One of the more pleasant activities in life is to calculate yourself into great prosperity. And that's exactly what we're going to do.

Now, I'm not sure about the above Elliott labels, but it seems pretty clear to me that we're in a large uptrend with tons of space to the upside.

From the $3k bottom we've seen a first impulse up that we're now correcting in wave 2. A large wave 3 should follow once we break through the brown down sloping resistance line.

As we currently are in wave 2, now is the time to reflect on the best way to profit from the inevitable wave 3 up in order to be optimally prepared for that event, when it happens.

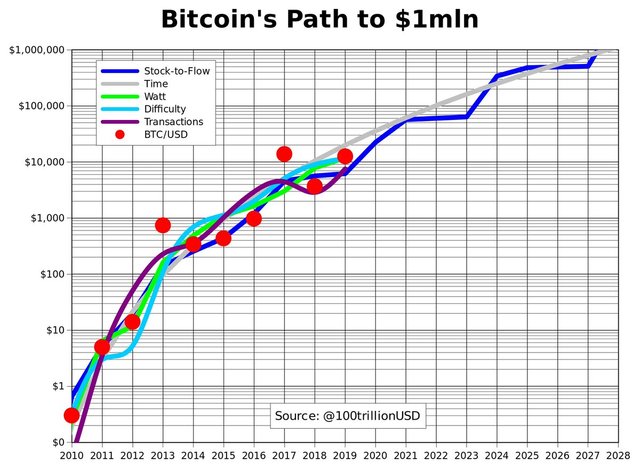

In addition to Elliott waves there is the 'Stock to Flow' model that measures the scarcity of supply. It's a well-known method from the commodities world. More importantly, this method makes it possible to calculate a theoretical price target. For bitcoin, at the next halving in May 2020, this price target is $55k. Mind you that is $45k up from here in only 9 months, averaging ca $5k per month. If we are going to witness this prediction materialize, it can only be described as an unparalleled opportunity of which we must profit in an equally unparalleled manner.

How to do that?

I'm going to look at options which are the most profitable instruments out there. The best exchange for buying options I know is: deribit.com. Now, the bid-ask spreads can be large (they used to be larger so there is improvement), meaning better no short term trading.

Also, looking back at the 2017 uptrend, it must be noted, despite the giant bull run, that there were periods of 3 months when the price hardly moved. So, in order to stay on the safe side we either must buy 6 months call options, or perhaps write 3 months at the money put options. If you choose to buy a vertical spread, meaning you buy the nearer strike price call and sell a further away strike price call, then this will be profitable, as long as we're going up, but no so much. It is an instrument better suited for moderately rising prices. Given the spectacular expectations attached to the earlier premises, taking more risk seems to be justified.

With respect to writing at the money options, as it is now, you can write a December 2019 ATM call option for approximately 0.2 BTC. If all goes well you'll pocket exactly that: 0.2 BTC per full bitcoin option written. And you can repeat it as long as the bull run lasts. Certainly not bad, but writing options scares the hell out of me. Also, I'm unsure where the system will close the option automatically, should it run against you. The required margin on Deribit.com is only 0.15 BTC which relates to $1500. Is the system going to close your position when it runs $1500 against you? Because a move against you like that is not at all unlikely. No, too much risk for me.

Alternatively, you can buy a March 2020 deep out of the money call since we are extremely bullish longer term. For instance a call March 2020 with strike price $20k is quoted for less than 0.1 BTC or $1k. Let's say bitcoin moves from 10k to 25k that would make the call option worth $5k or 0.2 BTC at $25k. Your invested bitcoins will have doubled. If prices were to go to $30k end of March 2020, then the call will be worth $10k or 0.333 BTC. Which means it has more than tripled. If we're looking at $40k end of March 2020, the call will be worth $20k or 0.5 BTC, which is times 5 in bitcoin terms and times 20 in USD terms.

You can argue that these targets are unrealistic, but I don't think so. The stock markets are going to go down, bonds are going to go down, real estate is going to go down as they're all in a gigantic bubble already. Money will flow into bitcoin and possibly gold, silver and some other commodities.

Of course, it won't end there. After the halving we usually have another year to a year-and-a-half of further price increase, possibly even with a parabolic ending as in 2013 and 2017.

So, it seems extremely profitable to keep buying longer term call options until summer 2021. Even if we were to move no further than $100k in the coming 2-year bull run (there are predictions of $300k also), it should be possible to double or even triple your position several times. With a modest investment of $1k, you should be able to make $100k. Put in some more and you're looking at an early retirement.

What if the expectation is wrong?

Unless you plan to take out whatever you've put in, provided you get the chance to do that, you're going to lose. How much you're going to lose depends on your own risk tolerance.

However, it must be noted that if bitcoin prices turn south badly, say below $3k, then you'll get another excellent opportunity to buy more on the cheap. So, it seems you can't lose. Either it goes up big time and you win big time, or it goes down and you get an even better opportunity. Just make sure that you haven't put all your eggs in the basket the first time.