Libra Credit

What is Libra?

Libra Credit is a decentralized platform that enables users access to credit anytime and anywhere, which will be based off of the Ethereum platform. Their platform will enable crypto-to-crypto as well as crypto-to-fiat lending, which the Libra Foundation plans to go live in July of 2018!

On May 22, Libra Credit (LBA) launched the mainstream digital currency exchange. It is attractive that Libra Credit is based on the Ethereum blockchain that facilitates the cryptocurrency lending while solving the problems people may encounter in the fiat currency.

The Libra Foundation was created back in 2017, when a group of talented executives from PayPal came together to address this growing issue for lending platforms that solves issues that are encountered in cryptocurrency as well as in fiat. In the words, of the CEO and Co-Founder of Libra, "Libra Credit helps mobilize your crypto currency in your wallet. You don’t have to sell it, but you can collateralize it so that you are still the holder, at the mean time, your problem of fiat currency will also be addressed."

The Team

Before diving into a couple of the individuals on the Libra team, it is of utmost importance to point out how skilled the history of the track record in digital services all across Asia. Their team has developed solid partnerships that will enable their team to strategically place themselves ahead of their competitors. Lets take a look at 2 of their team members, Lu Hua & Dan Schatt, and then one of their advisors, Scott Thompson.

Mr. Hua is currently the standing CEO for Libra, and he helped found the project with Dan Schatt. Prior to working for Libra Credit, he was the CEO over at moKredit, which is a digital credit service that served more than 30M individuals (definitely a good sign for Libra Foundation!). Before leading the moKredit team, he completed multiple positions at PayPal. He was in charge of product development, product management, and then during his final year he was in charge of Core Payments for PayPal in China.

He actually did a live stream for viewers in Korea yesterday, so if you are fluent and want to check it out, you definitely should, just click here

As mentioned before, Mr. Schatt helped to found Libra, and he is currently working as the President for the foundation. One of the additional things to mention about him is that he recently became a board member for Uphold, which is a cloud-based digital money platform allowing users to buy and transact between more than 30 cryptocurrencies. Before beginning his work for Libra, he was at Stockpile, working as their CCO. He was also the GM of Financial Innovations at PayPal.

Mr. Thompson brings an unbelievable amount of expertise to the team at Libra. He is one of the advisors for their team, and for the time being, he is the CEO at Tuition.io. Before jumping into the crypto world, he worked as the CEO for Yahoo, and was the President of PayPal. He also has experience working as CIO for Inovant, which is a subsidiary of VISA. I love the experience this man brings to the team.

The Platform

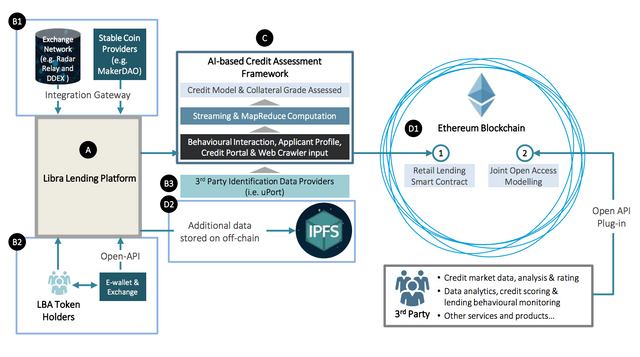

By implementing strategic partnerships into their platform, Libra has enabled a beautiful future for their lending platform. Their platform involves four important sections:

- Libra Lending Platform

- Partnership Network Access Integration

- AI Credit Assessment Engine

- Smart Contract Suites built on Ethereum blockchain

Libra Lending Platform

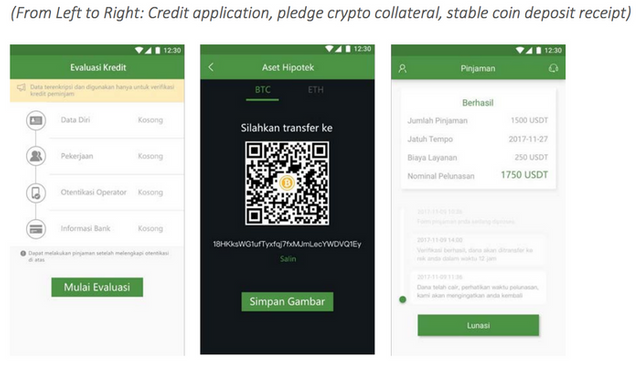

The lending platform is the front-end of their UI, which will allow token holders to gain access to their mobile application. It is good to see that they already have a product out that they are using to test crypto-to-crypto loans.

Partnership Network Access Integration

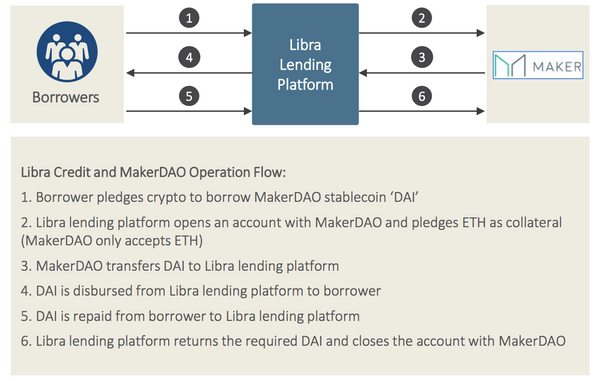

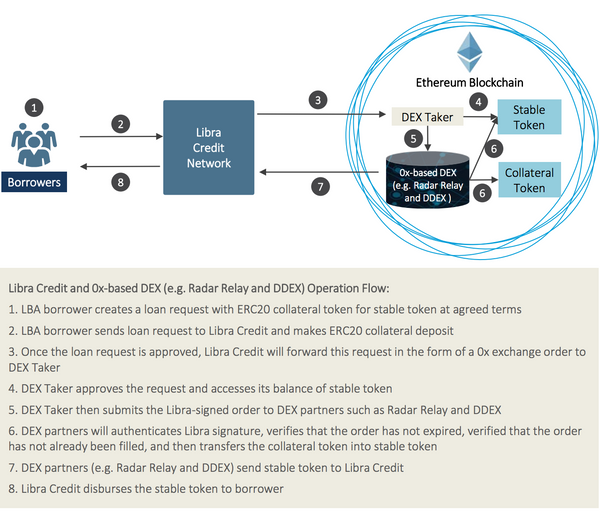

Two of the solid partnerships that Libra has integrated are with exchanges (Radar Relay & DDEX) and stablecoin providers (MakerDAO).

For the latter, Libra has partnered with MakerDAO to enable access to their stablecoin, DAI.

In order for people to have access to collateral for ERC-20 tokens, Libra has the ability to connect you to 0x exchanges (like DDEX).

Libra also enables users to connect to their platform by getting them to connect to different e-wallets through open APIs.

AI Credit Assessment Engine

This is one of the awesome aspects of the Libra platform, which connects your "mobile application behavior, application profile, social network, banking history and matching entries from credit rating providers". By using machine learning, Libra is able to create a trustable credit score. For determining their grade on collateral, Libra has brought on WebCrawler's technology, which "automatically analyses trading history, Github repositories, blockchain explorers, media reports, social network data, speculative information and cryptocurrency forum discussions to form a comprehensive collateral report".

Smart Contract Suites built on Ethereum blockchain

Every time a user borrows from a lender, they will be placed onto a smart contract, which will be stored onto the blockchain. In contrast to this, the customer's profile, as well as loan data is all stored off of the blockchain, and placed onto an IPFS (InterPlanetary File System), which will increase storage efficiency, cost and speed of transactions.

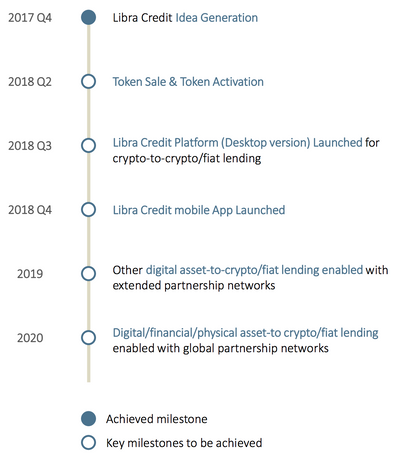

Roadmap

Libra crushed their ICO, and are already traded on public exchanges. Going forward, I am really pumped about their Desktop credit platform to go live within the next few months. This will be a huge stepping stone for this organization to prove their worth and to be able to tackle their competition. I personally think that having the mobile app launched later this year isn't as big of a deal as compared to the desktop version, as this will probably give investors a good idea as to whether are more keen to use their platform compared to others.

The Token

The Libra ecosystem and lending platform is built off of their ERC-20 token, LBA. Right now, their token has a circulating supply of 500,000,000 LBA, with a total supply of 1,000,000,000 LBA. The main usage of their tokens is to enable access to their platform. In order to use the lending program, you must be an LBA token holder! The LBA token is also used for the transaction fee for all of the payments on their platform. The team also enabled a form of incentive for users to own more than just "a few" tokens, by giving the ability to get referrals by owning a certain amount of tokens. They are also used as governance over their platform, so token holders can give feedback on development and different projects!

Libra Credit Links

Website: https://www.libracredit.io/

Whitepaper: https://www.libracredit.io/page/Libra%20Credit%20Whitepaper.pdf

Social Media

Telegram: https://t.me/libraofficial

Telegram group #2 (if first group is full): https://t.me/libraofficiallink

Medium: https://medium.com/libracredit

Twitter: https://twitter.com/LibraCredit

Linkedin: https://www.linkedin.com/company/18560125/

Reddit: https://www.reddit.com/r/Libra_Credit/

Discord: https://discord.gg/UmJUTDJ

Other Links

Airdrop Channel: https://t.me/airdrop_shark

Get PAID to sign up for airdrops: https://t.me/airdrop_shark/549

HashFlare Cloud Mining: https://goo.gl/Y4j1aw

Binance Exchange: https://goo.gl/k8wthn

If you appreciate these posts please upvote and follow or share your thoughts in the comments so I can continue to regularly share them with you all!! If your followers might find the post useful a resteem would never hurt ya ;)

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit