Blockchain technology is all the rage right now for geeks, anarchists, gamblers and corporate executives, with a vast spectrum of motivations and visions for future use cases. And while a diversity of participants and ideas is fantastic for the development of the blockchain ecosystem, many fail to grasp the original intention and core design of the technology.

With yet another global financial meltdown in 2008, Bitcoin launched shortly thereafter to great fanfare from cryptoanarchists and libertarians who wanted to relinquish control of the monetary supply from the central banks.

Satoshi Nakamoto and other cryptoanarchists understood the potential for blockchain beyond basic financial transactions. But it wasn’t until Ethereum launched in 2015 that a Turing-complete solution became a reality.

The distributed, decentralized, public and open design of blockchains are inherently anti-authoritarian; espousing protopian dreams of a free and decentralized society. But we’ve been here before with the cyber-utopian idealists of the early internet and world wide web.

Just as the internet of today is now dominated by centralized monopolies such as Google, Facebook and Amazon; blockchain technology could just as likely result in a future crypto-authoritarian dystopia. But of all future possibility threads, I think the core design and economic drivers of blockchains will converge toward a positive, decentralized future for all of humanity.

Corporate Status Quo

The blockchain ecosystem is already dominated by traditional corporates, financial institutions and fintech startups seeking to leverage the technology to cut operating costs, reap profits and build new monopolistic empires.

A consortium of over 80 of the largest banking and financial institutions have joined forces to build a private financial blockchain platform entirely under their control. Fortune 500 companies are forming an enterprise alliance to leverage Ethereum to pursue their own fiduciary duty to maximize profits for shareholders. Central banks in China, Russia, Canada, Denmark, England and Singapore are already exploring or developing ways to issue sovereign cryptocurrency while maintaining full control.

Having started the Sydney Ethereum meetup in 2014, I’ve witnessed firsthand the dramatic demographic shift from anarchist developers to corporate executives wearing suits. Ethereum meetups are rapidly devolving into investor clubs for speculators and recruiting pools for corporate executives.

In the information era of today, the primary business models of corporations essentially boil down to a simple three step process:

- Capture, monopolize and privatize data

- Create artificial scarcity by restricting access

- Repackage and sell that data in various ways

Google and Facebook profit from capturing user data, monopolizing and restricting access, then repackaging and selling that data in the form of a targeted advertising service. At a fundamental level, this business model is the same for any company with a database.

As we enter deeper into the era of big datasets being used to train artificial intelligence and machine learning, the monopolization of data will present tremendous competitive advantages resulting in further centralization and consolidation of wealth and power.

The reason corporations are enthusiastically pursuing *private* blockchain technology is precisely due to the potential to:

- Automate business operations

- Cut human labor costs

- Further monopolize data and market share

- Increase profits for shareholders

Societal Crypto Trojan

Given this trend of rising corporate and central banking interest in blockchain technology, it’s inevitable that the first widespread mainstream adoption of blockchain and cryptocurrency will be driven primarily by the existing status quo and power brokers.

The average citizen will be comfortably using behind-the-scenes cryptocurrency on a daily basis well before Bitcoin or Ether reach market caps that rival the smallest fiat currencies. When you open a bank account today, the teller doesn’t explain the bank’s entire technology stack and how the underlying transaction is processed. And in the near future, that same bank won’t explain how your money is actually cryptocurrency operating on a private banking consortium blockchain. Most won’t know, or care.

In a few years, the average citizen will comfortably interact with smart contracts and dapps without knowing it.

Why? Well as blockchain technology matures, banks and corporations have an economic incentive to leverage the technology to cut operating costs by automating and decentralizing their operations. Dapps, smart contracts and DAOs (decentralized autonomous organizations) have the potential to reduce infrastructure, labor and operating costs for all companies to near-zero.

The irony of course is that these corporations are investing in developing technologies which pose an existential threat. Once they’ve privately decentralized their entire backends, all that will remain is their brand, a user interface and a fiduciary requirement to deliver profits to shareholders.

Perhaps that’s enough for customers to continue paying a premium fee. Or perhaps customers will switch to a public DAO equivalent with zero profit requirements, that offers the same (or better) service with much lower fees.

In this sense, blockchain technology is a crypto trojan horse.

Blockchain Commons

Corporations and banks are pursuing private blockchains because they can control the data and maintain proprietary closed-source code. This strategy will definitely work in their favor for quite some time, but ultimately information wants to be free. The network effects of an open, public blockchain-based protocol will inevitably outpace any private systems.

The corporate mindset of today is conditioned to think within the confines of scarcity and controlling ownership models. This makes them an easy target to disrupt.

If you’re a real estate listing portal or property data company then you’ll likely create a private blockchain system for your country of origin to store data and run closed-source dapps. You’ll create fancy features that allow real estate agents, lawyers, buyers and sellers to interact and transact (for a fee). You’ll then form consortiums with other industry players to develop private blockchains for managing things like land and property titles.

Meanwhile a lone coder develops a public blockchain protocol which stores all global property data with completely free and universal access. She also develops opensource smart contracts which enable buyers/sellers to securely transact and transfer land or property deeds with a single click. This runs perfectly as coded, every time. She charges a tiny, zero-profit fee to cover the computational costs (gas). Anyone with an internet connection can access and use the protocol freely, without registering or asking permission.

Business models which operate on artificial scarcity simply cannot exist alongside a reality of public blockchains. Even if a group did attempt to deploy a for-profit protocol on a public blockchain, the code by default is opensource and thus it’s trivial to copy the code, lower the fee and then redeploy.

Public blockchains are owned by nobody, controlled by nobody and can never be shutdown. Smart contracts can be owned by nobody, controlled by nobody, and execute as coded every time.

The result is a blockchain commons; a universal common resource which renders old-world business models obsolete, and ushers in a new foundational paradigm on which to create value for all of humanity.

New Value Creation Model

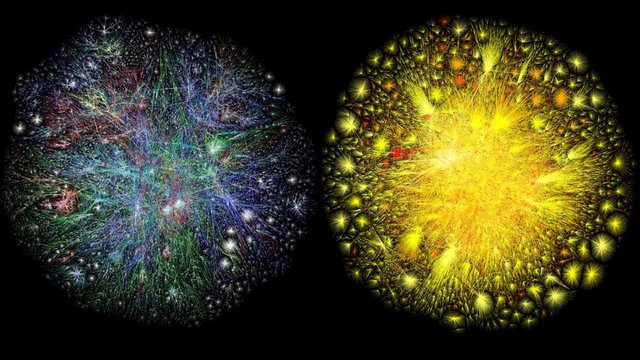

If you want to change the world on the blockchain then it’s all about building an open protocol, not just another startup. During the early days of the internet there were various groups competing to build the open communication protocols. While most faded, the ones that succeeded are now the standard protocols that power the internet today: TCP/IP, DNS, HTTP etc.

These protocols are free and universal, resulting in everything we’ve come to love about the internet. The blockchain ecosystem today is exactly like the early development days of the internet. Thousands of projects are now competing to develop the standard protocols for these and much more:

- decentralized storage

- decentralized law

- decentralized messaging

- decentralized governance

- decentralized insurance

- decentralized finance

- decentralized real estate

Once these protocols are in place, the key to creating value will be to imagine a future where all data is free, public and universal; where wealth, power and computation is a distributed common resource. If you begin with these tenants as the default then imagine what new entities, products and services can be built that add value on top of this new foundation?

I believe each industry and system in our global society will converge into single, public blockchain-based protocols.

Instead of ten thousand insurance companies each with their own business functions, we’ll have one universal decentralized insurance protocol.

Instead of a thousand social networks each with their own user and friend data, we’ll have one universal decentralized social graph protocol.

From a business model perspective it will be a shift from scarcity to abundance. The barrier to entry for competitors will be zero since all data is free and universally accessible. User-switching costs will be zero since they can instantly transfer their data to other services with no setup delay.

Products and services that focus on maximizing positive user experiences and offer complete and predictive personalization will thrive. Profits and user growth metrics will be redundant; what will matter is end-user satisfaction.

Organizations that leverage swarm coordination, artificial intelligence and emergent complexity will be able to develop tight feedback loops between their product/service and users. This will enable extraordinarily rapid and autonomous product evolution paired with advanced A/B testing to keep pace against dozens of competitive disruptions per minute.

In such a reality it becomes increasingly clear that the power shifts dramatically to the individual user; the choice of the people will truly determine the outcome of the whole. Products, services and entities which provide social benefits such as a decentralized universal basic income, decentralized universal healthcare and decentralized housing will become popular choices and give birth to the social decentralism movement, including projects such as my own: Peerism.

If the future is a series of probability streams, then anything can happen. But with public blockchains designed to be unstoppable from the beginning, I think the odds are in favor of a positive future we’d all want to live in :)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/peerism/blockchain-commons-the-end-of-all-corporate-business-models-3178998148ba

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit