.jpeg)

• BitShares features a reserve pool of 1.2 billion BTS (about $8 million dollars) that mechanically grows as dealings fees square measure collected and therefore the share worth rises. Each day, the blockchain is allowed to pay up to 432,000 BTS (about $77,000 per month), that is enough to rent alittleteam to take care of the network for years, even with no worth appreciation.

• Built mistreatment the newest in business analysis, BitShares 2.0 offers a stack of monetary services together with exchange and banking on a blockchain.

The BitShares platform itself is run and maintained by the BitShares community–an open pool of people and organizations committed to providing universal access to the facility of sensible contracts.

• BitShares 2.0 is AN industrial-grade decentralised platform designed for superior money sensible contracts.

Market-pegged assets, like the bitUSD, square measure crypto tokens that escort all the benefits of ancientcryptocurrencies like bitcoin howevertrade for a minimum of the worth of their underlying quality, e.g. $1.

BitShares represents the primarydecentralised autonomous company that lets its shareholders opt for its future direction and merchandise.

BitShares coined the term “decentralized exchange” (DEX).

• BitShares could be a technology supported by next generation entrepreneurs, investors, and developers with a standard interest to find free market solutions by investment the facility of worldwide decentralisedaccord and higher cognitive process.

• BitShares appearance to increase the innovation of the blockchain to all or anyindustries that depend upon the net to produce their services. whether or not its banking, stock exchanges, lotteries, voting, music, auctions or several others, a digital public ledger permits for the creation of distributed autonomous corporations (or DACs) that give higherquality services at a fraction of the valueincurred by their a lot of ancient, centralized counterparts.

“The advent of DACs ushers in AN exceeding new paradigm in structure structure during which corporations will run with nonehuman management and below the management of an incorrupt set of business rules. These rules square measure encoded in in public auditable open supply computer code distributed across the computers of the companies’ shareholders, WHO effortlessly secure the corporate from discretionarymanagement.”

• BitShares will for business what bitcoin did for cash by utilizing distributed accord technology to make corporationsthat square measure inherently world, clear, trustworthy, economical and most significantly profitable.

• BitShares X was initial introduced during a written report titled “A Peer-to-Peer Polymorphic Digital quality Exchange” by Daniel Larimer, Charles Hoskinson, and Stan Larimer.

The BitShares community chieflyrevolves round the BitShares Team and third parties WHO use Graphene (the toolkit that produces BitShares possible) to make their own Distributed Autonomous corporations.

• BitShares has developed another approach to making worth stable digital assets by employing a cryptocurrency as collateral during a contract for distinction (CFD). With this approach, 2 parties take opposite sides of a trade, wherever one party is secured worth stability, and therefore the alternative party is granted leverage.

• This works as long as enough collateral exists, and therefore the contract is settled by an honest third party with a worth feed BitShares could be a counterparty-trust free platform for money sensiblecontracts that operates over the net, and offers a group of monetary instruments that features CFDs.

.png)

• Market Pegged Assets (MPA) or “SmartCoins” that represent a spin off with edict currency, gold, or perhaps alternative cryptocurrencies because theunderlying quality also are out there on BitShares.

• The BitShares platform contains a versatile feature known as “user-issued assets” (UIA) which is able to facilitatefacilitate a good vary of profitable business models based mostly around bound kinds of services. A UIA could be a variety of custom token registered on the platform, that users will hold and trade at intervals bound restrictions.

• The creator of such AN quality will in publicname, describe, and distribute its tokens, and may specify custom necessities likeAN approved whitelist of accounts allowable to carry the tokens, or the associated mercantilism and transfer fees. These tokens yield numerous use cases like possession trailing, crowd fundraising, IOUs, and coupons.

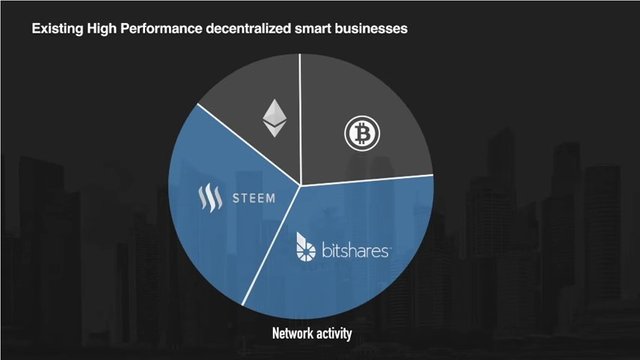

• BitShares provides a high performance decentralised exchange (DEX), with all the options expected of an expertmercantilism platform. Any 2 assets that square measure registered on the blockchain (MPA or UIA) could also belisted against one another at any time. Orders is settled nearly instantly at speeds of up to one hundred,000 transactions per second.

• With this typeof performance on a decentralisedexchange, there's now not a requirementfor traders to show their funds to the risks of centralized exchanges.

Decentralization provides BitShares hardiness against failure.

• With BitShares your trades execute in seconds, a bit like any centralized web site interface. in contrast to centralized exchanges, there is no high-frequency mercantilism, front running, or hidden orders. This puts all traders on A levelenjoying field.

• Every dollar, Euro, bitcoin and ounce of gold control as a SmartCoin on the BitShares exchange is backed by up to double the reserves of ancientcentralized exchanges. By perpetuallymaintaining reserves, you'll be able torest assured that BitShares is solvent in nearly any market. All of the reserves square measure unbroken as BTS continued the blockchain, and that theycan not be taken, as a result of there aren't any personal keys that may be compromised to steal the reserves.

• Assuming a ten second block interval, Bitshares is mathematically over 70x less probably to orphan when one block than Bitcoin when one block. when three blocks any random orphan can are resolved and therefore the likelihood of different chains is far less than the 0.000001% of Bitcoin. By the time Bitcoin gets to .7% orphan likelihood, BitShares has sixty blocks which mighthave a likelihood of being orphan of but 10−120.

• With BitShares, nobody should approve your account. you've got complete money freedom.

At simply some cents per trade, BitShares is one among the most cost effective exchanges around.

["Companies will issue their own stock on the BitShares network and permits implement, cheap mercantilism with complete protection against naked shorting."]

https://briandcolwell.com/2017/08/bitshares-now-you-can-be-hired-by-the-blockchain/.html

There is reasonable evidence that this article has been spun.

Rewording someone elses writing could be seen as plagiarism. Article spinning is strongly discouraged, and will be addressed very seriously.

Some tips to share content and add value:

This type of spam is strongly discouraged by the community, and may result in action from the cheetah bot.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit