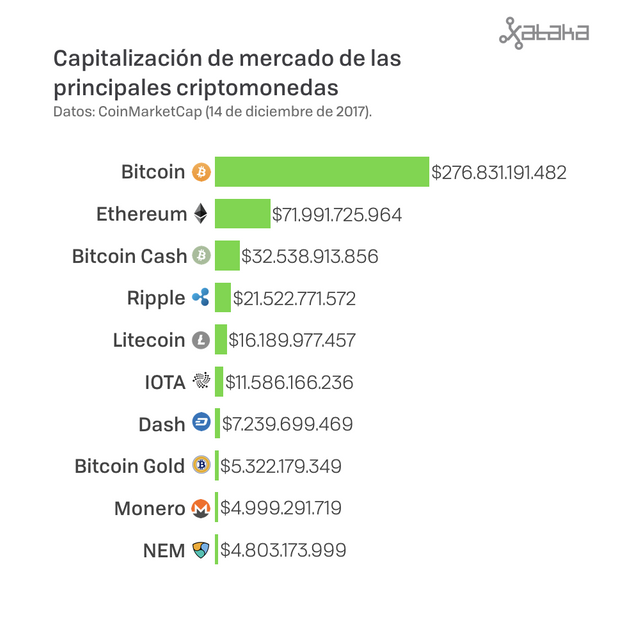

In full fever for Bitcoin, a fever that carries with it the rest of cryptocurrencies in general, there is an alternative that has been adding integers and has become for a few days in the fourth market capitalization, only behind Bitcoin, Ethereum and Bitcoin Cash: it is IOTA, a cryptocurrency that, although it has no limits for its use, is specially designed for micropayments in the environment of the Internet of Things. Ripple, the fourth until then, focused on transactions of small amounts, has been surpassed.

Its recent explosion, which caused it to increase its value by almost 500% in ten days at the beginning of December - it went from being below the dollar to be worth $ 5.50 - has part of origin in the announcement of an agreement reached with several partners, Microsoft and Fujitsu among them, for use in business-to-business communications.

However, the agreement with Microsoft was little more than a misunderstanding, something that revealed that IOTA's price dropped to 4.15 dollars per token. Even so, it continues above the 3.5 dollars that was worth when the price stabilized after the very rapid growth.

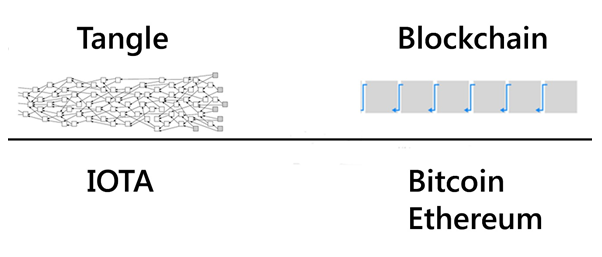

This is how Tangle works

What makes IOTA different from the rest of cryptocurrencies is that it is the first one outside the Blockchain system. Instead, it uses Tangle, a platform of interconnected nodes on which it bases its operation.

Anyone who wants to use IOTA must confirm two foreign transactions before they can send theirs. This is possible for two reasons:

In IOTA there is no mining as in other cryptocurrencies. This means that the resolution of mathematical problems that verify transactions, as in Bitcoin, can not be done freely, but only by users who want to operate with IOTA.

This verification can be done with any smartphone or computer. It is not necessary to use huge mining farms or high-end graphic cards for this, since not having mined is not increasing the difficulty as has happened with Bitcoin. This has an added advantage: the enormous energy expenditure that Bitcoin supposes, for example.

As all IOTA users verify third-party transactions before they can make their own, there are no commissions here. The reward for the user is to be able to make his transaction, with the mining one must give an economic incentive to the one who verifies the transactions of third parties. This has another advantage: the number of IOTA transactions per second is around 500, well above Bitcoin (7), Ethereum (20), Dash (28) or Litecoin (56).

Quantum resistance

This mechanics has another consequence for the system: it is resistant to quantum computing. Think of quantum computing as a way to perform processes at a speed incomparable to current computing. That ability can be applied to perform a sort of DDoS attacks to try to steal an account from an online service, or to mine bitcoins, for example.

The use of quantum computing to mine bitcoins would simply leave the mining farms in diapers. For what? To monopolize the commissions offered by mining. This, with IOTA, is not possible due to the commented alternative system, Tangle. In the hypothetical case that someone tried, the only thing that would be achieved would be the equivalent of issuing many IOTA transactions at a high speed. In other words, something that would benefit the network would not harm it.

A matter of scale

Anyone who experiments with IOTA can see in person the difference that Tangle offers in the face of verification. A purchase of IOTA in Binance, one of the exchanges in which it can be purchased, has resulted in our experience with 23 checks. A purchase of Bitcoin in Coinbase, with 6.

Its structure also makes its scalability "practically infinite". Hence, the number of IOTAs in circulation is not increasing as they are being mined further, as is the case with blockchain-based cryptocurrencies: from the moment of its creation there are 2,779,530,283 coins in circulation, 132 times higher than the number maximum that can reach Bitcoin, 21,000,000. At the moment it goes for something less than seventeen million.

Now we need to see how far it goes and if it continues to advance in volume of transactions and market capitalization. Much of its future depends on the future of the Internet of Things and if it finally comes to stay or on the contrary it falls short of expectations. Against him plays, above all, the low generalized security that exists in this environment. Time will tell.

This post has received gratitude of 1.00 % from @jout

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit