INTRODUCTION

Do you know what synths are? Synths otherwise called synthetic assets are the first class grade type of asset an investor can invest in or own. This type of assets is usually very safe to invest in and trusted because of the consistency in their value and the high profit potential it holds for investors. However, to have it issued or minted from a platform tells us a lot about how people can tap into the advantages just like the OIKOS network has made it open to its users.

OIKOS NETWORK DESCRIPTION

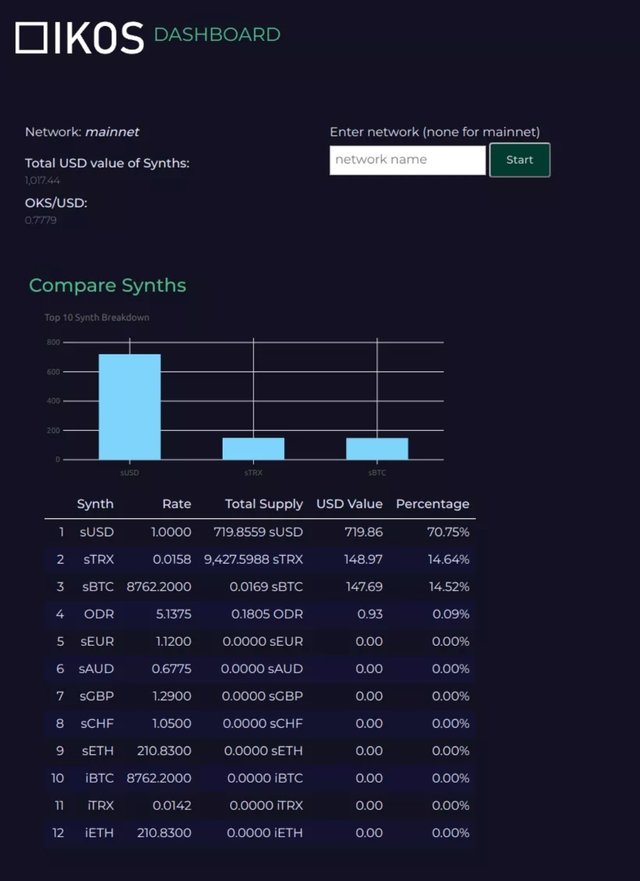

This platform is all about how you can acquire synthetic assets by using the OKS token of the OIKOS platform which will be used as collateral in the process. The process involves the staking of the OKS token in the platform from the users wallet. When a user subscribes to Oikos, such a person have to get the token in moderate volume or at least in volumes of the desired synths they would love to have and them staking with them. The need for staking arises to have the users rewarded in the ecosystem, to have them mint the Synths class assets in a special way. The style of staking they uses makes them get exchange rewards and more is generated when the synths would be converted to another form. All these are done in the exchange where trading fees is requested and then forwarded to the fee pool where other stakers get to claim the fees again on a weekly or biweekly basis.

THE CONDITION AND OPERATIONS FOR THE MINTING PROCESS

When the trade is on in the OIKOS exchange, the platform would display the fees and make traders aware of the little fees that is not above 0.3% that must be paid as a major part of the users' contributions made to the system. Then the minting and staking for the OKS holder is made to follow the designed money policy that guides the platform. The OKS token is going to be supplied to the system following the supply schedule beginning from the first year where close to about 1.5 million of the token would be issued on a weekly basis with a very low decay rate of 1.25%. This is an interesting part of the program that will run for up to 194 weeks until the token reaches the terminal rate where all the supplies would be cut off. After this, the token would be distributed in a pro-rata style as the proportions would be calculated by the team to continuously have collateral tokens for the users without compromising the level of the distribution. Some other part of the activities of the platform includes the burning of the token, minting of Synths and the C-Ratio which means the collateral ratio.

CONCLUSION

All of the terms above have their importance in the platform. The C-Ratio makes sure that all the Synths to be minted have enough OKS token to uphold them rather than having a few that can lead to the flunctuation and irregularities in the minting operation which can affect the user whose token is staked for the Synth.

USEFUL LINKS

Github: https://github.com/orgs/oikos-cash/

Medium: https://medium.com/@oikoscash

Telegram: https://t.me/oikoscash

Twitter: https://twitter.com/oikos_cash

Facebook: https://www.facebook.com/Oikoscash-102203241479884/

*AUTHOR'S DETAILS

Bitcointalk Username: Wlizzy

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2802457