Content adapted from this Zerohedge.com article : Source

Bitcoin has gotten a lot of attention in the last 6 months. Unfortunately, for those holding the cryptocurrency, most of it is negative. Going one step further, not only is the news negative, a lot of it is untrue.

Here are 6 myths that the media likes to portray as real yet are not. This should serve as a reminder of what the mainstream is promoting. FUD is at the top of their agenda.

Authored by Vincent Launay via CoinTelegraph.com,

Given all the negative press that Bitcoin has to fight against, the arguments in favor of Bitcoin may sometimes be lost in all the noise. So let's have a look at the typical attacks on Bitcoin and how the community could respond to them.

image courtesy of CoinTelegraph

The price of Bitcoin is too high

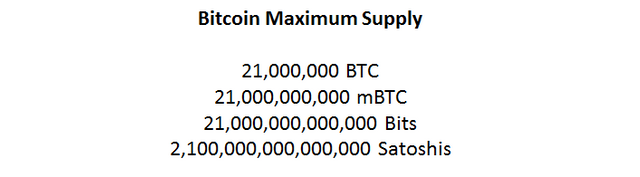

Despite being down more than 60 percent from its all time high, the price of 1 Bitcoin - around $7,000 at the time of writing ($7,116 at press time - Cointelegraph) - still deters many people from entering the market. Even though Bitcoin is on the main page of many online newspapers since mid-2017, most people still do not know they can buy a fraction of a Bitcoin. So let's set the record straight: 1 Bitcoin can be divided into 100 million satoshis (the smallest Bitcoin unit). Just because one cannot afford a full gold bar - which are $600,000 a piece - does not mean one cannot buy a gold coin or invest as little as $126 through a Gold ETF to get exposure to gold. The same thing can be done with Bitcoin.

Assuming a world population of 7 bln people, it means that there are 300,000 satoshis available per human being, or 0.003 Bitcoin. Since several studies have estimated that 3 to 4 mln Bitcoins have been lost in the early years, the true number is probably closer to 220 - 250,000 satoshis per person.

This problem led to an exuberant rally at the end of 2017, when all the coins below $1 suddenly started going up as many thought they were "cheap". As each coin has a different supply, the price of one coin is irrelevant, what matters is the market capitalization of the outstanding supply and whether a particular coin has a future or not. Since this rally, most of these coins have gone down 80 percent + as these increases never made sense in the first place.

Remember that there are more millionaires in the world than there will ever be Bitcoins, so the price of 1 Bitcoin will soon not be the right metric, but rather 1 mBTC (1 thousandth of a Bitcoin) or even 1 satoshi. The current market capitalization of Bitcoin is $120 bln, while the US Dollar M2 Money Supply is $14,000 bln and the value of all the gold ever mined is $8,000 bln, so there is still plenty of upside left. At $7,000 per Bitcoin, the price of 1 satoshi is 0.007 US cents - at this price anyone can invest.

The price of Bitcoin is too volatile to invest any money in it

There is no debate that the price of Bitcoin is very volatile, but it is so for good reasons. For the first time in the history of mankind there is a cryptographically secure, decentralized currency not backed by any central bank nor any physical asset. It would actually be even more surprising if Bitcoin were already stable. The volatility issue will likely sort itself out with time when the market capitalization of Bitcoin becomes comparable to that of the assets it is competing with - fiat currencies or gold - or if it goes to zero!

Cryptocurrencies are the most volatile and speculative asset class in the world, so if you invest in Bitcoin or other cryptocurrencies, you should know what you are in for and you should only invest what you can afford to lose. Investing only what you can afford to lose gives you something very valuable: time. If you have time, then you will never be forced to sell when the price is low and you can weather market cycles, including severe downturns.

Bitcoin is bad for the environment

When Bitcoin started being mined by Satoshi Nakamoto back in 2009, mining it could be done on a simple laptop and it took on average 10 minutes to mine a block just like it does today. The Bitcoin algorithm is such that it automatically adjusts the difficulty of the cryptographic puzzle that miners have to solve to validate a block and receive the reward such that it always takes 10 minutes to mine a block on average. The more resources are added to the Bitcoin network, the higher the difficulty. This difficulty is what makes the Bitcoin network the most powerful and hence most secure on Earth.

The reason miners have invested billions of US dollars in specialized mining equipment is because Bitcoin is so valuable - it is not as a result of an increase in the number of users nor the number of transactions. As long as Bitcoin is valuable, companies will invest in mining equipment to get the reward that comes with successfully mining a block. These miners consume large quantities of electricity to run their operations, and this is what has been heavily criticized. But since the cost of electricity is the main operating cost for miners, they are always looking for cheap electricity around the world. Electricity is cheap where there is a surplus of it, and this usually happens in countries that have large renewable resources, so the net impact of running a mining operation in a country that has excess hydro capacity for example may not be as bad as what has been written.

At $7,000 per Bitcoin, the current annual cost of the Bitcoin network is $4.6 bln, and a sizable portion of it spent on electricity bills. But what the Bitcoin network provides for this cost is a Blockchain that is unhackable by any existing computer or technology on the planet. While Bitcoin has been targeted by environmentalists, the legacy fiat system is not perfect either. A lot of resources are also dedicated to running datacenters, building and powering bank branches and printing banknotes just to name a few. The US Federal Reserve alone spends $700 mln a year just to print dollar bills. What makes Bitcoin an easy target is simply that it is relatively easy to figure out how much electricity it consumes.

40 percent of All Bitcoins Are Controlled by 1,000 people

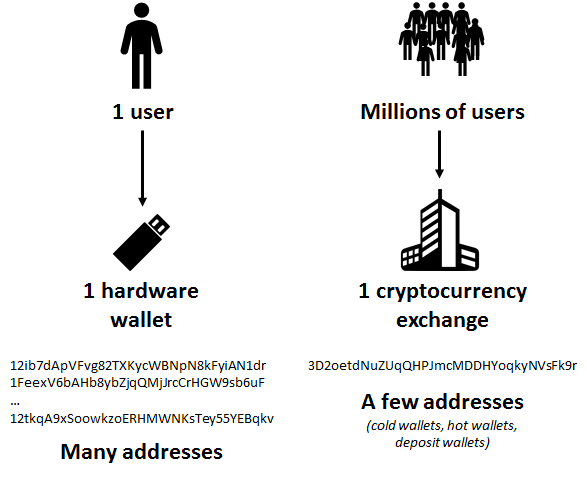

Another myth is that supposedly 40 percent of Bitcoins are held by only 1,000 people. The reality is that this is pure speculation. What we know for sure is that there are currently 24 mln Bitcoin wallets. However, one person may have hundreds of wallets while one wallet may hold Bitcoins belonging to thousands, or millions of people, which makes any analysis of the concentration of wealth among Bitcoin holders quite impossible.

The two wallets holding the most Bitcoins have been identified as being the cold wallets of Bitfinex and Bittrex, but someone looking a the raw data would simply infer that the owners of these two wallets are billionaires, while the Bitcoins in these wallets belong to thousands or millions of clients of these exchanges. Coinbase alone claims to have more than 10 mln users. When you trust an exchange with your Bitcoins - you should not - the exchange does not create a wallet specifically for you on the Blockchain, it simply allocates some of the Bitcoins that have been deposited with them from one user to another one.

On the other hand, most wallets create a new address every time there is an incoming transaction. This means that someone with a hardware wallet would have received 5 times 0.2 Bitcoin will own 1 Bitcoin spread over 5 different addresses. There is no way to know that these 5 addresses actually belong to the same person. The heavy concentration of wealth in the Bitcoin world may or may not be a reality, but convincing evidence has yet to be produced to close the debate on this point.

Bitcoin Is used to buy drugs and for money laundering

With Bitcoin, every single transaction is public, which is not exactly ideal if you are looking to engage in illegal activities. Two reports were recently released claiming that only 1 percent of all Bitcoin transactions were used for money laundering or 44 percent for illegal activities. Needless to say there is no consensus on this issue.

The problem with using Bitcoin or any other cryptocurrency for illegal activities is that you cannot do much with those yet if you have acquired them illegally. If you are running a large illegal operation and you suddenly decide to collect Bitcoins instead of cash, how are you going to pay for your expenses? You will most likely need to go through an exchange to get good old fiat currency in exchange for your cryptocurrencies, and you cannot do this anonymously as many exchanges follow Know Your Customer (KYC) and Anti Money Laundering (AML) procedures when registering users. This is where criminals using cryptocurrencies will get caught as law enforcement agencies are monitoring these exchanges. So cash will probably remain the currency of choice for criminals for the time being.

Bitcoin transactions are slow and expensive

Ever since the SegWit soft fork got implemented about 6 months ago, the theoretical maximum number of transactions per second increased from 5 to 7 per second to close to 20 per second, or 1.7 mln per day. This number is of course very far from what it should be to compete with the legacy payment systems. But it has never been the objective of the Bitcoin Blockchain to record every single transaction. Many of the smaller transactions could be recorded off chain, and this is precisely what the upcoming Lightning Network will make possible.

The whole Bitcoin network has been designed around incentives. Fees are necessary to prevent spam attacks on the network. Without fees any malicious attacker could simply send millions of tiny transactions just to fill up the blocks and paralyze the system. The fees make sure that the most important transactions - those for which high fees have been paid - are processed first. And even if it takes a few blocks to get a transaction validated, it is still much faster than a wire transfer that may take up to 10 days (in the case of international wire transfers).

A long road ahead

Most people still misunderstand what Bitcoin is and how it works, and it is going to take time for them to figure it out. When the internet went mainstream more than 20 years ago, many people did not even see the point of having an email address as they did not know anyone who had one. Bitcoin and cryptos in general are there. Bitcoin adoption is still increasing - even in the middle of a bear market which saw the price of 1 mBTC fall from $20 down to $6 - and it is all that matters. Bitcoin has had its fair share of booms and busts in its 9 years of existence, but what makes Bitcoin different from other bubbles is that even though its price went down many times, it has always recovered.

Non adapted content found at zerohedge.com: Source

Bitcoin is volatile, that is no question about that, nor a myth. 70% drop in a month is volatile.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The 8th Wonder in the world, the Bitcoin!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

basically Bitcoin is in the news from the last year.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

10 days for a wire transfer? I guess that's only in the USA with their stoneage banks. In Europe it's much faster!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed, I couldn't imagine waiting 10 full working days to transfer money!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting article and very informative, thanks for sharing. I've smashed the upvote button for you!

If you are looking to get hold of some crypto without investing or mining, look into https://www.crowdholding.com. They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative and comprehensive explanation about cryptocurrencies and Bitcoin. There are so many myths about what it's for and who uses it, which often makes me zip my lip about it when talking to coworkers and colleagues...until recently. I noticed that the more the mainstream talks about it and the more we see it in the media, the less the rumors will stick. Thanks again. -Respect

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @zer0hedge

Excellent article. I subscribed to your blog. I will follow your news.

I will be grateful if you subscribe to my blog @nepeso

Good luck to you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True, if one wallet gets 0.2 BTC x 5 they will have 1 btc spread in five different places (likely for an HD wallet).

But if you spend 0.21 BTC two of those addresses will be linked.

https://www.walletexplorer.com

Wallet Explorer is free and can link addresses in wallets to give some more info.

Sites like coinbase pay for a more advanced version and get more info.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm new here it's nice to see people put effort into there post opposed to the platforms I'm used to. Thanks for the article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good job. Awesome points.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Although Bitcoin has that weakness, it will still dominate for several years. No cryptocurrency can overcome Bitcoin by value very soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People don´t know anything about crypto, that's why they think BTC is to expensive, because they think they have to buy 1 BTC to be able to enter in the crypto world, while in reality you only need some dollars (to buy some satoshis).

Bitcoin transactions are much better now and much cheaper which shows to everybody that the team behind BTC is here to improve and solve the problems... They hear their community.

And Finally, for those thinking it is still too early to buy crypto, in 5 years we will be laughing at them!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hold your bitcoin as long as you can. You won't regret it! There will be FUD and myths to pressure you into selling. ALL fiat will collapse and unless you can eat gold and silver bars, crypto is here to stay.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent article. It is immediately evident how much work you did when you were preparing it. Good luck to you and Love.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like it so much, you explain all of this very simple, with very good arguments. We need to think that thanks to the open source network you will see improvements every day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Beware of OTC sales of bitcoin to big money. Their purchases are not on exchanges so we cannot see the increase in volume...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 22.78 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read! I have to say but those people thinking Bitcoin is expensive without finding a way to get at least a fraction of it are either too scared, or too stupid.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article. It is very obvious the amount of hard work you put into this post. Great work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this is some enlightment. 1st might not be the perfect one. someday some other altcoin will take up bitcoin role as main currency.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article , keep the good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very impressive post! Bitcoin and its underlying technology, blockchain, are truly revolutionary. All great things take time to be widely accepted and adopted. It is the same with Bitcoin and other digital currencies. Nevertheless, blockchain, both private and public blockchains are being developed and used by big companies and even governments. This adoption is one step in many towards widespread adoption of the technology. Blockbasis hopes to increase mass adoption within cryptocurrency by allowing users to send, receive, store and exchange Bitcoin, Ethereum and more with just an email address.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit