Recently, Ramki Ramakrishnan, an international banker and treasury manager, who is also a contributor at Forbes, technically analyzed bitcoin’s recent fall with Elliott Waves.

Bitcoin’s Recent Correction

On Thursday, all the top 25 cryptocurrencies, including bitcoin, Ethereum, and Ripple, experienced a huge price fall. The average value drop exceeded ten percent in almost all cases. Both Ethereum’s and bitcoin’s market cap fell by billions of dollars, with BTC dropping to $37.4 billion and ETH to $28.9 billion.

However, one day later, on Friday, bitcoin recovered from $2,150 to $2,521, and is currently standing on $2,640 (as of Saturday 6:40 PM). Some people credited bitcoin’s tumble to Bitmain’s announcement saying that the network of bitcoin is at a high risk of being split. Although, analyst Nicola Duke predicted such a correction in May for both BTC and Ethereum. The analyst stated that bitcoin could experience a correction of 46.5 percent. Duke predicted that BTC’s price will go as low as $1,470, however, that drop did not happen (yet).

Elliott Waves

According to Ramakrishnan, bitcoin experienced its biggest correction in two years. The banker had seen the opportunity in the fall to show traders and investors a technical analysis “to demonstrate to you how traders can benefit enormously by paying attention to technical factors.”

“Elliott Wave Analysis is based on a theory put forward by Ralph Nelson Elliott back in the 1930s. He figured out that all bull cycles are made up of five waves, and once the five waves are complete, we will experience a correction that will bring the price down in three waves. The first wave is counted from a significant low, as shown here. The first and third waves are often related to each other by a standard ratio. And one of the three waves going upwards is extended to travel a distance that is much longer relative to the other two,” Ramakrishnan explains.

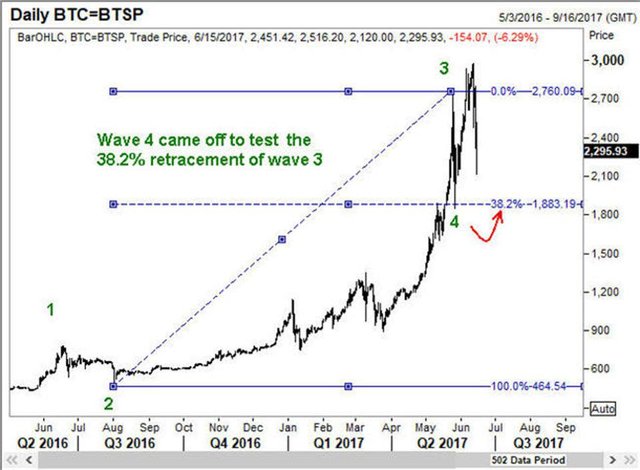

The banker explains that, in his analysis, he started a wave count from a significant low in 2015. In the below chart, one can see that Wave 1 was corrected by Wave 2. The third wave surged quite high, exactly 361.8% of the first wave.

Once bitcoin reached the third wave, the cryptocurrency started in a correction move (as seen in the chart below). Ramakrishnan explained that Elliott Wave practitioners often look for such correction to relate to “the prior impulse wave by a Fibonacci ratio.” In the current case, Wave 4 reached the 38.2% measure of the previous wave.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://bestaltcoin.blogspot.com/2017/06/international-banker-analyses-bitcoins.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @vimarcamlian! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for posting this. I suspect his Elliot wave labelling is incorrect which would in turn mean his analysis is in error too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit