I've been playing with BitShares for the last few weeks, and it's really interesting stuff. You can read more about shorting the USD here: Playing in the Margins: bitUSD and BitShares on Open Ledger.

Advanced technologies come with advanced challenges. How are "normal" people supposed to catch up with years of development to know what's going on and how it got that way? I could spend months reading through the 150,000+ posts on https://bitsharestalk.org/. I could spend hours in https://telegram.me/BitSharesDEX asking stupid questions. It's hard to know where to start. I guess I'll just keep working through the wallet help for the basics: https://bitshares.org/wallet/#/help

I know just enough to know the BitShares decentralized exchange and wallet in one is an amazing idea. The number one rule of cryptocurrency is to control your own private keys. If you don't control the keys, you don't own that asset. If you have cryptocurrency on a normal exchange, they control it. They own it. You have to trust them to give it back to you when you request it. BitShares solves that by keeping the keys in your browser (or the app) while also connecting you to a decentralized exchange. No trust is needed and the fees are tiny compared to normal exchanges which not only take a percentage of each transaction, but they often charge fees for withdrawals as well.

Right now one of the biggest problems I see is lack of liquidity. If the BitShares system had more volume, I'd do all my trading there. Without enough people using it, the spread on the buy/sell walls is too great.

So this morning I was looking into some trading bots. There's stakemachine by Xerox and BTSBots by Alt. I'm a bit overwhelmed. I went to create a new Bitshares account and it said I needed to pay for it, but first needed a lifetime membership account at the cost of 17,611.61748 BTS (currently over $140). I realized I could just open an incognito browser tab and create a new account there for free using the facet. So why would I pay for a membership? The trading fees are so low that even 80% back on them would take a very long time to make a 17k+ bitshare payment worth it.

I recently read this great post by @cryptoctopus Inspiration to Advertise and Market BitShares Decentralized Exchange (DEX) where they said:

Right now, there is no marketing behind the project even thou the product is awesome.

That's how I feel about this also. It's amazing technology, but it's confusing because it's so advanced.

It's tempting to just move on to simpler things. But for some reason, I can't. I think this, like Steemit, is important. I think decentralization provides hope for the future with more freedom and voluntary interactions.

So let me end with some newbie questions / observations which might be helpful for those who've been around BitShares for a long time.

Why should anyone purchase a lifetime membership? What are the benefits of doing so? Will the price of a membership always be the same or has it (could it) change over time?

The Advanced vs. Basic mode is helpful on OpenLedger, but things are still a bit complicated, even for people who are familiar with using a cryptocurrency exchange. For those who have never used one (many just buy from Coinbase), it can be overwhelming. How to fix this? I don't really know. Maybe links out to professional training videos explaining all the features?

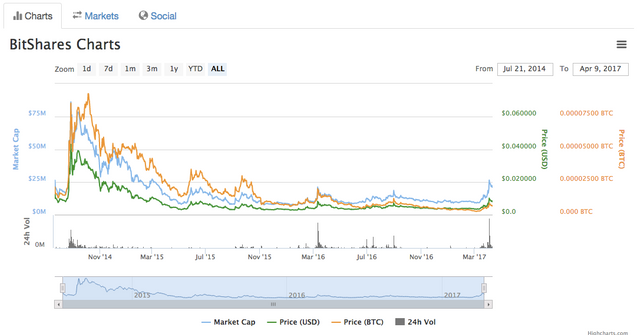

How can we get people excited about an asset which has mainly just gone down in value over the last 3 years?

Again, I think BitShares is an amazing system, but I feel like I'm hoping against hope that the rest of the world will realize this also and invest in it seriously to bring up the price. A test of the technology last month showed it can average 333 transactions a second! How are more people not really excited about this?

Part of me wants to promote this system more, but I also don't want others to buy in and end up as bag holders if the price just keeps going down.

What do you think? What advice do you have for BitShares newbies like me?

or do i get something wrong here.? pls correct me if i'm wrong

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think that's

MAX TXSand I was talking aboutAVG. TXS (LAST 100 BLOCKS)Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Answers to all of your questions:

A lifetime membership enables the account to save 80% of all its fees for the lifetime of the account, and allows the account to earn referral revenue from the fees of new accounts that it refers. This can represent a significant revenue stream for developers that onboard new users with their apps, like @chris4210 with blockpay. It saves a large amount of money when creating user issued assets, which cost over 7300 bts for a 5 character asset name, or 1400 with a lifetime membership. This will save back the lifetime membership cost in 3 assets.

The best training resource for starting in bitshares is Chronos

This is IMO the best explanation of the benefits of BitShares:

People can get excited about bitshares because it has the best decentralized exchange capabilities in the entire cryptocurrency space, has the fastest blocktimes in the entire cryptocurrency space, and is the only cryptocurrency to enable market pegged assets, or smartcoins, for holding stable value. It currently has a strong startup scene, with BlockPay, OpenLedger, PeerPlays, Apptrade, and many others planning to utilise its network in the future. Bitshares incorporates an entire stock market ecosystem onto the blockchain, that is easier to use for creating digital assets than ethereum tokens.

A great way to learn about bitshares is to read the whitepaper here: http://docs.bitshares.eu/_downloads/bitshares-financial-platform.pdf

You can explore the blockchain and see just how many assets there are here:

https://cryptofresh.com/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for a great reply. I understood much of #1 but it didn't add up for me until you mentioned app developers and how that can work for them. That makes a lot of sense. Would you say it only makes sense to become a lifetime member if you plan to release your own assets? Otherwise the math just doesn't make sense to me.

Is the whitepaper kept up to date (unlike the Steemit whitepaper)?

Thanks for the videos, I'll check them out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitshares is great, and it's way ahead of its time.

You ask a bunch of good questions. Having a decentralized exchange is huge right? But the volume, yes, well. Bitshares solves a problem that affects something like .0000001% of the world population, and that's maybe being generous.. I got lost in the decimals.

Essentially, it's hard to sell a solution to a problem that almost no one knows exists.

For crypto-geeks, Bitshares should be the Holy Grail, but the Bitcoin maximalist crowd has been too busy propping up their crypto-idol instead of championing new innovations in the space. Hey, they have their reasons and profit motives, who am I to judge.

Anyway, Bitshares isn't going anywhere, and there's still a ton of development going on around the platform as @dahaz159 mentioned.

From my point of view, Bitshares is SO FAR ahead of its time, that we won't see more widespread adoption until the crypto crowd has gone 1000-10,000x in size, along with the market cap of the relevant pioneers in the space.

Good news, that's what Steem is here to do!

When hordes upon hordes of people have their value stored on a blockchain, then they will need a decentralized exchange..

Steem: Creating problems we already have solutions for! ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said.

I think your predictions (1000-10,000x in size), though somewhat discouraging, make a lot of sense.

It's interesting to see a technology so ahead of its time that it's hard for people who do understand it to market it correctly for everyone else to get onboard.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I finally got to a point with trading on the bitshares exchange where I "got it". Part of the confusion revolves around its flexibility. You can literally trade so many pair combinations that I couldn't wrap my mind around the relative "values". Couple that with lack of liquidity, and I found myself going to outside exchanges to check the going rate on various cryptos.

Leaving your trading platform to check prices is totally counter-intuitive. The first thing I decided to do was to only trade in bitUSD:SOMECRYPTO. This allowed me to fully quantify my trade order.

So, the way I invest in bitshares, while simultaneously owning other crypto is as follows:

By borrowing bitUSD with bts as collateral, you are, by definition showing faith in the underlying bts asset. You have the opportunity to benefit from both your investment in the other crypto, and any price increase that my come to bitshares.

It is important to have reserve shares in case the bts price falls so you can add to your collateral position if it gets close to 2:1.

One last thought:

It would make a lot of sense to display the spot price for the common cryptos on the Exchange page. This would keep me from going elsewhere to check the price. Ultimately, with enough liquidity this problem will go away.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I completely agree and had similar confusions. That's why I created this cryptocurrency spreadsheet so I could track assets in USD, BTC, and BTS. I needed all three to compare prices across various exchanges and coinmarketcap. When a price is good in one place for arbitrage (or just to know the price hasn't yet "caught up" so it's a cheap buy), I needed a way to quickly compare relative values in various currencies. You may find that spreadsheet useful. I've really been enjoying playing with it and improving my own copy with buttons which activate scripts and such (see the comments for more on that).

I've done the bitUSD loan thing a few times now and only this last one will I have to a wait a bit to pay down because BTS went down in value and I bought BTS with my bitUSD loan. I actually went 5:1 on that one just to be safe and not have to check it all the time. I also have a good amount of BTS on an exchange so I can increase my holdings a bit when things move around.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I asked this question somewhere else but I hope to know more opinions so I asked again here... As I roughly understand, Ethereum and Bitshares are like two camps/ecosystems. What do you think about their biggest differences (advantages/weaknesses)?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's a great question. I don't know enough about them to answer, but I would like to hear other answers.

My hunch is Ethereum has more marketing behind it and maybe some more well-known investors or industry people promoting it. It seems the BitShares/Steemit ecosystems are built by developers for developers without much thought beyond just the actual technology. It's all quite fascinating to me how the technology itself isn't what really matters when it comes down to which one gets more marketshare.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A classic example of how superior tech fails in the marketplace is how VHS won over BetaMax video taping.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep. I mentioned that in my reply to Dan.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think more people should try it out. When I realised what I have on my computer I simply could not grasp the consequences. It is huge. It takes some time to get under the hood of it though. As for the price of bitshares, I hope they stay where they are. I'm mining and a fair chunk of it is bitshares.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I haven't even looked into mining it... Can you send me some links with more info?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Eobot has bitshares in their cloud mining service. I just started using them a week ago, so I'm relatively new to it. It seems straight forward, just remember that they hold the assets for 6 months if you decide to purchase by credit card. You avoid that by using bitcoin. Here is a referal link from me: https://www.eobot.com/new.aspx?referid=663733 if you like to sign up. I chose the 1000 gh for 220 USD . 5 years contract.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I thought BitShares couldn't be mined in the traditional sense?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. I don't know what @funkit is talking about. W A Y back in the early days there was PTS which was a PoW coin used to seed the BitsharesX project. That may be what he's referring to, but afaik nobody is mining that of significance if at all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post

Lifetime membership entitles you to earn through the referral.

http://favs.pw/bitshares-how-to-earn-money-with-the-referral-program

I am using the official light client, no basic mode.

https://github.com/bitshares/bitshares-core/releases/latest

Keep spreading the word, use BitShares as often as possible.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah, thank you. I didn't connect the dots with realizing how you get a chunk of someone else's lifetime membership fees. I guess that creates an incentive to become a lifetime member and then convince others to become lifetime members. If they join up, then you essentially get your membership fee covered by them.

That sounds kind of like a multi-level marketing or Ponzi scheme though. I can imagine many not liking the feel of that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your referrer gets a cut of your membership fee, but your referrer's referrer does not. So it's not remotely like MLM. It's really more like any other referral program you would find out there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Except that it stops at 2 levels deep IIRC. Originally Mx Wright suggested a MLM scheme and there was significant resistance. Cutting off the nesting level to a shallow depth of 2 helped to get acceptance of the idea.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't see Imperial Credits on your chart. An oversight I am sure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm a BitShares newbie too and it's definitely a mind blowing platform. I can only imagine what EOS is about to bring

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lifetime membership is actually a requirement to become a witness as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I still need to read the whole white paper. Are there backup witnesses as well like with Steemit?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Similar, tho they aren't paid (they are in steemit tho right?).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You should not buy #BitShares with the direct expectation that the price will go up but rather that the ecosystem will attaract users and that will lead to a price surge upwards.

So do not promote BitShares as an investment but rather as a useful ecosystem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It kind of sounds like you said "Don't expect the price will go up. Expect X to happen so the price will go up" but isn't that just two sides to the same coin. The end expectation is that the price will rise. The reasons for it rising and the timeline involved is secondary.

One of the challenges I've been thinking about since getting involved in crypto is how scarcity and usefulness does not automatically equate to value. For example: ip addresses are becoming more scarce. They are very useful as you can't do business online without them. And yet, they are quite cheap. There are far more satoshi's then there are ip addresses.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The reason behind the price of #BitShares rising is not secondary but in fact primary. The price will only go up and stay up only when the ecosystem offers value beyond token speculation. Value will be created when apps are built on the platform and BitShares are widely accepted and used (even if it is just within its own expanding ecosystem) as currency to pay for apps, computing, storage, goods and services etc.

If BitShares does not get traction as an ecosystem with a growing number of useful apps and active users then any price increase would just be as a result of speculative demand and that is a game of hot potato!

IP addresses are scarce but are shareable with little to no reduced utility. Satoshi's on the other hand cannot be shared as that would be double spending.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think, if we're honest with ourselves, all value is subjective and can only be determined in the moment of exchange. Whether it's fiat, BTC, sea shells or tally sticks, we determine value through our daily interactions and decisions of where to put our trust. Many coins have gone up in value without much ecosystem but a lot of great marketing. It's possible they will come crashing back down again or that value increases the network effect and incentive to build the things envisioned to support the value in the first place. I guess I'm arguing that there's a lot more psychology in place here than most give credit to. It's not just build it and they will come. Sometimes it's convince them this is a place you want to be, and enough people will come and start building it.

My company owns and needs 100's of ip addresses and they aren't really shareable in the sense that at least one is required for a unique web property. It would also be double spending if you typed in a www address and more than one person claimed ownership of the IP DNS pointed to. Subnet mask and private LAN IPs via NAT are similar to bitcoin side chains, but the main IPs are still needed for domains. The point being, scarcity alone does not determine value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I mostly agree with you. We even seem to say the same thing in different words.

Me:

You:

I would say scarcity plus utility results in value.

Even perception of value is utility as is the case with gold and silver whose non-perceptive utility does not justify their value.

I know of shared web hosting plans with one main IP that can support multiple domains, some even claim to support an unlimited number of domains.

IPs are used in different ways: some uses require dedicated IPs while some do not. As such comparing IPs and Satoshis is not possible because Satoshis are never shared while IPs are shared for some of its uses. When usage requiring dedicated IPs increases, the price of IPs will increase to reflect the increased scarcity as fewer IPs will be available for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's a bit of a jump for me as I think it changes the definition of utility, but I see what you mean.

And yes, our needs require individual IPs, but you're right, it's not an apples to apples comparison.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't really have any answers for you, but I have been playing around with OpenLedger a bit this week, since Poloniex suspended accounts for people residing in the state of Washington... so basically just "marking" this to see what anyone else has to say.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, that suspension is another example of why decentralization is so important.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most problems with Bitshares are not in the technology but in the community. There have been or still are some toxic people involved. That's why the marketing sucks, that's why Dan was pretty much forced to leave the project.

Probably the best thing would be if BTS price would go really low so a group of real business people could buy a large stake and then they could control the development.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've seen some examples of "toxic people" here on Steemit as well.

Would you be brave enough to name them, based on your perspective? Are they witnesses or committee members? Without an authoritarian hierarchy which can smash opposition or make it exceedingly uncomfortable for them to remain in the community, bad apples will always show up and bother others. The trick, I think, is figuring out how to build safeguards into the protocols themselves. That, and the entire community taking a stand against abusive behavior through naming, shaming, and ostracizing those who do it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe the worst group was – and maybe still is – the people I called "antidilution gang". When the price was going down, they wanted to stop all worker contracts so that less BTS would be liquid. That was a big reason why the development has been almost non-existent after Dan left. And a big reason for Dan leaving was that he (and Cryptonomex) had used all the initial funding and they had even funded some of the development with their own money. There wasn't anything left and they couldn't get more from Bitshares DAC or community.

Those people didn't understand that Bitshares was supposed to function as a DAC and fund its own development. Bitshares is doomed with individuals like them as big shareholders. They had too much power and probably still have (I haven't checked for a while).

I don't think I'll remember all the names anymore without searching a lot of old topics at Bitsharestalk, but here are a few:

I was quite vocal against them year ago when things got heated. But unfortunately in that point a lot of good people had already left the project so nothing happened. Then I left, too, because Steem was launched.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for sharing that with me. It's hard to summarize years of experience within a community, but I think you did a great job.

When I look at the price charts of bitshares, I can see why so many people were so against causing further dilution in their time and investments. Some people think really strategically and long term while others are interested in the here and now. If so many people were angrily losing money, I can see how it would get very difficult to keep doing things which cause them to lose even more money. It's not an easy situation at all.

As a business owner, I realize not everyone wants to be a business owner. Some people prefer to be workers who enjoy a stable paycheck and security. They'd love to share in the profits but have no interest in being on the hook with risk for losses.

If I try to put myself into a similar situation... I wonder what I would do. If Steemit INC, for example, was to sell a lot of STEEM to fund development driving the price of STEEM down around a penny or two, I'd be pretty frustrated by that. Also, another hard thing to consider, is once a cryptocurrency gains a perceived value, due to the psychological effects of anchoring, it can be very difficult to re-value that token without significant investment. That said, if that low price of STEEM was relatively temporary (maybe a couple years max), I can see the long term vision enough to think it would be a good buying opportunity to double down and hope for a big win in the future.

What are some worker contracts (or work in generally) that you feel needs to happen to really take BitShares to the next level?

Thanks again for your time. I really do appreciate hearing the back history without having to spend weeks reading through the forums. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most of the antidilution gang are Chinese which caused a lot of communication problems. Their English was bad and they just couldn't articulate their points or plans so clearly that other people would have understood them. That prevented the community from making any coherent plans that everybody could stand and act for. The system got paralyzed.

There were lots of great lessons to learn. Decentralization is not a miracle drug that makes everything magically better. It makes cooperation and decision making much harder and that can cause serious harm for a project.

I'm not sure what would be the best way to get Bitshares rising again, I haven't been following what's happening in there. Now that Dan is working on a new platform, I'll wait and see what it will be about. If it's a general smartcontract platform that can easily implement financial contracts, it might make sense to use it to replace Bitshares.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! I have been looking for answers for the reason behind Bitshares problems for months now. No one was brave enough to explain it like @samupaha did here.

So, I thank you very much, @samupaha. And I thank @lukestokes for openning the subject.

BTW, I know I am writing this 5 months after the article was published, but it seems that the same problems mentioned here are still valid.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 5.40 % upvote from @bellyrub thanks to: @sadekj.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Marketing is horrible. All this time hearing about Bitshares, even owning some, and I had no idea about the exchange until a few days ago.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's kind of a bummer. :(

I only know about it because @billbutler had me sign up under his referral. I'm glad he did.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You used my referral? Cool. You might be my one and only! Although I've been singing Bitshares praises for quite a while now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, I haven't yet taken the plunge to buy my own life-time membership. Seems the only way to make that pay off is to get a couple other people signed up under your own referral and have them buy their own memberships. The fees are so low that 80% back on them still isn't enough to cover the 17k+ BTS needed for the membership. At least, that's how it seems, but I may still pay the fee eventually if I continue to be as impressed with the ecosystem as I have been so far. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're right, it's BitShares weak point. It carried over into steem to a certain degree, but steem did make improvements. But I believe with this price rally we're seeing the return of enthusiasm tothe BitShares community and a renewed and strong interest in marketing. Go back in Telegram and review the discussion that started around 5AM Sunday and lasted until almost noon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @lukestokes and @samupaha for the post and replies. Very informative. I really wish BitShares would revamp the benefits they offer with the lifetime membership. Saving on trading costs and earning referral fees are nice but will not drive viral adoption. I'm a newbie to the platform and I find myself wanting to cheer it on but there doesn't seem to be any forward momentum. By the way, who benefits from the exchange revenue? Has it ever been discussed if lifetime members be made the beneficiary?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I found this image to be the most helpful at explaining how that all works:

As for OpenLedger, I think they distribute profits via their OBITS coin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit