Hello Dear Steemit Community.

I will write a real introduction post soon. Once I successfuly organized the first NRW-Blockchain-Meetup (DE) (Facebook Event) I will have pictures and some real content to make a quality introduction post.

Until then I want to introduce you to a series I'll write called "1001 Blockchain Usecases".

Disclaimer: If you just want to read about the usecase, scroll down. If you want to read me ramble about my reasoning and motivation, please continue right here :)

I have a list with this exact title where I write down all the ideas involving blockchains, tokens, smart-contracts and everything else our new favorite technologie has to offer.

These ideas are not ment to be perfect as they are just that, ideas.

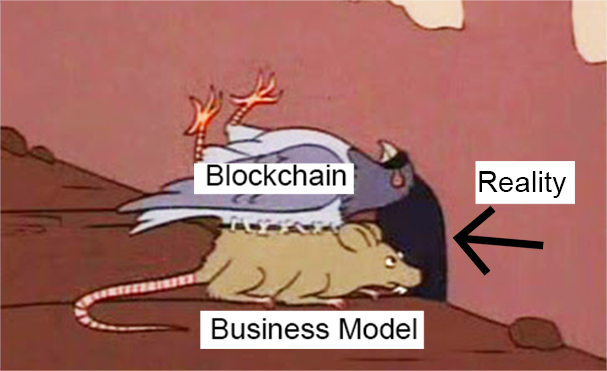

Their purpose is to sharpen our minds and try to figure out what makes the difference between real value the blockchain can provide and those ideas, that are just a businessmodel that works way better with a centralized approach but, for hype purposes, get a blockchain slapped on it.

I get Blockchain Ideas everyday. Most of them sound amazing at first, but as soon as I start fleshing them out, I see lot's of problems. But sometimes there are models where it seems like they could create real value. The best models are those that not only create value for the creator but for the whole of society.

in this series I want to explore these ideas together with you. I invite you to praise, criticise and discuss every possible problem you see so that we as a community sharpen our understanding of this new space of possibilities together.

Introduction

Since I have generated a reasonable amount of crypto currency I yearn for some investment opportunities that I can use to hedge against the crazy volatility. There is USDT, there are DigixTokens. But these are still speculative and they don't represent real-realworld value (USD/Gold are means of exchange, not value in and of itself [yes gold hase uses but it's main use are it's characteristics as a fungible, rare metal])

There only seem to be x10 or nothing bets out there in the ICO space. Shooting for the moon without having flown a plane, driven a car or even tested the engine. (Referencing Andreas M. Antonopoulos great talk about Ethereums Killer App, Rocket Science and ICOs)

This is the reason I love Steemit. It is not only a theoretical idea that promises to be big in the future but something that is already used daily by lots of people. It delivers interesting value in a way only a blockchain technology could achieve. Steemit is amazing!

This space of usecases, those that can be executed today. This is the space I'm exploring recently. My motto is: the smaller the better; as long as it provides real value for real people.

As I worked in real estate property management I know a thing or two about the space. Generally speaking, investing in real estate is one of the most solid assets out there. You could argue that the cost is getting stupid again, you can argue there may be a bubble. But in light of global longterm trends of urbanization the value of RE (if it is in proximity to a major city) you generate a steady cash-flow that even tends to increase with the years as the urbanization drives up prices.

[Btw; You can split the market in three tiers of location. Tier one is almost impossible to develop/acquire as the prices are astronomical. Tier two is perfect for development. Tier three is what you don't want to touch unless you know what you are doing.]

So, why doesn't everybody own property then? - Because you need to pass a certain threshhold of wealth to be able to own property with the above mentioned characteristics. I would love to own a condominium but I can't afford one. I could only afford a fraction...

Pt. 1: Buying, Owning and Tokenizing Real Estate and Property

In theory this should be easy. We create and fund a Smart-Contract and get Tokens in exchange for that. Then we vote on a representative interacting on our behalf with the real world.

In theory he would now buy real estate, give the Smart-Contract owenership and we would have tokens that represent the real estate. Buuuuuut there is no legal footing on this. As far as I know there hasn't been a case of a Smart-Contract owning real world assets. Digix tokens don't own the gold they represent. They are just a promise of the people behind Digix to send you X grams of gold in exchange for Y tokens. As USDT is a promise that they are backed by USD. The token doesn't own the USD, it's just a token of a promise we trust.

At least right now you always need a gatekeeper. This can be a person you trust, a company in singapur, OR, and that's my favorite, a "Genossenschaft".

"What the F is a Genossenschaft?" you might ask. And how the F do you pronounce it? Well, I can help you with the first but for the second one you almost certainly need to be german like me ^_^ (Shoutout to /deutsch)

A Genossenschaft is an amazing construct that enables a group of people to own assets without creating too much hassle (and overhead costs) for them, compared to a AG (or listing your company on a stock exchange).

It's basically a shared organisation, enabling people to buy shares in the organisation.

One of the most used cases for a Genossenschaft is a Wohnungsbau-Genossenschaft (WBG) ~> Co-operative housing society. This is an organisation that builds and owns Real Estate. To live in that RE you have to be part of the Wohnungsbaugenossenschaft (WBG). And you do that by investing some of your money into the organisation. The goal of the WBG though isn't to create the highest possible returns for their shareholders (there is no fiduciary duty!) but the goal is to create affordable living space for their members. At least most of the times. If you want to generate returns as well you can do that, too. The purpose of the Genossenschaft is decided in a democratic manner where every member get's one vote. It's a truly democratic and unique organisational form that even is UNESCO World Heritage.

Die Unesco begründete ihre Wahl damit, dass die Genossenschaft eine allen offen stehende Form der gesellschaftlichen Selbstorganisation sei, ein Modell der kooperativen Selbsthilfe und Selbstverantwortung.

The Unesco justified its choice by saying that the cooperative was an open to all form of societal self-organization, a model of cooperative self-help and self-responsibility.

Isn't this amazing? If you would'nt know that this sentence describes a more than 100 year old organisational form you could think it references the blockchain.

There are some costs involved in keeping this organisation running, mostly offices, bookkeeping, taxes and organizational dutys. So running a Genossenschaft comes with the same costs as a small-business, but with waaaay less overhead than a stock exchange listed company.

Plus I'm certain that it is possible to create most of the Genossenschafts structure in a smart contract. This hasn't been done before, therefore we need a precedent case, but this is the reason I'm writing this (And the reason I already have scheduled an appointment with an expert on this field, the 18.07)

This gives us a mechanism to have real RE ownership on the blockchain in a stable and worlwide recognized country (Germany) without the need for a gatekeeper, greatly reducing risk for tokenholders and increasing the degree of true decentralization while still beeing recognized by the local government.

Okay. Now we have bought and tokenized RE. But how do we create a steady cashflow from tenant to tokenholder? What do we do when something is broken? How do we find a new tenant when the old one leaves?

This would be a HUGE pain for all partys involved if we only had the Smart-Contract and a bunch of anonymous token holders scattered all over the globe. Can you imagine coordinating the replacement of a lightbulb; releasing the funds while beeing certain that the system doesn't get abused and/or creates huge amount of headaches for all stakeholders is not as easy as you might think.

Well, luckily there is an invention that takes care of all these nitty gritty details. It oversees facility management, insurance and even finds new tenants. It can handle all the fiat cashflow still neccesary to manage real estate long term. This amazing service is called "property management". It's the field I worked in for some time and this is the missing link for real estate and tokenization.

All you need to do is either pay a fixed amount per month or give them a cut of the income generated and they manage all the nasty little details so you can sit back and watch your pile of money grow. I mean, of course there is someone doing this already or have you thought rich people manage their tenants themselves? ^_^

So, we need to find a property manager that kinda understands our corporate construct and boom. Done.

They get some (vested) tokens of the property so they own their fair share and if they get instructed well by our representative they can be the perfect missing link between real world and crypto world.

If they don't handle their job well or misuse our trust, we fire them. Plus all their shameful behaviour is recorded on the blockchain. For ever. For ever-ever? For ever-ever! So. If you are a property manager that intends to keep working as one, you have strong incentives to do a great job.

There needs to be a new set of light bulbs in the elevator? No problem, they create a request to the contract, funds get released (if the amount is small enough this happens automatic, if it's something major it first needs to be approved by the owners. This is nothing new for a PM, this is standard practice in this business). They take the released funds, exchange them for fiat if the facility manager can't buy lightbulbs with crypto yet, and boom, process done.

Our property is successfully "online" for a year and the token holders want to increase it's value? No problem, tokenholders vote and exectue upgrage_process, property manager get's offers from construction companies, presents it to the tokenholders, they vote again, funds get released, boom. Upgraded the property.

As this is still the same old real estate market we are operating in, there is a chance that the construction company says the budget is 50.000$ but only finishes it 80% and says it needs more funds to complete the project. We can't reduce the risk to 0% but we can set strong incentives for the companys to calculate their offers correctly and/or finish the project anyways. First, this project is on the blockchain and usually this means it is open to the public. Secondly, we can easily escrow the funds. Then this blackhat construction company would need to 1.) accept that their unprofessional behaviour is on public record for all eternity and 2.) they need to blackmail a decentralized group of people. Compared to a single owner this is way harder.

I could go on and on with this, elaborate on every little detail, find small problems and present possible solutions for them. But this was not the idea. The idea was to present you the concept: Genossenschaft + smart contract + tokens + property management = tokenized real estate without a gatekeeper.

TL;DR: How do we execute this?

- Create a Genossenschaft. Mention in the articles of incorporation (Gesellschaftervertrag), that the shares are represented by a special token and that voting and consensus is organized over the Smart-Contract associated with the tokens.

- Sell the tokens to fund the Crypto-Genossenschaft

- Buy property and real estate with the funds.

- Hire a property manager as a representative to keep everything up and running.

There you go. We just created (in theory) tokens that represent real world value, giving everbody access to a real world market that has high barriers of entry. Now everybody can own a fraction of real estate, get steady returns and liquidate their real estate asset way easier than liquidating a whole unit of Real Estate. The tokoen is pegged to a real world asset and therefore something desireable if you need to hedge against volatility without going into fiat or if you just want to incorporate real estate in your portfolio long term.

I for one would love this token as I am always quite sure of the value and as I even get a monthly dividend on my investment.

And the most beatiful thing? This can be done today. At least it can be tried today. And you don't need millions of BTC and ETH, just a couple to start.

Thank you for reading this. What is your opinion on this? Where do you see problems? Would you be interested in seeing RE-Tokens like this created and would you like to have them in your portfolio?

Kind Regards,

Wunrok

P.S. please excuse my poor english. I'm still learning.

P.P.S. As you might have picked up, I already am scheduling meetings with experts from law, property management etc. because I am determined to try this out if there are no major road blocks. If you are interested in getting in on this, you know how to contact me.

Welcome to Steem @wunrok I have upvoted and sent you a tip

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Go for it! It definitely makes sense. Not the potential high returns of an ICO or other cryptocurrencies that might expode 10- or 100-fold (or lose all its value), but a more or less safe and solid investement with steady returns. We'll meet in Düsseldorf.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It seems as brilliant idea to me and I would like to participate in something like that. Of course, it would need some more polishing, fine-tuning, thinking through etc. on the road, but I still think it might work and be of interest and value to many.

However, huge project ahead, but go for it and keep us updated (although maybe with some shorter and more concise post than this one was 😉).

Anyways...

Followed, Upvoted & Resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitly will do. To be honest I started writing this post 2 weeks ago and while writing it I more and more explored the potential. Therefore it took me some and this is more like 2 posts in one ^_^

After I talked to some people and made some progress I will write a more focused post on the potential of Genossenschaft + Crypto - In that post I will outline ways to participate in an early stage.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great! Looking forward to it! 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmm, http://tokensale.propy.com/ ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting link, thank you.

You see right there the problem with real estate and blockchain. You need to sign a paper contract and the asset is not tokenized but you are the one owning the property.

In my case the Genossenschaft owns the property and therefore they sign the deed.

As a tokenholder you don't own the property but a part of the organisation owning the property.

Additionally, the token gives you all the benefits of owning real estate (steady returns and a quite secure asset) without the hassle of buying and owning real estate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit Wunrok :) Nice post, i will follow your account, please follow me at @mekong

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit @wunrok!

I'm a bot-helper, and I'm created to help. Congratulations on the registration on Steem - you really like it here! If you like me, make an upvote of my comment and follow me. Your upvote will allow you to give more money to new users, such as you. Let's make Steem better together!

I follow you, and to get more upvote and resteem - follow me!

All the money I earn will be donated to charity.

Steem on!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome @Wunrok ;) Nice to see more people like you - here joining steemit! Becoming a steamian is a great adventure! Here you can win money while bloging! At the beginning it wouldn't be easy, but it isn't impossible. So just write from your heart and everything will be allright. Wish you much luck! Cheers! Wish you much luck! Greetings, @khunpoom!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome and Thank You for being with us!! Following your Blog now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit ! have fun with it. Followed. Follow me back 😘

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit