#AMA RECAP

Dated: 22nd November

Guest : Ryan Chow(Co-founder) of SOLV Protocol

Host: Vishveshwara

Vishveshwara: Hello MCG. Welcome to Our Live #AMA session with SOLV PROTOCOL. I Request everyone to be alert all the time & ask everything about the project. Invest & get our profits.

Vishveshwara : Let's Welcome RYAN CHOW to MCG Community.He is the Co-Founder of SOLV PROTOCOL & played important role in building the platform.

Ryan Chow : I can't wait to introduce you guys of Solv Protocol!

Vishveshwara: We are equally excited to know completely about the project.So let's start our Today's AMA session, with few basic questions.

Vishveshwara: Could you briefly introduce yourselves as well as SolvProtocol? What is Solv's milestone?

Ryan Chow: Hello everyone, I'm Ryan, co-founder of Solv Protocol. I'm responsible for our marketing and research team.

Solv is the first DeFi platform that focuses solely on the minting, managing, and on-chain transactions of all Financial NFTs. You can think of Financial NFTs as NFTs that represent and certify any type of financial equity.

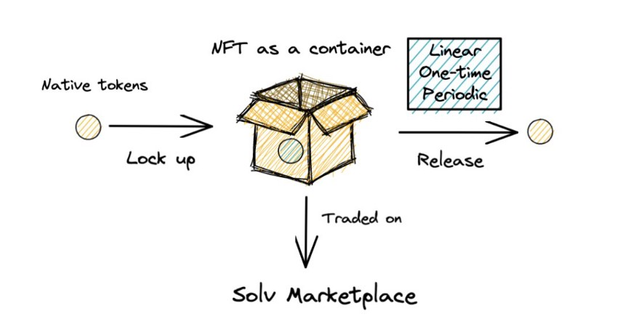

Our flagship product is the Vesting Voucher. You can conceptualize a Voucher as an NFT container with a set of easily definable unlocking rules. Our Vouchers have the ability to be fractionalized, thus giving locked-up assets liquidity and making for a wide range of use cases.

As for Solv's milestone, After completing collaborations with over 20 DeFi projects, using Vesting Vouchers for various scenarios such as fundraising, community building, and token liquidity management. We have proved that from a cost perspective, Vesting Vouchers can grease the wheels of managing tokenized allocations for all parties.

Early-stage protocols like ColdStack and Yin love this product for its efficacy in managing lock-up allocations.Seasoned protocols like DODO and Prometeus issued vouchers and used them to incentivize the community to deepen its relationship with the protocol.

The use cases of Vesting Voucher are just out of our grasp, we are reaching for the impossible. Since our main net launch in June, Solv has reached $70 M+ in total value locked (TVL) and boasts 2000 unique Voucher owners!

We have also bought a $3 million worth of coverage through Unslashed Finance, $1 million worth of coverage through Tidal Finance.

Ryan Chow: Done~

Vishveshwara: Nice 👌 👌.That's Good Intro about the Project. Also I forgot to tell you, please type DONE after answering each question.

RaGreen: Awesome 👏👏

Vishveshwara: Let's move on to 2nd question

Ryan Chow: Let's go~

Vishveshwara: 2. What makes Solv unique, especially now that there are a lot of On-Chain Liquidity projects now. And how can this unique value proposition prove to be a defining solution in DeFi?

Ryan Chow: Since our products are based on the EIP-3525 Token standard, which is our original NFT Standard built for Financial NFTs, our Voucher is the only product of its kind in the industry that has both splitting and multi-attribute description capabilities. Compared with the ERC-20 solution, it has stronger information description capabilities and can meet more complex and diverse business needs at a low cost. And compared with the ERC-721 solution, it has better liquidity.

Talking about our ecosystem, we've built a strong network of resources. That is, we have established cooperation with more than 25 blue chip projects. And we are committed to continuing to bring high-quality projects to the platform to avail investment opportunities via Vesting Vouchers to our user base. This will allow us to maintain a pole position.

Ryan Chow: Done.

Vishveshwara: Excellent👌

Vishveshwara: 3. What value do you believe Solv Vouchers can bring to retail investors?

Ryan Chow: To start, all retail investors can now participate in early investing. This is an Institutional-level investment opportunity for retail investors. Solv Protocol is mainly targeting allocation trading, where retail investors can enjoy a low friction, high transparency, fraud-free trading experience, and easily obtain their preferred lock-up allocations. In addition, we will soon launch liquidity mining rewards, and users who trade Vouchers will get incentives in the form of $SOLV Vouchers.

The Voucher is an excellent opportunity for holders to invest in projects at a discounted price. In July, a 2-year DODO vesting voucher- meaning the DODO tokens locked in the voucher will be released in 2 years was issued on the Solv Marketplace, with a unit price of $0.49633 when the DODO spot price was $1.02. Now, its price is $1.5. So, it's safe to say that all of the buyers here have enjoyed high returns in a short time

Ryan Chow: Done~

Vishveshwara: Thats Nice, rewards for early adopters👌👌

Ryan Chow: Exactly!

Vishveshwara: Let's go to 4th question.

Vishveshwara: 4. IVO is a totally new way of issuance. What is the difference between IVO and the previous initial public offering of tokens? Our community members want to know if $SOLV's IVO is worth getting involved with?? Could you introduce the rules of IVO for us and how to participate in it?

Ryan Chow: Going to answer everyone's most concerned issue.

Ryan Chow: An IVO is an Initial Voucher Offering. All users participating in our IVO will enjoy the same rights as private equity investors and will be able to participate directly in Solv's primary market investment. In this IVO, Solv will publicly sell SOLV Vesting Vouchers, a type of NFT that represents locked-up $SOLV tokens. Solv directly distributes Vouchers to users as an on-chain certificate for locked Tokens.

Vouchers tokenize locked up tokens, which in turn releases asset liquidity. Before the unlocking period, users can transfer Vouchers to meet their funding needs. Solv has established a marketplace specifically for financial NFTs on its platform. Holders can receive a certain number of SOLV tokens on the Solv platform during the unlocking period.

To participate in Solv's IVO:

There'll be $350k Solv Vouchers sold on Binance NFT. ($400 per Voucher)

There'll be $350k Solv Vouchers which are only purchasable for addresses on the whitelist sold on Solv marketplace (on BSC). And the maximum purchase limit is $400 for each address

Ryan Chow: To get your address added to the whitelist:

Participate in the Gleam campaign.Participate in the activities held by Solv partners. Details will be posted soon. Please note that the addresses which are successfully added to the whitelisted need to pass the KYC. And it should be FCFS.

Ryan Chow: DONE.

Vishveshwara: Ya, I Hope it Clears a lot of Doubts, if not. MCG Community please feel to ask your questions in Telegram Live Segment.Let's move on to our next question.

Vishveshwara: 5. Solv Protocol is making Partnerships with many StartUps. Can you explain how they have been helpful in the growth of the platform?

Ryan Chow: We have established cooperation with more than 25 blue chip projects.In terms of community building, the users of our collaborative projects have also become loyal users of Solv Protocol.

In terms of investor network, investors from the project parties we work with are also interested in our products, which also expands the investor network of our projects.

Ryan Chow: Done

Vishveshwara: Nice👍

RaGreen: Guys take a Minute to read all info 🎓. This is a Wonderful project invest by Top Teir VCs.

Ryan Chow: EXACTLY!

Vishveshwara: Last question from my side. Then we can move on to Twitter Questions

Vishveshwara: 6. How many members are there in your team? Do you have plans to expand your team? What kind of talent are you looking to hire?

Ryan Chow: Our team has more than 20 members worldwide. We welcome all new members who would like to contribute to the Solv ecosystem to join our team. If anyone is interested in joining the Solv Protocol ecosystem, you can contact our Telegram group admin.

Ryan Chow: Done~

Vishveshwara: Awesome 🙆, MCG is a Place to find you jobs

Vishveshwara: Let's start our 2nd Segment, where we answer best Questions from Twitter Community.

Ryan Chow: Let's go~

Vishveshwara: 1. How do you make us believe SOLV community, investments are secure in the platform? How Safe are the Smart Contracts? Is the platform Audited by any Third-party service providers? Can anyone access to the locked liquidity pool on pancakeswap? From @tweetsyummyfood

Vishveshwara: Thats not a Single Question, very concerned Retail Investor. I appreciate it.

Ryan Chow:Solv Protocol is designed to protect users' assets. To further our commitment, we work closely with world-class blockchain security solutions to defend our users' assets from external and internal risk factors. We are proud to say that our source code has successfully passed the audits by both SlowMist and CertiK, key blockchain security organizations, and is on schedule to be audited by a third security network.

In the pursuit of higher protocol security, Solv has purchased $1million USD worth of insurance coverage through Tidal Finance and $3 million USD of insurance coverage through Unslashed. This allows the Solv users to get insured over SC risk.

The current plan covers smart contract vulnerabilities deployed on Ethereum and Binance Smart Chain. Needless to say, this is quite momentous as this is the FIRST time Defi insurance is being applied to the NFT sector!

Besides, we are offering a $50,000 bug bounty to incentivize developers and white hats to help us secure our protocol by uncovering its vulnerabilities and shortcomings. And we are pleased to be able to launch this undertaking with Immunefi, which is a leading bug bounty platform experienced in the testing and securing of Defi protocols.

Ryan Chow: Done~

Vishveshwara: Everyone should note that Ceritik is the Top Smart Contracts Auditor and they provide services to №1 exchange in the world Binance

Vishveshwara: Let's move on to 2nd question.

- Looking at the Project Solv Protocol, it feels like NFT is more than Art. Does your project think that more real world use cases will emerge for NFTs as time goes on, why should we take NFTs seriously From @chorbhat

Ryan Chow: The explosion of NFT artwork and Gamefi has given many people the mindset that art and games are the right paths for NFT development, naturally tying NFT to art, collectibles, cards, and game.

But the value of NFT does not depend on NFT itself, the application scene will empower NFT value, NFT value can be redefined.

Many people currently get to know the financial NFT as simply UniSwap v3. UniSwap v3 uses NFT to act as an LP token, which uses the ERC721 standard.

We believe that ERC721 is just a starting point for Financial NFT and is by no means mainstream.

Solv Protocol aims to bring the primary market into the DeFi space through financial NFT. We launched the Vesting Voucher to address the trust gap that exists between investors and the project team. This product is built on the new NFT standard: vNFT Vesting Voucher protocol and is better suited for financial protocol-related descriptions.

Ryan Chow: Done

Vishveshwara: Thats Neatly explained 👌 👌✌️

- In Solv Protocol, Vouchers can be used in NFT lending platforms such as Nftfi, Pawnfi, Taker protocol, and Drops, but will you include this function in the Solv protocol in the future? And what characterizes the Voucher's potential in the lending scenario? From @Linhhong221

Ryan Chow: Yes, if you guys interested, this article would help you to better understand the Vesting Voucher: https://medium.com/solv-blog/vesting-vouchers-how-financial-nfts-can-prove-invaluable-to-the-future-of-defi-sector-9744f158b4bb

Actually, EIP-3525 is fully compatible with ERC721, we are working on those lending protocols now and will not develop this function of our own probably. In the lending scenario, we provide liquidity to holders with vested tokens which is impossible in the past. This liquidity will help them perfectly solve the shortage of funds under some circumstances.

Ryan Chow: Done~

Vishveshwara: Let's Move on to next Question.

- For the long term Strategy to retain loyal Solv protocol investors. Do you any incentive program for Good Supporters. It's not easy to find investors these days. From @BTCLove10

Ryan Chow: We connect high-quality investment firms in the crypto world, wealth advisory platforms, and investors.

The institutions that participated in the seed round of our project include IOSG, Spartan, Hashed, and other well-known institutions. Our private round has just closed and we have Blockchain Capital, Sfermion and many other amazing VCs involved. Our latest funding PR will be posted on our official medium account, please stay tuned.

Ryan Chow: done @Vishveshwaraa

Vishveshwara: Ok Nice 👌 . One last question from Twitter segment.

- Can other NFT project integrate and utilize your NFT Voucher products and mechanism on their protocols? How composable and adoptable is your NFT Voucher? Can you discuss with us its capacities and limitations in terms of external integrations? From @0JeanWayne

Ryan Chow: Yes totally available. With our unique token standard(Eip-3525) which is compatible with ERC721, we could integrate with most of the NFT projects as long as we see the value of collaboration. For example, Solv vouchers could be lent on taker protocol in the near future. I should say the capacities will beyond your expectations because it would solve most problems for most projects.

Ryan Chow: @Vishveshwaraa Done

Vishveshwara: Excellent 💪

Vishveshwara: We have completed 2nd Segment. I hope many here know a lot more about the project. We encourage you to ask all your questions in Telegram Live Segment.

Vishveshwara:

Now it's time, we answer questions from our telegram Community. No Spamming, tagging and No Copied Questions will be rewarded. Follow all the Rules to get rewards.

Chat will be open for 90s please ask your questions.

Chat is Open Now. 🏃 🏃

Chat is Muted, I hope everyone got enough time to ask questions.

Vishveshwara: @ryanchow666666 please select 5 best questions and you are free to answer all the concerned questions.

Member: 1. Most investors focus only on the short-term price rather than the real value of the project. Can you tell about the long-term benefits for investors in the project?

Ryan Chow: Yes, good question. First we made the vesting period to be three years and there won't be any tokens circulated n the marketplace in the first year thus the dumping risk is really low. And lockup time for team members is even longer. The price won't decline even in a long term. And the products we are making now is actually pretty innovative and still have several backup products to be published and they are well recognized by our partners and investors.

Vishveshwara: 4 more to go.I really appreciate the Commitment from the team members. 😊

Member : 2. Is your platform suitable for crypto beginners? Or does it only limited for professional users ?

Ryan Chow :It's actually really easy to operate on Solv protocol and I think it's beginner friendly. We will public an Video tutorial within this week for you guys to understand it better and quicker.

As you can see, we are focusing on the coming IVO at this stage to draw traffic to the platform

Member : 3. So many projects just like to speak about the "long term vision and mission" but what are your short terms objectives? What are you focusing right now?

Ryan Chow: As you can see, we are focusing on the coming IVO at this stage to draw traffic to the platform.

Member : 4. What is business model of your project? How it works? And who are your potential customers and which markets are you targeting on?

Ryan Chow: We are building a marketplace especially for financial NFTs, and trading fees will be our main revenue. Both project teams and investors are our customers.

Member : 5. Where can I currently buy Token?

Ryan Chow :You can participate the coming IVO to get the vesting tokens, the details will be posted on our social network very soon:).

Ryan Chow: Bingo. @Vishveshwaraa

Vishveshwara: Awesome, you are best @ryanchow666666

Ryan Chow: Thank you all guys!

** Ryan Chow :** Don't forget to follow us:

Ryan Chow:

Twitter: https://twitter.com/SolvProtocol

Telegram: https://t.me/SolvProtocol

Discord: https://discord.gg/Q52FDfxy

Website : https://solv.finance/home

Vishveshwara : We have come to end of #Ama session with SOLV protocol. I request everyone to join thier Groups and invest in this Top Project.

Vishveshwara: All the Best @ryanchow666666 , we expect you to comeback soon and again we can celebrate project success.