tl;dr: Bitcoin may or may not be the “one chain to rule them all.” Whether it is or not, it is special.

Among many of the original Bitcoinistas, there is a belief that you don’t need more than one blockchain.

In their mind, the blockchain is the universal ledger, the immutable, non-negotiable foundation of trust upon which a global, digital society can build.

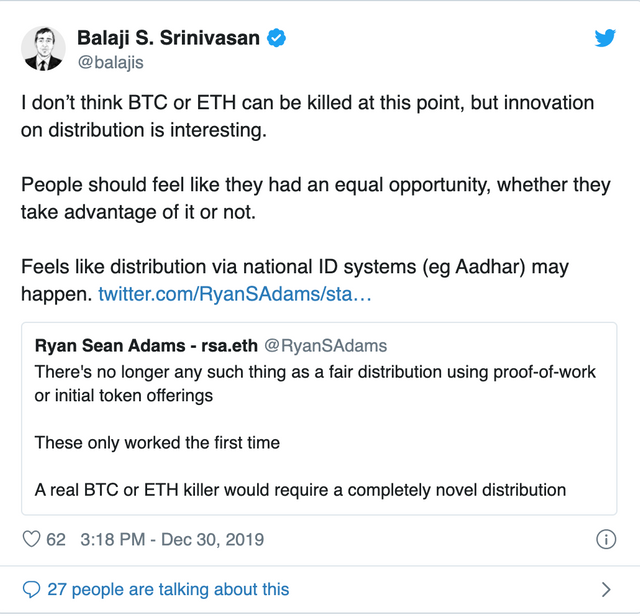

All of the other chains, Ethereum included, can never provide the degree of trust and security that Bitcoin can, simply because of the length of the chain and the accumulated proof-of-work that has gone into it.

Admittedly, this is not a huge majority of people, but it is sizable and many of their arguments have merit. [Jimmy Song](Among many of the original Bitcoinistas, there is a belief that you don’t need more than one blockchain.

In their mind, the blockchain is the universal ledger, the immutable, non-negotiable foundation of trust upon which a global, digital society can build.

All of the other chains, Ethereum included, can never provide the degree of trust and security that Bitcoin can, simply because of the length of the chain and the accumulated proof-of-work that has gone into it.

Admittedly, this is not a huge majority of people, but it is sizable and many of their arguments have merit. Jimmy Song is one of the most vocal from this group. So is the team at RSK, which is building a smart contract layer for Bitcoin.) is one of the most vocal from this group. So is the team at RSK, which is building a smart contract layer for Bitcoin.

They are collectively known as “Bitcoin Maximalists.”

The most fervent of this group think that only Bitcoin will survive and every other crypto will die off.

Some suggest that there may be specific use cases for which Bitcoin is not well-suited.

I am not quite a Bitcoin Maximalist myself, but I do consider myself a “Bitcoin Exceptionalist.”

Exceptional Brand and Longevity

Bitcoin is the innovator and a proven survivor.

It has the longest chain, it has the biggest global brand, and it has the most value.

I did a quick sort of the Fortune 500 list.

If Bitcoin were a public company (it kind of is), its market cap would be #40, just behind Nike and ahead of PayPal and IBM.

Not bad for a 10 year old start-up with no marketing budget and no employees and a 9,000,000% return in the past decade.

Even more impressive considering that Bitcoin has died 378 times.

This makes it exceptional.

And all of this provides additional evidence that Bitcoin is here to stay.

Every day that the chain exists adds to the Lindy effect and takes us one step closer to a new era of banking.

Exceptional Security

Every time a block is mined, network members pay a security fee of 12.5 Bitcoin in the form of a block reward. \

Every day 1800 Bitcoins are generated.

At a rate of $7000 per BTC, that’s a $12.6 million dollar daily network security budget.

Nearly $4.6 billion per year. Microsoft spends $1bn per year.

At some point, the level of security and trust that the Bitcoin blockchain can offer will dwarf what others can provide.

This makes it exceptional.

Bitcoin in the Roaring 20s

I suspect this means that the 2020’s will be a decade where our conversations about money and value are going to really heat up.

We will move from “what is this Bitcoin thing?” to “now that Bitcoin is here to stay, how do we adapt?”

Satoshi, Johannes Kepler, Edison. The great innovators understand that change requires patience.

Bitcoin is exceptional. We just need to be patient until everyone else realizes it.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://500biz.com/forex/bitcoin-maximalism-vs-bitcoin-exceptionalism/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit