Hi Steemians,

I came across a post by @lukestokes from a year ago, were he showed a great real example of Shorting the U.S. Dollar With BitShares.

Until May 29th 2018 I never used Bitshares with debt. I just used it to hold my BTS and other crypto. Its decentralized and we always keep the control of our funds here, and not go into risk of loosing them on centralized exchanges like Gate.io that they can suddenly start asking for KYC. By the way, I finally was able to get my eosDAC after 2 days without making the KYC on Gate.io.

How I made 40 bitUSD out of thin Air - By following an Example of @lukestokes

--

I first borrowed the bitUSD, and then I bought BitShares with it. 4 days later, the value of BitShares went up so my collateral was above 4.20 , so selling at that point or above was for a profit.

This is what I did.

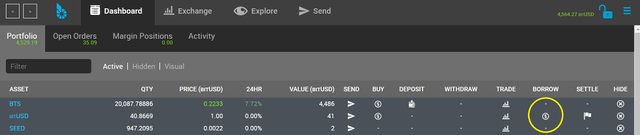

I first clicked on the Borrow button (See image below) to borrow some bitUSD from the network.

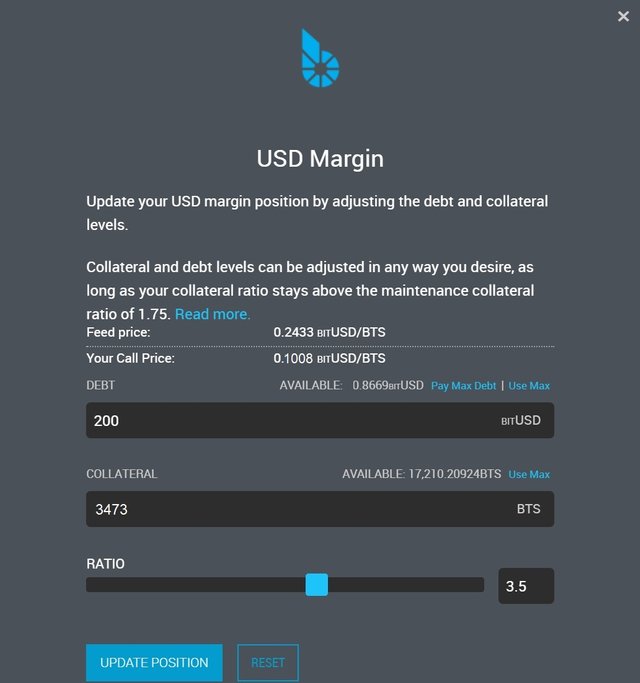

When you click there, another box will appear, were you need to choose the amount of USD to borrow (your debt), and the ratio of collateral to cover the debt. I chose 3.5 ratio to be confortable in case the price of bts went down a bit. >Collateral and debt levels can be adjusted in any way you desire, as long as your collateral ratio stays above the maintenance collateral ratio of 1.75.

With a margin call (my USD/BTS call price was 0.1008), your collateral is sold in order to pay your debt. You can read more on collateral by clicking on read more of the box below (inside the bitshares wallet).

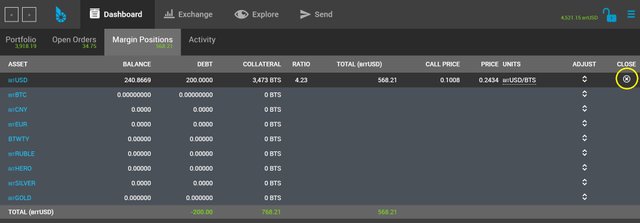

I clicked on the Update Position button and my debt and collateral were updated as follows.

With this 200 bitUSD I bought 1,090 BTS.

Initiatlly as you can see on the box, my ratio was 3.5. When it changed to 4.23 I decided to close the position. In order to close it, you need to have the 200 bitUSD you borrowed initially.

So I sold the 1,090 BTS I bought initially with the 200 bitUSD I borrowed, and got 240 bitUSD at the current price of USD/BTS (you see here its 40 more bitUSD than what I borrowed), so this 40 bitUSD were created from thin air! With borrowed funds from the bitshares network. We always kept our bts crypto (the one we used as collateral).

I clicked on the Close Position cross button and my debt and collateral were updated as follows.

My debt was removed and the collateral returned, and I stayed with the 40 bitUSD!

All this works when BTS goes up after you decide to borrow from the network.

--

Hope this information was helpful!

Regards, @gold84

DISCLAIMER

--

This shall not be taken as financial advice. I am not a financial advisor and none of your investing should be carried out based on any information presented here. You can lose all of your money investing in crypto currencies. The information above is for educational and entertainment purposes only.

Interesting. Despite It is risky as well in case the market drops suddenly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed @toofasteddie ! But if you do it when BTS is so low like 20 cents, and do it with a big ratio of debt/collateral you reduce the risk a lot. In any case, I thought, if BTS goes to 10 cents or less I would buy as much as I can of BTS so, for me in this case it was more a winning situation.

Regards, @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well done! One thing I would recommend, however, is keeping a much higher ratio that 4 to 1. I usually go with something like 20 to 1. Otherwise, you'll learn the hard way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your feedback @lukestokes ! In my case if the call price says: 0.1085 , it means that BTS has to go to 0.1085 in order to be margin called? Did I understood right?

Regards, @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's not entirely that obvious, but yes, something like that. Depending where you are in the queue here will determine if you get called or not (scroll down and click Holders and Traders)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @lukestokes ! I did not find my user on the top 250.

Regards, @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @lukestokes ! I have a question for you out of this context, regarding foxy. I know you no longer a partner there because you sold your part to your partner, however, I thought you could help me clarify this.

If I start using foxy to bill my customers, do I avoid paying PayPal fees? Is there a way with foxy to receive credit card payments, without paying PayPal fees?

Hope my questions make sense.

Regards, @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No, you always have to pay your merchant account and payment gateway provider fees.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @lukestokes !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If it goes down?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will this work if everything is in reverse? crypto has been nose diving.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome i think i will try this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting. Despite It is risky as well in case the market drops suddenly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

something the same work does not hurt in terms of loans. this is great. i like the activities of your way of investing. what else the promo-steem activities are there..you can support my little promo activities in some of my post. you are amazing for me. hope you successful lord @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit