Mortgages Loans Are at the Heart of Society

Owning a property is among those fundamental human needs, a necessity the majority of individuals are unable to manage simply taking a home mortgage by the bank. From the U.S. alone, over 8 million home mortgages have been awarded each year.

We're having a decentralized, Peer-to-peer Mortgage Lending platform makes two purposes

- Modernizing the ageold lending system as a way to allow it to be efficient, efficient and customer-centric.

- Expanding homeownership opportunities to get a brand new production of borrowers, fulfilling their different way of life and requirements.

Homelend can be really a decentralized platform which allows financing next-generation homebuyer mortgages. Homelend lets crowdfunding mortgages employing peer reviewed units with all the security, automation and transparency offered by distributed ledger technology (DLT) and contracts that are smart.

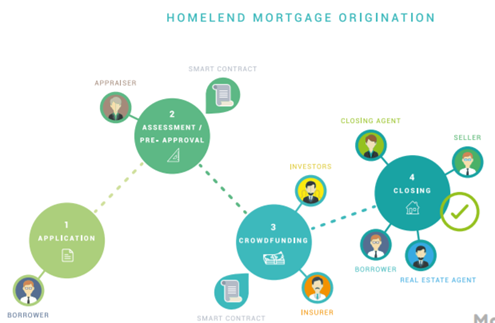

Just how does this function?

By minding distributed ledger technology (DLT) and smart contracts, Homelend includes individual creditors and creditors on an end-to-end platform which streamlines and simplifies the whole mortgage origination procedure.

Business model

Homelend will be developed like a blockchain solution which may greatly raise the home financing chances for several families and individuals. Our value proposition is sensitive and anchored into a P2P innovative approach that intends to work with technology for society's sake. None the less, Homelend is additionally based on a strong and lucrative business version, which knowingly reaches to tackle an underserved sector. On the 1 hand, Homelend creates a investment opportunity for a lot of people, with an option that combines a conventional industry as realestate, using an advanced technology such as blockchain. On the flip side, it's potential for most individuals (who thanks to various conditions, for example current limits in the conventional credit threats units, tend not to have a very solid credit history however are differently credit worthy ) to get housing financing and solve a few of these most basic ambitions: owning a house of their very own.

Accessibility to the mortgage crowdfunding system will probably be In the event the home is successfully shut, the debtor will deposit numerous HMD exemptions using a value corresponding to 1 percent of their approved home mortgage.

The Homelend Advantages

-From manual & lengthy, to Streamlined & Efficient

By minding pre-defined small business logic to contracts that are smart, digitizing eliminating and documentation unnecessarily procedures, Homelend will automatically perform an endtoend origination procedure, cutting down it from 50 days for less than 20.

-From Ambiguous & Clunky to Transparent & User-Friendly

Homelend intends to generate a financing process which isn't just smart, but also straightforward and fair. It enables borrowers are going to soon be able to readily make an application for financing to track their application status in any way times and interact directly with lenders.

-From Costly Intermediation to Cost-Effective & Middleman-Free

The immutability, transparency and security given by DLT makes it feasible to list trades, including obligations, without any banks acting as middlemen. This may reduce prices for both lenders and borrowers, while decreasing the length between these.

-From Vulnerable & Unreliable to Trusted & Secure

Centralization and paper-based procedures are the crucial causes of the vulnerability and insecurity which describe the conventional mortgage market. The exceptional traits of DLT and contracts that are smart empower Homelend to deliver a stage for all individuals to rake considerable quantities of money at a dependable, translucent, and secure method.

The Homelend Token (HMD)

The HMD token may be that the gas occupying the Homelend peertopeer lending stage. It's main function is to give access into this Homelend platform. This usefulness market also has an instrumental part in empowering a quick, smooth and userfriendly work flow that's secure and unified.

All components might be converted into and out of HMD. The sum entire quantity of HDM Assets to be issued at the Token Generation Occasion (TGE) is likely to be 250 million. With the entire supply, 50-million HMD token (20 percent ) is likely to be held at a reserve fund, and also 200-million HMD tokens (80 percent ) is going to maintain flow.

Symbol : HMD

Total Suppl: 250,000,000

Standard : ERC-20

Face Value : 1 ETH= 1,600 HMD

Accepted Currencies : BTC, ETH, USD

Softca : US$ 5,000,000

Hardcap : US$ 30,000,000

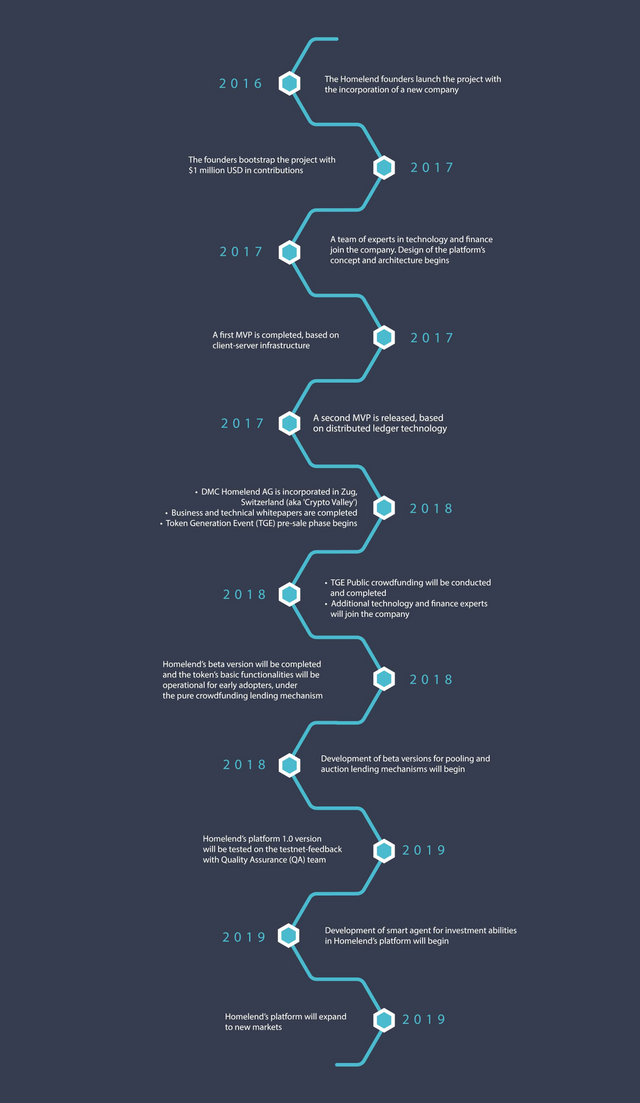

ROADMAP

Website: https://homelend.io/

Whitepaper: https://homelend.io/files/Whitepaper.pdf

Telegram: https://t.me/HomelendPlatform/

ANN Thread: https://bitcointalk.org/index.php?topic=3407541

create by humanitee

https://bitcointalk.org/index.php?action=profile;u=59625

ETH address 0xC53AF309cb2c85F830148EDf1dfa4B2520E56594