The subprime mortgage crisis in the United States was a prominent part of the 2008 global financial crisis. It has exposed a lot of problems in the country's mortgage market, most of which have gone unresolved and many of which are hardly unique to the US. Those problems include irresponsible lending practices, opacity, market fragmentation, outdated underwriting criteria and widespread fraud. In some ways, the response to the crisis made things worse by driving away major investors. The cumulative effect is that it is increasingly hard for most people to secure the credit necessary to acquire real estate.

Since much of the difficulty has less to do with people's ability to pay and more to do with a dysfunctional market structure, supplanting that structure with an alternative model would seem to be an obvious way out. The Block66 project is based on this understanding. It proposes to establish a blockchain-based marketplace that would bring borrowers and lenders of different types together in a more secure and affordable way. Later, it also hopes to enable a more trustworthy form of securitisation of mortgages through a sophisticated token economy.

How will Block66 transform mortgages?

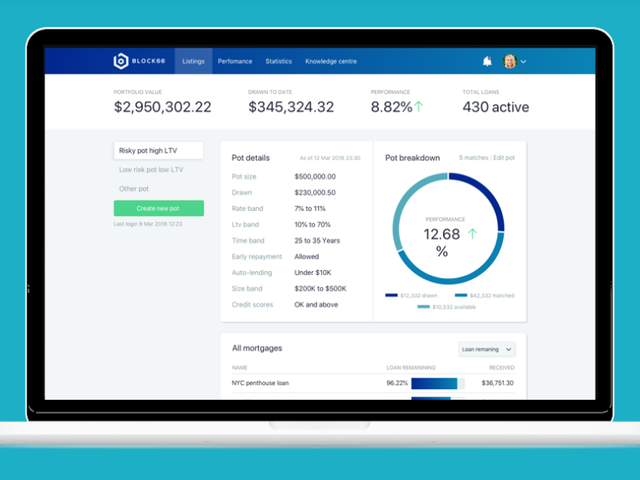

Block66 will run its platform as an Ethereum dApp. Borrowers will be introduced to the platform by Block66's partner brokers, who will help them submit the necessary information, such as their borrowing needs and affordability data (regular income, expenses, credit balances and any dependents). Third-party APIs will be used to carry out identity and credit checks before submitting the application to the system. It would then be matched with the platform's lender users, who will also go through identity checks and submit their lending criteria. The platform's matching engine will try to pair borrowers and lenders, prompting the latter to accept or reject any suitable matches. Both sides will have full information on each other's relevant needs and capacities. Once a borrower and a lender come to an agreement, a proof-of-loan (PoL) smart contract will be created. Both parties' lawyers must confirm any further conditions before the mortgage can proceed.

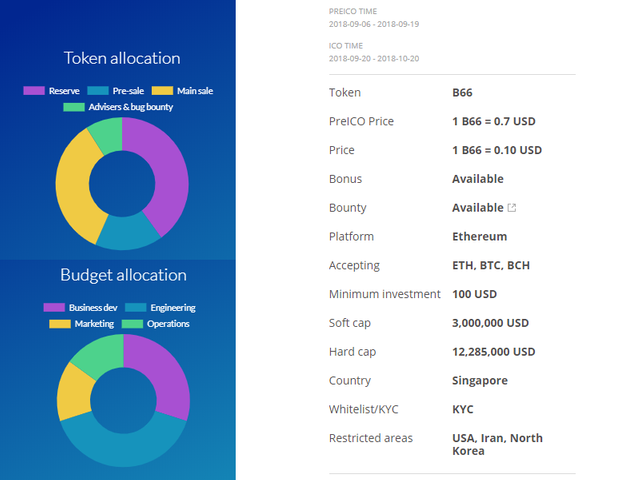

The platform will make use of several different tokens. B66 tokens would need to be activated through a special smart contract by their owners to generate BNET tokens, which will be used to pay all platform fees (and also to reward experts who will be used as virtual underwriters on the rare occasions when the platform fails to process borrower applications automatically). Both the initial mortgage funding and later repayments with interest will be carried out using ETH, albeit at dollar prices. All borrowers will be given access to a crypto-fiat exchange for those purposes, allowing currencies to be converted seamlessly to ETH or vice versa. Mortgages will be kept safe with the help of a digital trust fund.

Eventually, Block66 plans to enable trading with one more kind of token: the PoL token, issued once a mortgage is funded and representing either a loan or a bundle. It will be possible to seamlessly divide PoL contracts with their related tokens into fractions, increasing their liquidity. Block66 hopes to support secondary mortgage trading among its lenders with the use of PoL tokens. However, there will be restrictions in place to prevent the original lender from selling all their tokens.

What are the advantages of Block66?

Block66 should be able to draw in new participants on all sides of the mortgage market by making it vastly more accessible. Both institutional and private investors, including smaller lenders, will be able to participate in the platform, which in turn will expand the options available to borrowers and make the market more competitive and healthy. The platform will charge much lower fees and greatly streamline the whole process, while also providing greater transparency and security. Its system will combat fraud by flagging contentious applications. Using a trust fund should protect each mortgage even in the event of bankruptcy due to the strict regulations that govern them. Block66's plan for securitising mortgage should prevent many of the usual problems through built-in transparency, anti-fraud and anti-offloading measures.

Block66 was founded by a group of tech startup veterans and has a number of valuable partnerships within the cryptoindustry (perhaps most notably, with the Crypto Realty Group). A demo of the Block66 platform can be viewed on the ICO site. Its strategy is informed by a solid understanding of the mortgage market and involves an initial focus on borrowers in the good to prime credit bands, who have become increasingly underserved in recent years. Though initially Block66 will concentrate on North America, it plans to eventually move into the international mortgage market, making use of the geographic flexibility offered by blockchain technology.

ICO details

Reinventing mortgage lending for the blockchain era

Fixing the mortgage market is an urgent need. At the moment, many members of the middle class struggle to afford new homes due to problems created by market inefficiency. Meanwhile, many would-be investors are forced to buckle in the face of uncertainty and high entry barriers. Blockchain technology, with its ability to support streamlined and fully transparent operations, may well be the answer to many if not all of the mortgage market woes.

Though not all of Block66's proposal is set in stone (for instance, it has not yet been decided whether or not BNET tokens will be tradeable externally), the core part of the concept seems entirely workable and likely to find plenty of demand. If its technology works as promised and it finds enough interested partner brokers to kickstart its ecosystem, Block66 may well achieve its goal of reinventing the mortgage market along new and much more functional lines.

Links:

Website: https://block66.io/

WhitePaper: https://bit.ly/2MNpUIM

Telegram: https://t.me/block66_Official

Facebook: https://www.facebook.com/Block66Official

Twitter: https://twitter.com/Block66_io

Medium: https://medium.com/@block66

ANN: https://bitcointalk.org/index.php?topic=4511083

Author: https://bitcointalk.org/index.php?action=profile;u=980049

This article was created in exchange for a potential token reward through Bounty0x

Bounty0x username: the1arty

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.

@bonanza-kreep more articles will be?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit