The Hard Spoon: EOS Edition by Ryan Yi

In the blockchain space, open source allows for the creation of simultaneous instances of blockchain networks. Often these instances vary in terms of shared history and modified codebases.

The “alt-coins” of the early days were basically rough copies of Bitcoin code, adjusted slightly for different block rewards and inflation schedules. Balances usually began as a blank slate and did not reference any existing blockchain as a database.

Fast-forwarding to the days of Ethereum, the practice of “airdropping” tokens became more commonplace: projects would take a snapshot of Ethereum addresses and send tokens in amounts proportional to the amount of Ether in these wallets (or other configurations). This way a project could bootstrap an initial network effect and follower base by distributing their tokens to the existing Ethereum user community, and this has been shown to be effective.

With the high profile hard fork of Bitcoin that created Bitcoin Cash, “snapshotting” became a way to wage competition. At a certain block height, the forked chain would send an equal amount of coins held in those addresses with the intent of luring existing users away from its competitor (usually the core chain). How effectively forks create value warrants an entirely different conversation.

Hard Spoon — A Genesis Airdrop

Predominantly, airdrops have been limited to the Ethereum blockchain. New tokens would belong to an Ethereum smart contract.

The idea of a hard spoon is to widen the scope of this process to an entirely new blockchain at genesis. The idea is to snapshot the state of address balances on an existing blockchain and redeem them with an equal amount of the new blockchain’s native asset. Or, as Cosmos defines it:

“Hard spoon: a new chain that takes into account state from an existing chain; not to compete, but to provide broad access.”

“A hard spoon is a meta-protocol on top of a blockchain creating a token that inherits the blockchain’s underlying token’s balances.”

Cosmos’ Tendermint aims to do this with Ethermint (hard spoon of Ethereum) and perhaps with OmiseGO.

EOS Edition

Much has been written about EOS, which is vying for the same market of developers and dApp projects as Ethereum. A detailed explanation of the protocol and its technology can be found here. The purpose of this writing is to focus on its distribution narrative, not debate the project’s merits.

Today, EOS exists as an ERC-20 token. As it stands, there are around 1 billion EOS ERC-20 tokens and are distributed as follows:

- 10% (100M) retained by block.one.

- 20% (200M) sold in the First Sale (2017.07).

- 70% (700M) sold in an Ongoing Sale (2017.07~2018.06).

By June 1st, 2018, the entire supply of ERC-20 tokens will be floated (minus block.one’s). On the same date, the EOS ERC-20 contract is promised to be frozen in perpetuity, thereby rendering those tokens non-transferable. Below we will explore how exchanges will treat the trading of EOS ERC-20 tokens during this period.

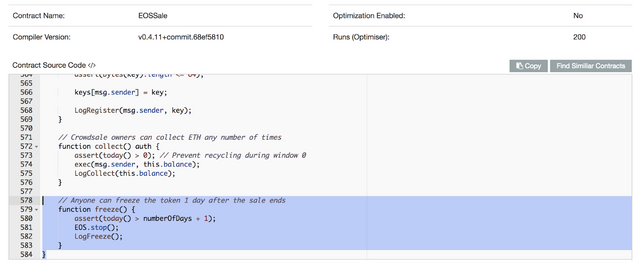

Freeze Function (highlighted) on EOS Contract Source Code

The EOS codebase, developed by block.one, is meant to serve as a template for any new EOS chains. It is entirely possible for multiple EOS chains to exist at genesis. The ERC-20 EOS token serves no function currently other than as a placeholder for EOS-native tokens, if and when an EOS chain launches.

Mapping the ERC-20 Balances

On June 2nd, 2018, there will commence a snapshot of all registered (mapped) EOS wallets. As preparation, EOS ERC-20 token holders must create an EOS-native wallet, and map it to their public Ethereum address, thereby providing a redeemable amount of EOS-native tokens that is equivalent to the respective EOS ERC-20 wallet balance. This assumes that the future EOS chain honors the snapshot.

Given these conditions, EOS ERC-20 token holders will have to either self-register their wallets, or trust that their exchanges will honor the registration process (and many of the top exchanges have made commitments to honor.) Otherwise, unregistered token holders will be locked in the smart contract into perpetuity without a guaranteed claim of any future EOS-chain native assets.

The freeze function provides a basic a control environment:

- The freeze date strongly signals the state of mapped addresses and ERC-20 token balances as the go-to state. We note, however, that there is no way to guarantee future EOS-chains from honoring an altogether different distribution date or method.

- Without the freeze function, we could imagine a scenario where the snapshot takes place, captures the state of the placeholder claims, and thereby renders any future utility for the token as useless. This would logically lead to a pricing race-to-the-bottom.

- The strong signal paves the way for community organization.

Bend the Spoon

One salient point of the entire EOS crowdsale is the magnitude of funds that have been raised in their ongoing token distribution.

Including block.one’s initial 10% EOS allocation (100M), at current EOS prices of ~$18, would put the valuation at $1.8B. A quick look at the crowdsale’s wallet shows that the influx, at both historical and current ETH prices, brought in the range of $2.8B ~ 3.9B. In sum, the EOS war chest would amount to $5B ~ 6B. To provide context, that would constitute 25% of the fully diluted EOS ERC-20 valuation.

The more striking part is the dynamics of the registration process. While users might expect the following function,

% claim of EOS-chain tokens = F(wallet ERC-20 / total ERC-20 supply)

When in fact, the percentage claim is a function of the % of mapped addresses.% claim of EOS-chain tokens = F(wallet ERC-20 / mapped ERC-20 supply)

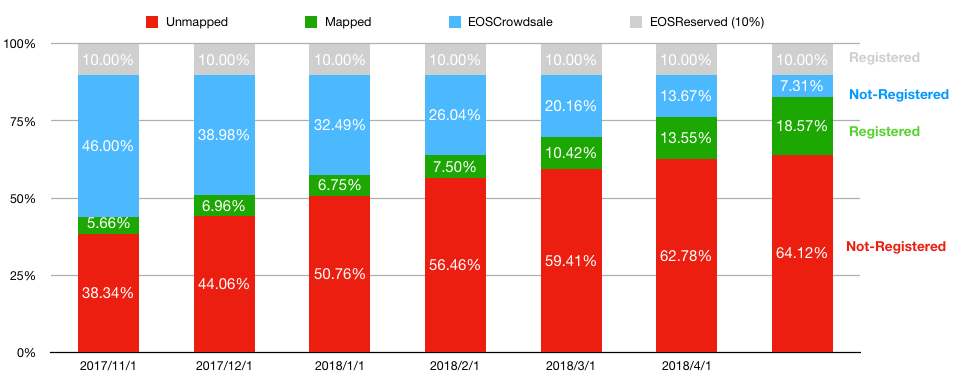

Below is a rough breakdown of the mapped EOS ERC-20 tokens to date, by PeckShield.

Registered vs Unregistered, by PeckShield Research

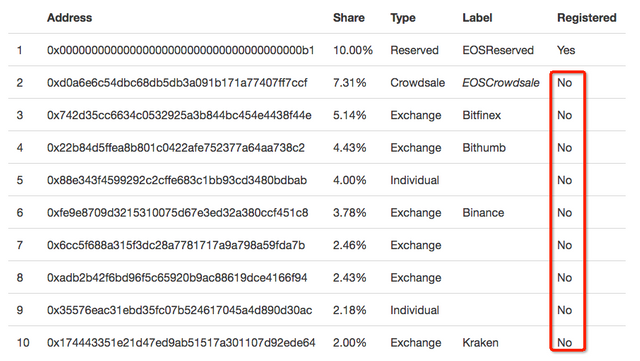

Top 10 EOS ERC-20 Holders, by PeckShield Research

- Of the 64.12% unregistered addresses, the top 10 account for 26.42% of the ERC-20 token supply. This includes the major exchanges that have yet to (but most likely will) formally register including Binance, Bitfinex, Kraken, OKEx.

- Let’s also assume that 7.31% remaining in the crowdsale all end up registered.

- Estimated Registration: 62.3% (26.42% from exchanges+ 7.31% from crowdsale + 28.57% registered)

- This leaves around 37.7% as unregistered wallets.

- Assume from our linear model above then, a 1:1 token swap would mint 623M EOS-chain tokens, compared to the outstanding 1B ERC-20 tokens.

- If you had 100M ERC-20, which was 10% of total ERC-20 supply, you would now have (100M / 623M) EOS-chain allocations, or 16% of token supply.

- Mapped wallets would receive a relative 61% proportional increase in token quantity.

Please note these numbers are illustrative and are in no way deterministic. Changes will depend on the course of the next month.

The point is that because relatively few people have registered, this will give a greater percentage of ownership to those who have registered, which benefits the most organized.

Look to the Exchanges

In the crypto world, exchanges have to custody and deliver assets, making them more akin to quasi-banks.

So far this analysis assumes that on-chain transfers of ERC-20 assets become frozen. There are two scenarios for how exchanges might handle this action:

Scenario 1: Exchanges halt ramping & trading

- Exchanges cut off the withdrawal & deposits for EOS ERC-20.

- Exchanges halt EOS ERC-20 trading on the platform.

- The exchange registers the wallet addresses, snapshots the balance, and distributes EOS-chain tokens upon launch of the mainnet.

- Exchanges restores withdrawal & deposits for EOS-chain tokens.

Scenario 2: Exchanges halt ramping, continue trading

- Exchanges cut off the withdrawal & deposits for EOS ERC-20.

- Intraexchange EOS-chain supply will equal to intraexchange EOS ERC-20 supply.

- Exchanges allow the continued trading of EOS ERC-20 using its own book debit and credit system (which does not rely on smart contract code.)

- EOS mainnet launches and distributes EOS-chain tokens.

- Exchanges redeem user wallets with EOS-chain tokens.

- Exchanges restore withdrawal & deposits for EOS-chain tokens.

- Because exchanges chase volume, I would not dismiss the possibility of scenario 2. With a live launch process underway, markets will be particularly interesting — grab your popcorn!

Exchanges as Block Producers

Exchanges have emerged as BP candidates in the EOS ecosystem. For the long-term EOS ecosystem, agency issues might become an issue — namely, how well-aligned are the exchanges to run a business, serve customers, custody funds, and vote on proposals?

Consider this thought experiment: can exchanges delegate the EOS tokens on their platform? Technically, when tokens are delegated, they are locked in smart contracts, and non-transferability is a friction for an exchange’s liquidity. But, you could imagine a scenario wherein the exchange holds a reserve pool of EOS in a cold wallet which is delegated (maybe to themselves as a BP), while portioning non-bonded liquid EOS tokens for trading. This would have to be optimized depending on the deposit / withdrawal velocities of said tokens.

Closing Thoughts

As the main chain launches, there is no definitive method of gauging the book building and distribution process for the EOS-chain token. But, given the concentration mechanisms and the agency of the stakeholders, this launch will be particularly interesting to observe — all the while as they get war-ready to take on Ethereum. More saliently, this reinforces the centralization vector narratives of the project.

Notes:

Although the transfer function in the contract is no longer working by 2018.06.02, it is possible to register a key. But at the moment there seem to be no defined process in the genesis scripts how to deal with these later registered keys.

block.one is a software company and is producing the EOS.IO software as free, open source software. This software may enable those who deploy it to launch a blockchain or decentralized applications with the features described above.

block.one will not be launching a public blockchain based on the EOS.IO software. It will be the sole responsibility of third parties and the community and those who wish to become block producers to implement the features and/or provide the services described above as they see fit. block.one does not guarantee that anyone will implement such features or provide such services or that the EOS.IO software will be adopted and deployed in any way. Proceeds from the EOS Token distribution will be the revenue of block.one.

Side note: it will be interesting how compliant investors will mark-to-market an asset that basically disappears.

Further Reading:

No improvement: EOS Token Registration Continues to be Low — ONLY 28.57% Tokens Registered

How to Efficiently Distribute Network Tokens

Merkle Air-Drops: Make Love, Not War

Disclaimer: The content provided on this site is for informational and discussion purposes only and should not be relied upon in connection with a particular investment decision or be construed as an offer, recommendation or solicitation regarding any investment. The author is not endorsing any company, project, or token discussed in this article. All information is presented here “as is,” without warranty of any kind, whether express or implied, and any forward-looking statements may turn out to be wrong. CoinFund Management LLC and its affiliates may have long or short positions in the tokens or projects discussed in this article.

https://blog.coinfund.io/the-hard-spoon-eos-edition-94399d843ffa

So interesting, tks for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes interesting. great read

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit