Introduction

This article has been written to go into depth about the Arbitraging (referred to as ARB) platform and why you should stay far away, especially at this point in the company’s history. I know it is very long, but I strongly encourage anyone that is considering investing into the platform to read the entire thing before making a decision, you will not regret it. I want to start off by saying that I am not, and have never been, invested in the platform, nor any lending or investment platform of any sort. I haven’t been “burned” by a lending platform which is a common counter that pro-lending users use to counter an anti-lending argument which this article is. I will do my best to keep this article as unbiased and emotionless as possible and simply stick to plain facts and observable patterns. If any section contains mostly speculative argument, I will warn you.

Arbitraging (ARB) is a platform that claims that a user may deposit ARB tokens (an Ethereum ERC-20 standard token) to their platform, deposit them into aBot, and then receive returns based on the performance of the arbitraging bot. aBot is claimed to take arbitrage opportunities between two exchanges and execute

them automatically and seamlessly and then returning profits to the users that have deposited in aBot. If you don’t already know what arbitrage trading is, it is when you take advantage of price differences between two different exchanges by purchasing an asset for cheaper on one exchange, sending it to another exchange where the asset is being traded for at a higher price, and then selling it on that exchange. In theory, the user would pocket the difference in the price between the two exchanges minus some fees.

From here on the article will be broken down into sections which will go into detail on various issues that I noticed while exploring all information on ARB. If you’re not interested in reading every single piece of this article, the two

most compelling sections are the section about aBot and the section in General that discusses the interview with Crypto Meena.

White Paper and Website Issues

On the surface, the White Paper seems solid with a decent design and a nice flow. When all of the filler content like images and padding is removed, there is really only around 4–5 pages of real content. Some of this content is redundant and some is irrelevant. Other parts demonstrate a lack of understanding of basic economics and the meaning of decentralization. Overall, the white paper gave me the impression that this company has no idea what they are talking about and is only interested in selling the token and is not focused on building a genuinely good product. There is not a single part of the white paper that discusses how the ARB model works or any technical information on the ARB system.

The white paper claims that the value of the token by the end of Q2 2018 (which has already passed) will be $50, by the end of Q3 $100, and by the end of the year $200. A $200 evaluation of their token would put them at over a $1.5 billion market cap placing them in the top 20 cryptocurrencies overall. Considering they haven’t been listed on any notable/relevant exchanges yet, it’s hard to believe they would even be in the top 100, let alone the top 20. Claims/price predictions like these are just shams to improve investor participation. Take a note out of the CEO of Binance that says any platform that makes price predictions for their token will never be listed on their platform.

https://www.linkedin.com/pulse/binance-listing-tips-changpeng-zhao/

The website is a single page where you can find bits and pieces about ARB and how it works. Unfortunately, combined with the White Paper, they don’t give any understanding of the ins and outs of ARB and the platform. The website is riddled with spelling and grammar issues — a sign of a company that doesn’t take its presentation seriously. The website is filled with buzz words that intrigue investors such as decentralized, financial, technology, fintech, innovations, blockchain, and more.

The website makes many claims and guarantees that can’t be backed up by facts, therefore shouldn’t be mentioned at all. For example: they claim that they will in fact revolutionize the investment platform industry and they are certain that the community will transition to using aBot and mBot. They also use standard MLM terminology such as “Control Your Own Money — Make Your Own Profit — Be Your Own Boss.”

The website was built by the same company that built the Davor Coin website (said by the CEO himself David Peterson in an interview discussed later in this article). This is why there are so many similarities to standard lending platforms and platforms that have already exit scammed. The roadmap is filled with a few filler items, the real roadmap items are few and far between.

I don’t want to forget to mention that all the verbiage of investments and the way everything is worded, it irrefutably makes the ARB token a security by definition.

Team

The team section holds a slew of poor quality pictures of a completely unverifiable team. David Peterson, the CEO, only has around 50 connections on Linked In. Two of the other Linked In profiles have little to no connections (surely less than 10) and one of the profiles no longer exists at all.

I was unable to find any other evidence that David Peterson is really who he says he is. CEO’s/founders of real companies should be able to be verified from multiple sources, not just a Linked In profile that can be created in a day’s work. His Linked In profile says that he is from France, but it has been stated many times that he lives in the United States. Why the discrepancies here?

Platform/Product Issues

The ARB platform is broken down into three products: vBot, aBot, and mBot, plus an internal exchange. I will go into detail on each product below.

vBot (Visual Bot)

This product offers an interface where users can see various arbitrage opportunities between exchanges. It is up to the user to make the trades on their own accord.

Issues with vBot:

- Only 3 exchanges are offered: BTCMarket, Bithumb, Kraken

- The only honorable mention amongst the 3 listed exchanges is Kraken. They have a decent amount of volume which is very important to successfully execute an arbitrage trade

- BTC Markets is an exchange with only $2 million in daily volume. The amount of volume this exchange has makes arbitrage trading practically impossible, it would be better to not list this as an exchange on vBot — it can only hurt the users to attempt an arbitrage trade here. Slippage on a trade alone would eat up

most, if not all, of the profits in the arbitrage process - It’s interesting that vBot lists Bithumb as one of only three choices (two if you exclude BTC Markets). It is impossible for any foreigner to trade on Bithumb AND it is impossible for any South Korean citizen to move $10,000 out of the country of South Korea to attempt to make an arbitrage opportunity on an exchange outside of South Korea. With that being said, it’s not possible for a resident of any country in the entire world to execute a meaningful arbitrage opportunity using Bithumb

- Only 5 coins are offered: BTC, LTC, ETH, XRP, BCH

- While these coins do in fact offer the highest likelihood for high volume which is good in an arbitrage trade, there are plenty of alt coins that offer better arbitrage opportunities due to the sheer nature of alt coin markets. The increased volatility may be used to an arbitrage traders advantage if the conditions are right

While on the surface, it might look like a useful tool for an arbitrage trader, but when dissected, you can see that the tool offers absolutely no use in reality.

aBot (Automatic Bot)

At the time of writing, aBot is the main focus of the ARB platform and what most investors are interested in. aBot is the automated arbitrage trading bot that claims to make arbitrage trading seamless and easy for users, ultimately creating a passive income opportunity for users.

In my opinion, this is the biggest red flag of the entire article, so pay close attention to this part. I will give an example of how the aBot process works from start to finish. We will use Frank as an example. Frank purchased 1000 ARB tokens during the ICO for $0.50 per token. When aBot was released, Frank wants to put his 1000 ARB tokens into aBot when the price of ARB is $1. In order for Frank to do this, he must send his tokens from his ARB wallet to the aBot wallet and input an exernal wallet address of choice where he would like profits to be distributed to.

Once Frank has completed the above, the ARB tokens have now left the possession of Frank and aBot now shows that he has $1,000 USD in aBot. Each day, the profits for that day are posted and Frank receives his payout in ARB tokens to an external wallet address of choice. Frank monitors the performance of aBot over the course of a month when he finally decides to pull out his investment. At this point, he received an average of 1% per day on his investment for a total of 30%. His profits were around $300 USD over the course of the 30 days, however, the price of ARB went up to $2 over the course of the month. This means that as he was being paid out over the course of 30 days, the price was increasing and instead of receiving 1 ARB per $1, he was receiving less, up until when it hit $2 at which point he was receiving 0.5 ARB per $1. Frank will have anywhere between roughly 175 ARB to 275 ARB depending on how the price increased over the course of the month. Let’s say he received 275 ARB to be as lenient as possible.

This is where the red flag is raised. Now that Frank has cashed out his aBot investment, he is supposed to get back his investment. Since he put in 1,000 ARB, he should get back 1,000 ARB right? Wrong. Now that ARB is $2 per token and he put in $1,000 at the beginning of the month, he will now receive 500 ARB ($1,000 / $2 per token). Now Frank has a grand total of 500 + 275 ARB = 775 ARB. Frank has less ARB than he had when he initially put into aBot, but he now has $1,550 worth. Had he held onto his initial 1,000 ARB and not put it into aBot, he would have had $2,000 worth.

There are two issues here: A. Frank got back less ARB than he initially had, and B. the ARB platform has now pocketed 225 off of Frank. Even though ARB paid Frank 275 ARB over the course of the month, ARB still had a net gain of 225 ARB of Frank. If we assume that aBot is real and is actually making arbitrage trades, then any profits made from aBot are also pocketed by ARB. The only person losing in this situation was Frank.

This issue expands more on the issue posed by ARB’s internal exchange and the regulations they have placed on trading in order to prevent price drops and encourage price appreciation. Also, the promises and speculation of massive price increases and a timeline behind them. By encouraging price appreciation, they can ensure that they are always having to pay out less tokens than were put into the platform. Does this sound familiar to anyone? BitConnect DavorCoin

Ponzi

Unfortunately, I do not have experience with aBot, so I cannot expand on what happens when the price of ARB goes down. One of two things could happen: 1. You receive more ARB than you original put in. 2. You receive the original amount of ARB that you put in, regardless of price changes. I hope that the case is not option 2, because that would be a double red flag on top of the increase in price scenario.

mBot (Manual Bot)

The next product is mBot, or the manual bot, which has not been released yet. mBot is claimed to be able to allow users to see arbitrage opportunities (like vBot) and then allow them to execute those trades within the ARB dashboard.

There is not too much official information published on how mBot will work and the intricacies of the long-awaited bot, but ARB is certainly building a lot of hype around the product in preparation for its launch.

The website says that users will be able to convert their ARB into fiat within the dashboard for use in the arbitrage trades, similar to how it’s done with aBot. If mBot works anything like aBot where you put in ARB and leave it in there for a certain amount of time, then make profits on manual arbitrage trades, then convert the fiat back into ARB, this could pose the exact same issue as with aBot. If the price increases while the tokens are inside mBot, you will receive less tokens back than you originally put in.

Internal Exchange

At the time of writing, the only exchanges that ARB is listed on are exchanges that list almost any token for free due to their ease of implementing ERC20 tokens. This means that the majority of the trading of ARB takes place on their internal exchange. This is the reason that they are not listed on Coin Market Cap, another posed issue in itself. The fact that they are having trouble getting listed on public exchanges is worrisome for any interested investor. Most platforms now-a-days that only have internal exchanges or where the majority of their volume takes place on their internal exchange are considered illegitimate by most avid investors.

To top of the issue of an internal exchange being the only place to trade ARB effectively, there has been a number of rules placed on their exchange that is claimed to be to encourage price growth. They have implemented a system where it will not allow you to undercut prices and will automatically “fix” your order to undercut as little as possible. Second, they only allow you to post up to 4 sell orders per hour but allow unlimited buy orders (up to 3 open at a time). Finally, all orders expire after 48 hours if not filled. This one is very interesting and I personally don’t know what to think about it. I don’t see why they would implement a rule like this when no exchanges do something so silly.

Placing rules like these in place to encourage price stability or price growth is pure manipulation of customers and manipulation of trading and pricing of their coin which is surely illegal. Unfortunately, there are no official laws or bodies in place to stop this from happening so ARB can get away with it.

Warning — Speculative Section

If you don’t care for speculative arguments, then please don’t read this section. Considering that vBot only offers arbitrage opportunities for 3 exchanges, two of which are useless, makes it difficult for me to believe that the team has the ability to properly execute real automated arbitrage trades on either aBot or mBot. If the team was capable of connecting many large exchanges and seamlessly creating an environment where arbitrage is automated, then why doesn’t their vBot show all of the opportunities that they monitor? Again, this is only speculative and there could be plenty of reasons that they don’t show them; however, only showing 1 viable arbitraging exchange makes no sense if they have actually integrated API’s for many of the larger exchanges — which would be the ONLY way to properly implement an automated arbitrage system. There is simply no arguing that fact, any beginner arbitrage trader would know this.

Etherscan Issues

After little research into the ARB contract address and token overview, the

following issues were found.

- Etherscan contract reputation

Etherscan has a reputation system for tokens on their platform. The reputation of ARB is “Unknown.” After a little digging, I was able to find that there is a simple application that can be submitted by ARB to request to receive “Neutral” status. Neutral status is the most common status found on ERC20 contracts on Etherscan, yet ARB hasn’t received this status. This means that either A. they haven’t applied for it yet for a reason I cannot think of, or B. they were declined neutral status by Etherscan (which should raise a red flag)

- Saturation of top holders

The top 10 wallets that hold ARB have around 65% of all tokens in existence. Having such a majority of tokens in the hands of so few is dangerous for any coin/token.

- Number of token holders

As of writing this article there is only roughly 1750 holders of the ARB token.

Let’s disregard the fact that the top 10 wallets hold 65% of ARB for a minute. If there are around 8,700,000 tokens in existence and there are 1750 holders, that gives us an average of almost 5,000 ARB tokens per holder. ARB is currently trading at around $4 per token on their internal exchange, which would give the AVERAGE investor in ARB $20,000 in ARB tokens.

Now let’s remove the 10 wallets that hold 65% of arb. 35% of 8,700,000 is 3,045,000. Now we have 1740 holders (1750 — top 10). 3,045,000 divided by 1740 = 1,750 ARB tokens on AVERAGE per investor. At $4 per token, that is $7,000 invested on average per user. It’s nearly impossible that the average investor in the ARB platform has invested $7,000, let alone $20,000 in the previous example.

General Issues

This section may run a little long because it will contain many of the items that I didn’t feel fit into a specific category in the other sections of the article.

Unsustainable Returns

Any company that boasts the possibility of an average of 1% returns per day should be avoided, or at least approached with extreme caution. Simple calculations show why this could never be possible in any investment.

The average investor in ARB is supposed to have $7,000 worth of ARB based on our calculations earlier in this article. Let’s say that a user was in ARB for a full year and deposited their earnings back into the system regularly to benefit from compound interest. 1% compounded daily for 365 days = 1.01³⁶⁵ = 37.78 * $7,000 initial investment = around $264,000. Need I even say more? This simply is not possible, let alone sustainable.

Referral Program

ARB offers a referral program where every person you refer will pay you 5% of their earnings forever. I’m not sure how it’s possible for ARB to do this because I don’t know where they could possibly get the capital to pay out this ridiculous referral program when they claim they sold most of their tokens during the ICO. Most successful and sustainable referral programs end at the first reward and are not residual income opportunities.

Social Media Presence

The lack of presence of any team member of ARB is very worrisome. I don’t hang around the ARB chat often and have only dropped in a few times myself, but I have never once seen an official team member of ARB talking with the community inside the ARB telegram channel. I also haven’t been able to find a recent video/interview with David, the CEO. The only time we have seen David’s presence in recent times is through text announcements (which may very well not even be written by him).

Community Discrepancies

This is an interesting section because it shows how their numbers don’t add up, especially when it comes to their community. Their Telegram has almost 7k users. Their twitter has only 1500 followers. From what I can tell, they don’t have a facebook page. Here’s where it gets weird. Their website says they have over 40,000 users. Their etherscan says they only have 1750 holders of ARB. How can there be only 1750 holders of the token when their site says they have 40,000 users and they have almost 7,000 users in their telegram. What are these people doing with ARB? Are they even real?

Extended Final Round of ICO

Back in March when the ARB ICO was coming to the end and they were in their final round, they extended the final round of the ICO. The final round was the most expensive round. The roadmap shows that the ICO ended April 10th, but the XRPC bitcoin talk thread (see References for link) shows that the ICO end date was supposed to be March 15th. Why would they push out their end date of their ICO? The only logical explanation is to get more money at the last minute. Timelines are created for a reason and they should be followed strictly, especially when it involves investors and money. When companies start changing their timelines unexpectedly, they lose integrity and trust of their investors.

Interview between CEO David Peterson and Crypto Meena

After finishing a good bulk of this article, during my research into ARB and the connection of XRPConnect and XRPC, I came across this video between the CEO David Peterson and Crypto Meena on youtube. This interview took place right around the time that David took over as CEO for ARB and was making changes to the structure and business model of ARB. This video alone is evidence enough that ARB is a complete sham, everything else in this article at this point is just icing on the cake. I will outline the biggest issues that I noticed during the interview. You may view the full video by following the link in the references section of this article.

- Company has been rebranded from XRPConnect to XRPC at the time the interview occurred. Since then it has yet again been changed to ARB. When confronted about why it is called “XRP,” David Peterson said it had no meaning and was not related to Ripple. With that mentality, the company “XRPC” contained absolutely no meaning behind it what-so-ever which is hard to believe. Warning speculation: maybe it was named XRPConnect because it was created before Bitconnect exit scammed and was a complete copy of their platform? Later it went on to be renamed to ARB to try to further separate the name from previous exit scams, but the concept remains the same

- The CEO was changed in early phases of the company from a developer to David Peterson

- The website that ARB is using was developed by the same team that built DavorCoin (one of the giant coins like BitConnect that exit scammed)

- Percentage returns were intentionally lowered from 45% to 30%

- How is it possible for them to determine the average return would change from 45% to 30% is returns were based on bot performance? This makes no sense.

- Company originally had MLM (multi-level marketing) format, but it had been removed. This is likely due to the surrounding media regarding MLM’s being scams in the ICO community

- Blatant lying about how their exchange is decentralized and how their system is fool-proof for investors

- The way the ARB system really works is not in favor of the customer at all. ARB has full control over your funds at any time because they have the private keys associated with your portal wallet, your aBot wallet, and your exchange wallet. They call it decentralized for no reason and claim that the way they run their system will become the new standard. This is not only factually incorrect, but a complete lie. If it were decentralized, you would always hold your private keys, period.

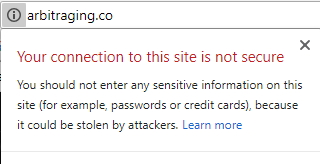

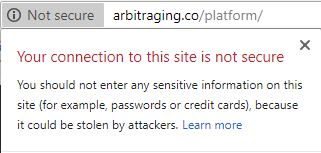

Technical Issues

Regarding technical issues, I spoke with a friend that has a small background in tech and had him do a little digging for me. He didn’t do too much and said he didn’t put too much effort into finding out these things, but they are definitely mentionable. The results of his findings are outlined below.

- IP address is publicly accessible

The IP address of arbitraging.co and the user portal are publicly accessible with a simple DNS lookup. After a bit of further research, you can easily find that ARB uses Liquid Web as their web hosting service provider, which leads us into our next issue of DDoS protection

Simply adding their website to CloudFlare could mitigate some of the risk here

- No DDoS protection

Liquid Web offers DDoS protection plans but does not offer DDoS protection by default. After a quick harmless DDoS attempt on their server IP address, it was obvious that they did not have DDoS protection.

Again, adding the domain to CloudFlare can, at times, prevent DDoS attacks altogether if done properly and the server IP address is inaccessible

Registration email was sent to spam folder with untrusted originThe email server that is sending their emails is black listed with Gmail, and likely many other mail clients.There are many solutions to this issue such as swapping to a trusted mail server or mail service such as GSuite, Office 365, Zoho — all of which almost guarantee emails will not be marked as spam

SSL is unreliable. Sometimes it works, sometimes it doesn’t

Conclusion

If there’s one thing these types of platforms are good for, it’s getting in early and getting out before it’s too late. In this case, you may be able to make a nice profit while minimizing risk, you only need to make sure you don’t get greedy and know the warning signs for a declining platform. The changes to the way you can put in and take out of aBot along with the exchange changes are early warning signs that things are going downhill for ARB. If you participated in ARB and you haven’t pulled out already, now might be a good time to do so. Thank you for taking the time to read this article and I hope you were able to come to the same conclusion as me and many others after being presented with all of the evidence from this article. Invest safely.

References

- Interview between Crypto Meena and David Peterson:

https://www.youtube.com/watch?v=xBtUEPRoVwY - XRPConnect Bitcoin Talk thread:

https://bitcointalk.org/index.php?topic=2483544.0 - ARB Website: https://arbitraging.co/

- ARB White Paper:

http://arbitraging.co/index_files/docs/Whitepaper_EN.pdf

so...why they win World Crypto Conference on Token Tank if they are scam???? you tell me why?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @scamitraging! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit