversed and is heading upwards when, in fact, the security will continue to decline.

The slump in bitcoin over the weekend was predicted by some technical analysts, who last week cited a bearish trading pattern, the “death cross,” as a signal of further downside.

It remains to be seen whether further downside pressure awaits the popular digital currency amid recent comments from technical traders, citing current prices in bitcoin as a zone of support - price levels that trigger buying.

There is lack of evidence, however, to support the view that current prices would attract fund inflows into the market as demand remained subdued.

Data from coinmarketcap.com showed the total market cap of cryptocurrencies fell to $262 billion – at the time of writing – down from just under $300 million last week – and more than 300% down from the more than $800 billion at the turn of the year.

The slump in the wider crypto market so far this year has weighed on crypto-funds with at least nine funds said to have closed, Bloomberg reported.

Crypto-funds are down roughly 23% in 2018, according to Eurekahedge Crypto-Currency Hedge Fund Index, easing investor euphoria which followed a more than 1,000% gain at some crypto-funds last year.

Ripple XRP rose 2.04% to $0.48980 on the Poloniex exchange, while Ethereum rose 0.13% to $384.02.

https://steemit.com/bitcoin/@ngaga/bitcoin-eases-from-session-highs-after-rebound-from-nearly-two-month-low

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin Eases From Session Highs After Rebound From Nearly Two-Month Low

Bitcoin eased from session highs Monday amid profit taking following its rebound from a nearly two-month low a day earlier.

Bitcoin rose 3.13% to $6,986.8 on the Bitfinex exchange, easing from a session high of $7,132.0. Bitcoin rebounded from a low of $6,432.40 on Sunday, just shy of its Feb. 6 low of $6,000 which followed the so-called crypto bloodbath.

Yet, investors remained wary of yet another bull trap in bitcoin. A term describing a false signal indicating that a downward trend in a security has reversed and is heading upwards when, in fact, the security will continue to decline.

The slump in bitcoin over the weekend was predicted by some technical analysts, who last week cited a bearish trading pattern, the “death cross,” as a signal of further downside.

It remains to be seen whether further downside pressure awaits the popular digital currency amid recent comments from technical traders, citing current prices in bitcoin as a zone of support - price levels that trigger buying.

There is lack of evidence, however, to support the view that current prices would attract fund inflows into the market as demand remained subdued.

Data from coinmarketcap.com showed the total market cap of cryptocurrencies fell to $262 billion – at the time of writing – down from just under $300 million last week – and more than 300% down from the more than $800 billion at the turn of the year.

The slump in the wider crypto market so far this year has weighed on crypto-funds with at least nine funds said to have closed, Bloomberg reported.

Crypto-funds are down roughly 23% in 2018, according to Eurekahedge Crypto-Currency Hedge Fund Index, easing investor euphoria which followed a more than 1,000% gain at some crypto-funds last year.

Ripple XRP rose 2.04% to $0.48980 on the Poloniex exchange, while Ethereum rose 0.13% to $384.02.

https://steemit.com/bitcoin/@ngaga/bitcoin-eases-from-session-highs-after-rebound-from-nearly-two-month-low

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

can i buy bitcoin now or? i need to wait

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article keep the good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoinnnnn ❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is my short analysis of ETH or BTC price:

https://steemit.com/trading/@examachine/ethereum-long-term-technical-analysis-was-it-a-normal-correction

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome blog!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin prices have had fluctuations like this before, i am not bothered because the importance of bitcoin is non-negotiable. It'll bounce back

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, I'd have to say that measuring and trading according to beta of the prices can still be a bit messy. Unless you have a large amout of money and time to watch movements all day, I'd just buy at what you percive to be the dip and hodl

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is an orcrested fall to suppress the price of bitcoin. the so-called fourth dimension action.

https://steemit.com/bitcoin/@digitalpapiro/the-fourth-dimension-of-bitcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, the cryptocurrency markets are seeing a shakeout happening still. The interesting part is that Bitcoin's dominance has gone up. The good news is that the marketplace is around where it was in November of 2017. So, some people thought that they were late to the party...well, right now, it is like getting in "early" before the second boom. We don't see the market going too much lower before heading back up, though it may bounce within a certain range for a bit.

There are no guarantees in life, but we do think the market will head back up. This is such a revolutionary technology that has made such a big splash in the pond that it will keep going. Patience is a part of the game.

One key thing to remember though is that many of these cryptos are absolute junk. An analyst said one thing interesting...that there could be $100 billion or more of junk coins to be shaken out of the marketplace before things go back up. This also explain's BTC's dominance going back up.

Also, keep in mind that the regular stock market has been getting hammered as well.

So, we continue to build our portfolio's and trade the bounces. We put some information out there about how to profit during these times where the market is flat, and we will have more information on that this week, so, keep you eyes peeled!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin has the right balance of pros and cons. That's why it's so popular.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good approach. it better to trade then holding.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It takes a lot of education and conviction to become a Hodler of last resort.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes there's a chance it will come back much stronger right now, but a lot of those people have either cut their losses by now or are sitting on pins and needles at the momen

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"You gotta know when you HODL em, and know when to fold em." -Kenny Rogers

I am part of the former...I HODL! The money I have put into crypto is looked upon as some type of investment. When my grandmother gave me some stock in AT&T years ago and there was no internet to check prices on the daily, I would peruse the newspaper here and there to see what was happening. The truth is that I wasn't hoping to cash out that stock in a short amount of time...I was looking at the long term. The same can be said about my viewpoint on crypto and Bitcoin: I'll be hodling and looking at some of the key dates and events throughout this year and next. This is an exciting time in the history of crypto assets and I'll be sure to stick around to see what happens in the long run. -Respect

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Verry nice post.

Thumbs up and a resteem from my side for hard work and dedication best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A lot people want hold on to their crypto in this time but also need liquidity. We make it possible to do both by providing crypto-backed loans! HODL the SMRAT way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://yobit.io/?bonus=fvhEK

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

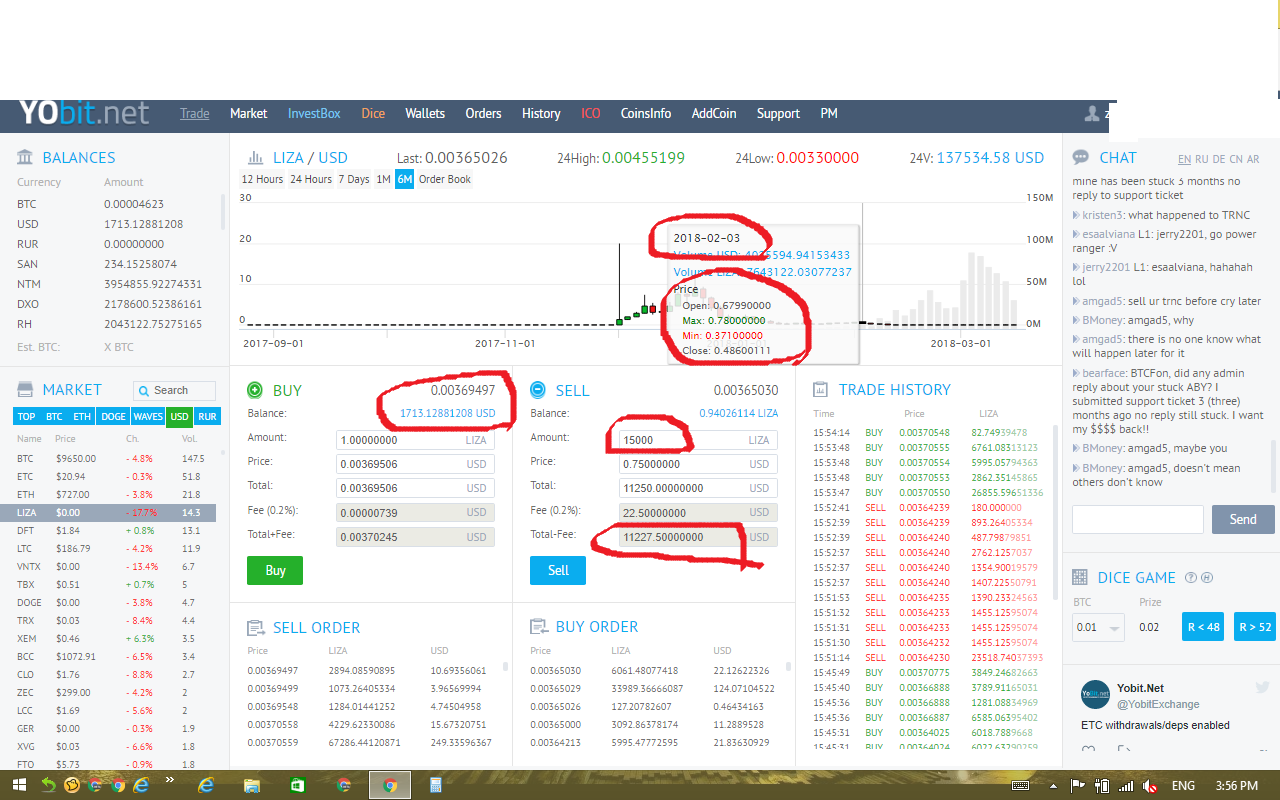

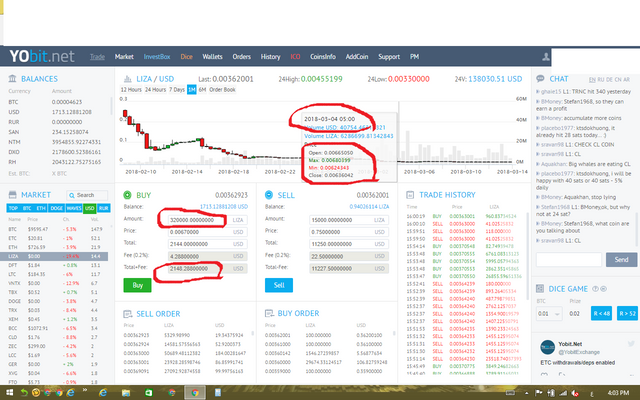

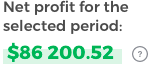

to all trader don't be greedy i lose chance coast me more than 11000$ how? https://yobit.io/?bonus=fvhEK

.png)

.png)

see the pics

i buy 15000 liza if i sell them at price 0.0075 $ they make more than 11000$ but i'm greedy don't sell them then i but them

in the invest box they make 320000 liza what happen the price down and i sell them make 2000$

so don't be greedy here https://yobit.io/?bonus=fvhEK you can make much money but be careful from scam coins

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How is it possible that 17 typings and all wins?

https://steemit.com/@pikpok

Trainers show class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

iam a vietnamese trader, i have a all chart altcoin, It will be useful to you.sorry if i bother you. but i bet you will be interested with it, and we will have a discussion about crypto graphs.

https://busy.org/@sonpham1997/bitcoin-update-bitcoin-trends-today-06-04-2018

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thailand's Ministry of Finance has laid out its proposed impose rates for digital money exchanging and ventures in the midst of the continuous authoritative procedure to direct and charge the segment.

Talking after a week by week bureau meeting on March 27, Thai fund serve Apisak Tantivorawong declared the administration's expense system for cryptographic forms of money that will supposedly incorporate all retail exchanging and returns on digital money ventures. Financial specialists will be required to pay 7 percent in esteem included expense (VAT) on all crypto exchanges close by a 15% capital additions assess on restores, the Nikkei Asian Review announced.

As announced beforehand in mid-March, the Cabinet of Thailand – the administration's official branch – has effectively affirmed two illustrious declaration drafts concerning the direction of digital money exchanges and authorizing charges on crypto-related ventures. The move to quick track the new laws with the presentation of two regal declarations comes at the command of Thailand's delegate head administrator Wissanu Krea-ngam requiring the bureau to "thoroughly manage" the beginning however developing household ICO and digital currency division.

The Nikkei report expresses that Thailand's decision military government is hoping to manage the cryptographic money market to 'slap speculators fiddling with computerized coins with expenses to keep the growing segment from being utilized for illegal tax avoidance, tax avoidance and other criminal exercises.' While the case is consistent with a specific degree, representative PM Wissanu has already focused on that the new laws aren't intended to control or preclude digital currency action or ICOs in Thailand yet protect adopters.

The administration's turn to direct the area with a traditionalist, delicate touch approach has discovered help from previous Thai back clergyman Korn Chatikavanij who now fills in as executive of the Thai Fintech Association. "[T]hey must be mindful not to enable their preservationist senses to bring about draconian directions", the previous back clergyman told Nikkei.

Korn likewise cautioned of the developing pattern of Thai business visionaries enlisting their new companies in innovation forward goals like Singapore that have shown a friendlier administrative atmosphere for gathering pledges through introductory coin offerings (ICOs).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thailand's Ministry of Finance has laid out its proposed impose rates for digital money exchanging and ventures in the midst of the continuous authoritative procedure to direct and charge the segment.

Talking after a week by week bureau meeting on March 27, Thai fund serve Apisak Tantivorawong declared the administration's expense system for cryptographic forms of money that will supposedly incorporate all retail exchanging and returns on digital money ventures. Financial specialists will be required to pay 7 percent in esteem included expense (VAT) on all crypto exchanges close by a 15% capital additions assess on restores, the Nikkei Asian Review announced.

As announced beforehand in mid-March, the Cabinet of Thailand – the administration's official branch – has effectively affirmed two illustrious declaration drafts concerning the direction of digital money exchanges and authorizing charges on crypto-related ventures. The move to quick track the new laws with the presentation of two regal declarations comes at the command of Thailand's delegate head administrator Wissanu Krea-ngam requiring the bureau to "thoroughly manage" the beginning however developing household ICO and digital currency division.

The Nikkei report expresses that Thailand's decision military government is hoping to manage the cryptographic money market to 'slap speculators fiddling with computerized coins with expenses to keep the growing segment from being utilized for illegal tax avoidance, tax avoidance and other criminal exercises.' While the case is consistent with a specific degree, representative PM Wissanu has already focused on that the new laws aren't intended to control or preclude digital currency action or ICOs in Thailand yet protect adopters.

The administration's turn to direct the area with a traditionalist, delicate touch approach has discovered help from previous Thai back clergyman Korn Chatikavanij who now fills in as executive of the Thai Fintech Association. "[T]hey must be mindful not to enable their preservationist senses to bring about draconian directions", the previous back clergyman told Nikkei.

Korn likewise cautioned of the developing pattern of Thai business visionaries enlisting their new companies in innovation forward goals like Singapore that have shown a friendlier administrative atmosphere for gathering pledges through introductory coin offerings (ICOs).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit