Great Tools For Investors When Prices Are Volatile

Open:https://bit.ly/3Bcg1bW

Open:https://bit.ly/3vBDYIb

- Bitcoin Fear and Greed Index

Buffet spoke a fundamental truth. Knowing the market sentiment is one of the basic things an investor needs in order to take the right steps.

By combining the Greed and Fear Index with historical Bitcoin price movements, you can make decisions on whether to accumulate, hold, or to take profit.

There are several Fear and Greed indices developed by different parties, for example, alternative.me and btctools.io. They offer slightly different calculation methods but in general do align with each other.

- Stock To Flow Model (S2F)

This is a well-known model developed by PlanB. The stock-to-flow model uses Bitcoin’s scarcity to predict its value. For this cycle, it predicts a BTC price of over 100.000 USD.

So far, PlanB’s model has not been invalidated.

While one should not make decisions based on a single indicator, I think that S2F provides a useful general trend of where Bitcoin price will go.

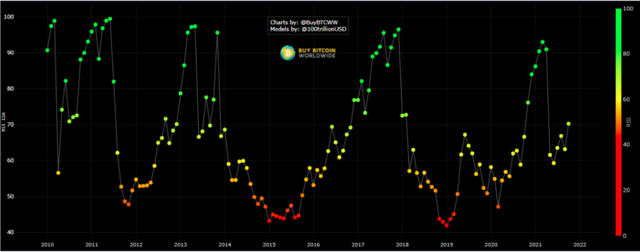

- Bitcoin Relative Strength Index

Same as the previous one, this model is also developed by PlanB. A live chart can be found here.

As stated on the website, in general, looking at the RSI axis on the right side, a high score (equal to or greater than 70) indicates that Bitcoin is overbought, and a low score (equal to or lower than 30) indicates that Bitcoin is oversold.

- On Chain Indicators

Glassnode offers a lot of useful cryptocurrency indicators, such as the Number of Active Entities, Long-Term Holder SPOR, Long-term Holder Net Position Change, etc.

The problem: These indicators are only available for subscribers.

But.

Glassnode publishes a weekly on-chain newsletter which is free. You can subscribe via email or check out past issues here. In the newsletter, Glassnode publishes and analyzes a lot of charts that normally can only be viewed by paying members.

Really cool!

The downside is that when the newsletter is published the data shown in the charts is several days old. For traders, this lag is a problem.

But if you only focus on the long term then I think the stats provided by the newsletter can be quite useful.

Cryptoquant.com also provides some on-chain indicators such as Net Unrealized Profit and Loss (NUPL), Long-term Holder Spent Output Profit Ratio(LTH-SOPR) which overlap with what Glassnode publishes. As an unpaid user, you can see the charts with a small time lag.