Many of the wealthiest people in the world have acquired their fortune through successful investments. But there's only one trader who managed to amass billions of dollars. Trading is inherently risky and it is usually very difficult to beat the overall market in the long run; that's why most traders eventually suffer great losses. But Jim Simons managed to create an entirely new form of trading, one that has beaten the market almost every year.

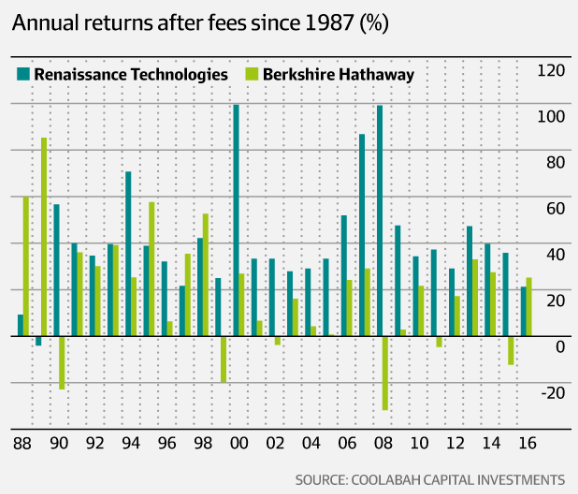

Simons is a brilliant mathematician and he used his computational prowess to develop the most successful algorithmic trading fund in the world. Renaissance Technologies is heavily integrated with the financial industry as it makes money by trading on stock exchanges, but they don't hire financial analysts. Instead, the company hires mathematicians who further develop the core computational ability of the company. This has allowed the company to produce a higher rate of return than almost every traditional fund. Due to this, algorithmic trading has seen great adoption in the financial sector. The chart on the right shows that Ren Tech. has outperformed Warren Buffett's Berkshire Hathaway even.

The crypto market, however, is quite new. Due to the hodl culture, a portion of the community are long-term investors. And due to the swift fame crypto has acquired, another portion are timid, short-term speculative investors. That leaves behind a minority group of traders. And these independent traders are managing the large portion of daily trades that take place in the crypto market.

An institutional fund has the opportunity to step in and offer some degree of similar services available in equity markets. It will also have the resources to utilize algorithmic trading.

Advantages of Being Part of a Large Fund

In the equity markets, a large portion of trade volume is done by institutional investors, investment banks, and trading firms cored on algorithmic trading.

Established trading firms have noticed the potential in the crypto market, but have still largely sidelined it. Now, a new ICO is bringing to life a project that will bring an established Forex trading fund, CountingHouse, into the crypto market.

Institutional investors have the resources needed to carry out algorithmic trading. This computational advantage gives a proven edge that an individual cannot have. It takes a team to develop and maintain the necessary mechanisms. It can be costly to develop a successful system for algorithmic trading and the development can take up long periods of time. CountingHouse, however, already utilizes algorithmic trading so it needs limited capital to apply that to crypto. Actually, the fund has already tested its existing infrastructure in the crypto market and has observed a significant success. CountingHouse is offering a means to be a part of a readily available infrastructure that can trade successfully; the best part of this is that the funds will be directly utilized for trading.

A large portion of crypto trades are carried out based on gut feeling and odd charts. Now, CountingHouse could be paving the way towards a more advanced approach of trading crypto.

CountingHouse is allowing its investors a chance to take advantage of an opportunity. Its founder has explained that this introduction of algorithmic trading could be as profitable as algorithmic trading was when it first entered equity markets decades ago. CountHouse is the first established company to join this market, but you never know, maybe this entry could spark a chain of entries leading all the way to interest from Ren Tech and Jim Simons even. But it could be a while till that happens. Till then CountingHouse is the only option to trade crypto with an advantage.

Essential CountingHouse Links

🌐 Website: http://countinghousefund.com/ico

💡 Whitepaper: https://www.countinghousefund.com/whitepaper

👨 ANN Thread: https://bitcointalk.org/index.php?topic=3406903

💻 Telegram: http://t.me/Countinghouse

⌚️ Token Sale: LIVE NOW

Connect with me:

https://bitcointalk.org/index.php?action=profile;u=1700741;sa=summary

https://steemit.com/@hatu – Follow for a new ICO analysis every day!

Twitter

Telegram Group – Keep up with ICOs

In the business world sometimes less is more, where many times you have to risk the little you have to get a lot. The one who does not risk does not win, and if you do not earn money you gain experience. Thanks for posting very interesting success

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I believe a lot of people would risk (invest) at least small amount if they have the opportunity to do so. With CountingHouse, people have the opportunity to invest in a managed fund.

And I agree with you, sometimes liss is definitely more. It's best to diversify investments; small amounts spread over.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

followed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I suppose you enjoyed the read.

Welcome aboard!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We can work as a team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Quite true; this fund will allow almost anyone to be a stakeholder. So, at the very least, the crypto community could collectively benefit from the success of the fund.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 5.18 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 23.25% upvote from @emperorofnaps courtesy of @hatu!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit