Bitcoin Whales and How They Make Market Waves

Infrequently when there's an immense drop in bitcoin's value dealers called "bitcoin whales" are rebuked for dumping available. Bitcoin whales are people or gatherings who hold tremendous amounts of #bitcoins and can at times influence the market towards their special cost. These market movers have been around since the good 'ol days – 'shaking out powerless hands' multiple occasions throughout the years – yet have fizzled their missions now and again also.

What is a #BitcoinWhale ?

On the off chance that you exchange bitcoins or #altcoins, you've likely heard the expression "#whale" before as the name is utilized to depict huge digital currency holders. The term is utilized thusly in light of the fact that whales are the greatest animals in the sea and they can overwhelm littler fish with their substantial size. Bitcoin whales are taken a gander at correspondingly on the grounds that their broad possessions can influence substantial schools of littler merchants with only a couple of fruitful exchanging techniques. Also the littler the market and less liquidity implies whales can obliterate littler #altcoin showcases way more effortlessly than bitcoin. We additionally accept that #Satoshi #Nakamoto might be the greatest whale of all as the maker purportedly possesses 1 million bitcoins.

Do this process again

There are numerous exchanging moves whales use to benefit, such as utilizing an exchanging strategy usually called the 'do this process again cycle.' The wash exchange is utilized as a part of numerous sorts of business sectors and can be compelling if planned effectively and exceptionally beneficial on the off chance that you are a bitcoin whale. The broker with a considerable measure of property begins offering bitcoins lower than the market rate which now and again can cause a frenzy auction by little time merchants. The trap is the whale sold just beneath the present market esteem and sufficiently only to watch freeze result. At that point the whale pauses and watches the frenzy offering happen until the bitcoin cost achieves an amazing failure. Now, the whales rapidly gather up far more bitcoins than they initially began with and after the 'wash' they normally 'rehash' this sort of exchange frequently. Individuals theorize that there are numerous ways whales can toss their '#BTC weight' around to either drive the cost up or down to amass more bitcoins. Further, whales are not simply people and can be an association like a bitcoin venture support also.

Using #Buy and #Sell Walls

Whales as it were don't need to #exchange their bitcoins to influence the market as they can likewise feign with purchase and offer dividers. In digital money markets, trades utilize a request book to encourage exchanges where a purchaser can set up a request to purchase or offer at a predefined cost other than the spot cost. For example, if the market drops dealers will normally purchase at a lower offer and offer if the cost achieves a more elevated amount. Keeping in mind the end goal to submit a request in the trade's request book, you need to truly possess enough subsidizes to cover the request. This implies a whale and significantly littler merchants from numerous points of view can feign and influence it to appear like a purchase or offer dividers exist. Nonetheless, in many cases extensive purchase and offer dividers vanish just before the cost draws sufficiently near on the grounds that a major player was simply feigning. By the by numerous purchase and offer dividers are genuine and can change the chances rather rapidly on the off chance that they figure out how to exchange somebody's benefits.

#OTC Markets and Dark Pools

In some cases whales don't buy or offer on customary trades on the grounds that their possessions or requests could create some excitement in the market. For digital currencies over the counter exchanging (OTC) or "dim pools" is the place huge purchasers and institutional brokers can buy tremendous measures of bitcoins without being seen by people in general eye. Dim pools are like #OTC exchanging as they are typically found on trades that empower 'confidentially' exchanges which guarantees a whale's moves are more private. Normally OTC markets and dull pools just permit dealers who buy a rich measure of bitcoin at one time and set essentials for section.

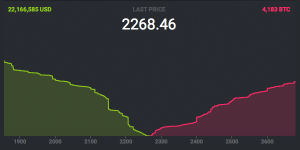

The Infamous Bear Whale

Back in October of 2014, there was an occasion where an enormous bitcoin whale exchanged 30,000 bitcoins for $300 a piece. Numerous merchants and examiners figured it would wreck the market at the time yet rather, the request was tore through by purchasers and bitcoin's cost in this manner rose to $375. The occasion was recollected always, and the merchant will perpetually be known as the "bear whale." The 30,000 BTC arrange was likewise recorded on video close by numerous images and illustrations portraying the epic killing of this enormous whale. Numerous bitcoiners felt triumphant that day in October in light of the fact that a whale of that size neglected to influence the market.

#Whales Are Often Blamed for Big Market Shake Outs

Whales have been examined in the #bitcoin space for a long while, and they are normally rebuked for unexplainable market marvel. Further, there are a great deal of discussions crosswise over bitcoin gatherings making the inquiry — what number bitcoins does it take to be a whale? It appears the appropriate response differs from 1,000 bitcoins to 10,000 bitcoins as indicated by different strings on #Bitcointalk.org and Reddit. Numerous individuals trust that whales can even now influence the market because of bitcoin's moderately little market #capitalization where multi-million dollar requests can at present shake things up. As bitcoin markets wind up more grounded and acquire liquidity, examiners trust it now takes greater bitcoin whales to move the exchanging waters.

Yeah good content i have actually learnt something today.

Cheers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit