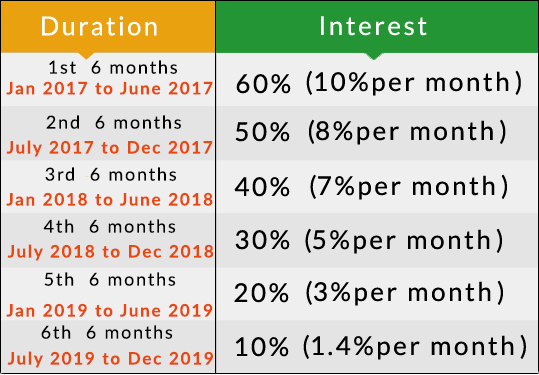

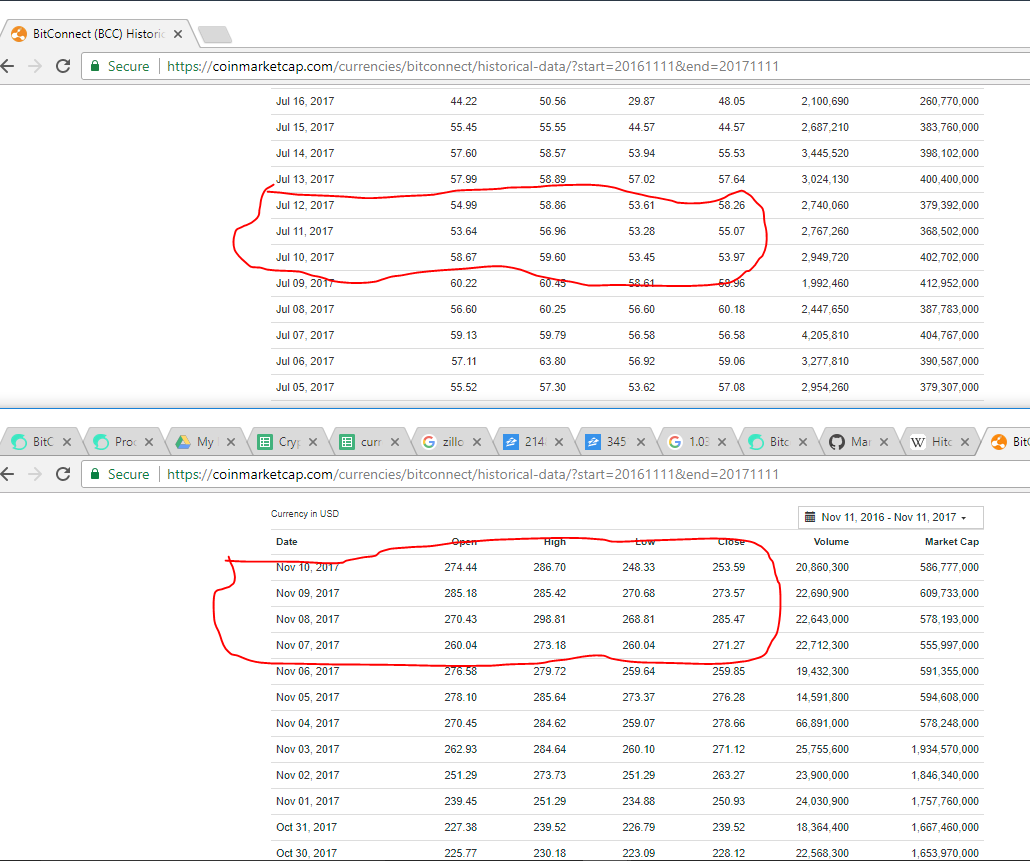

Charlestines.com is correct. Since the loans are pegged at the initial loan amount in $USD for the term, the lender is paid a percent of the initial dollar value. The staker is paid a percent of BCC. So since if you loaned over $10,000 it would take 120 days for a ROC, the BCC price 120 days ago was about $50 (early July), so $10,000 would be 182 BCC tokens. 120 days later ( early Novemeber) the price of BCC is about $250, so to "return" the lender's capital Bitconnect would pay the user about 40 BCC ($10,000/250{$/BCC}). What happened to the other 142 BCC? The staker would've taken $10,000 worth of BCC in July, which would have been 182BCC. Fast forward 120 days, and they would have a BCC wallet with 182 BCC of principal. So assuming compounding (ignoring the $100 minimum) the lender would total $ 34,000 (($10,000 x 1.0125^120)-1) of interest, wheras the staker has made $14,500 (58BCC x $250{Nov. Price};58BCC = 182 BCC *(.08+.08+.08+.08{monthly stake interest})).

However, the lender's total is $44,000 ($10,000 principal + $34,000 interest), whereas the staker has $60,000( $250 * 182BCC principal + $250 * 58BCC interest). This even ignores the compounding of staking interest ((1.08^4)-1)

TL;DR take away over the last 4 months a staker would have $60,000 whereas a lender would have only $44,000 starting with the same $10,000 initial amount.