For centuries, financial markets have been built on principles of trust. This has led to inefficiencies in time and costs, and counterparty risks in the financial system have shown to be catastrophic in turbulent times. At DIB.ONE founded by professional traders, we envision and develop an ecosystem for peer-to-peer initiation, trading and settlement of financial products and derivative contracts that make use of the Ethereum blockchain. Hereby eventually decreasing costs and underlying settlement time, and improving transparency.

So what do we do..

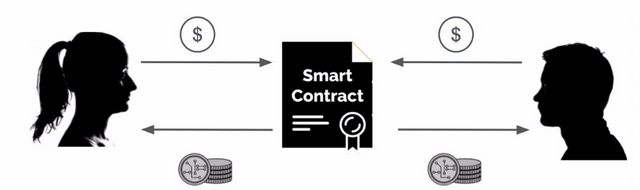

From a philosophical point of view, we liberate financial markets from intermediaries as brokers, exchanges, clearing houses and registrars. From a practical point of view, we develop open protocols that enable anyone to propose or accept offers for financial contracts where the Ethereum network serves as an agent of trust.

After months of development and iteration, we have finished the smart-contracts for our Option contracts and Contracts For Difference (CFD’s). Our protocols make use of Ethereum, enabling us to use Turing-complete smart-contracts. Besides, we are strongly convinced that the underlying consensus algorithm is most secure and will be future-proof. Looking ahead, we are very excited about scalability implementations on Ethereum. Especially as layer 2 solutions enable us to compete with existing, centralized, trading platforms, but give users the security of distributed networks.

Let’s take an example to see how it works — Alice and Bob

Let’s take an example to explain how it works: Alice and Bob want to close a Contract For Difference with Gold as the underlying value. The spot price of Gold is $1,302.03 per ounce and Alice thinks that in the next 24 hours the price of Gold will go up. On our platform (or any platform) she publishes her offer to trade with 10x leverage. This means that the margin she places as a deposit in our smart contract is $130.20. Bob, in contrast to Alice, thinks that in the next 24 hours the price of Gold will go down and also wants to trade with a leverage of 10x. Bob, just as Alice, places $130.20 as a deposit in the smart-contract. Both Alice and Bob receive a token that represents their short/long position. If they change their point of view and want to sell their position, they can do this by selling their token. Notice that this mechanism works the same for Options, where positions are represented by tokens.

At the end of the contract, the Ethereum network checks, with the help of Oraclize, the price of Gold and pays out accordingly to Bob or Alice. If the price of Gold goes up to $1,352.05, Alice will receive $50 from Bob’s deposit + her initial deposit. If the price of Gold goes down with $50, Bob will receive this from Alice her deposit + his initial deposit.

Currently, we use ETH for deposits. This gives as a result that we have 2 changing values, the underlying value (Gold) and Ethereum. If the price of the underlying value or ETH changes and there is no margin left to earn for one of the parties, either the counterparty can add extra margin or the contract can be settled before maturity. Having 2 changing values is not optimal, so we are developing our own stablecoin that uses our CFD’s to ensure a stable value of $1 per token.

Benefits — Why Alice and Bob should make use of our infrastructure.

If Alice or Bob would make their Contract For Difference at a centralized exchange, it would be the exchange that keeps ownership of their funds by handling their private keys. Time has shown, that centralized exchanges impose the risk of being hacked and having the private keys of wallets, thus funds stolen. Moreover, Alice and Bob are tied to withdrawal limits and time constraints.

The philosophy behind DIB is that no trusted third parties are needed for trading. This is the true Blockchain spirit.

If Alice and Bob make use of our infrastructure, they will at any time remain owners of their crypto and will manage their positions themselves. They do not have the risk of the exchange being hacked or authorities seizing their tokens and they are not tied to withdrawal limits.

Roadmap

We are testing our own stable coins with the CFD’s we developed and we are closely watching secure oracle solutions and Ethereum’s scalability solutions and implementations.

We take security very seriously and only after all tests are finished, we expect the beta-version of our platform to go live on the Ethereum testnet on the 1st of September. From that point, we will keep on developing our existing products to reach excellence in safety, speed and user experience. Also, we will present other financial products including peer-to-peer insurance, structured products and lending solutions.

Our mission is to develop open blockchain-protocols for all traditional investment banking products.

We invite interested readers to subscribe at dib.one or follow us on social media to stay updated on our latest developments. Closer to the launch on the testnet, we will give early access to our community.

✅ @lucasroorda, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lucasroorda! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit