UPDATE (2-NOV):

There were some NEW ANNOUNCEMENTS regarding QASH ICO released on Mike’s AMA on 1-NOV. I will soon be writing a post to discuss the changes, the effects and my thoughts on his Q&A. Most of my analysis here will be otherwise true. Updates are available here.

Quoine

QUOINE is a successful and profitable FinTech company that provides trading, exchange, and next generation financial services powered by blockchain technology.As of 29th September 2017, QUOINE is the first global cryptocurrency firm in the world to be officially licensed by the Japan FSA (License 0002). Their QUOINEX and QRYPTOS trading platforms handles annual transactions over $12 Billion.With over two and a half centuries of combined experience in finance, QUOINE believes cryptocurrencies and blockchain technology will shape the future of financial services. QUOINE believes in addressing Liquidity in the Crypto Economy this will especially benefits existing trading pairs with low trading volumes and a small order book.

Quoinex

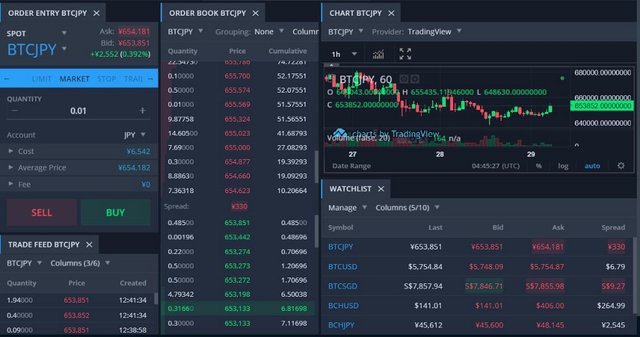

Quoniex is an platform launched in Q2 2014, it allow users to exchange FIAT currencies with cryptocurrencies. It is regulated by JFSA, hence every cryptocurrency that is onboarded needs JFSA’s approval.

I have been a user of Quoniex since Q2 2016, it has become a defacto method for me to purchase BTC with SGD. I found the platform easy to use with the support provided responsive. They have a mobile app which allows for trading which I found very useful at that point of time.Enhancing Liquidity will benefit Quoniex platform immensely providing access to Order Books from other exchanges and vice versa. This will enable Quoniex users to trade at a competitive price and be less subjected to volatility in the market.

Qryptos

Qryptos is a second platform launched in Q2 2017, it allow users to exchange between altcoins. This is different from Quoniex as the altcoins listed were not regulated by JSAF.

Qryptos Trading Fees Structure

Qryptos is radically different from normal exchanges when it comes to encouraging liquidity and volume. It does so by restructuring trading fees. In this case, the Maker receives a trading “fee” instead. The Taker is also subjected to a substantially smaller trading fee as compared to other centralized exchanges.Enhancing Liquidity will benefit Qryptos platform immensely providing access to Order Books from other exchanges and vice versa. This will enable Qryptos users to trade at a competitive price and be less subjected to volatility in the market.

Liquid

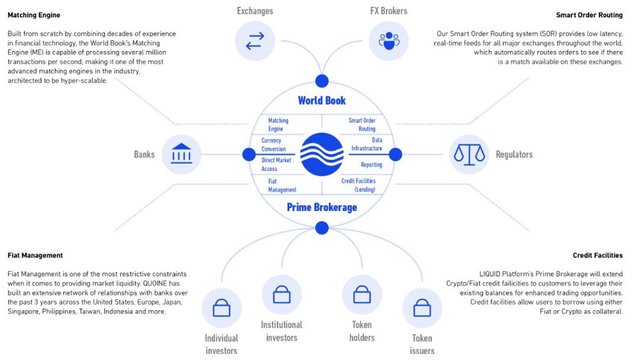

LIQUID is the next step in their visionary roadmap that will impact other Exchanges, FX Brokers, Institutional, Individual investors, Banks and Regulators. It is proposed to launched on Q2 2018.

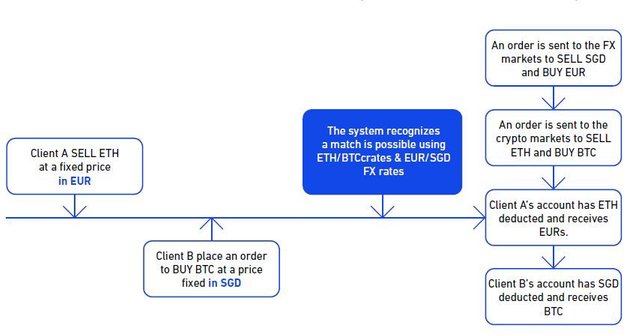

One of the key features that LIQUID has is the World Book. It is a composite of two order books.

Internal Order Book: An order book that contains FX-adjusted orders for all orders placed by users of the World Book.

External Aggregated Order Book: An order book that contains all other orders (but FX adjusted) that exist throughout the world other than those placed in Internal Order Book. Each order in this book is linked to an order on the various exchanges internationally.

In this case, LIQUID assists in communicating with external FX and crypto markets to setup the transaction even though there is no common currency in their requested trading pair. This will change up the dynamics in exchange trading as the trading pair will not be subjected to fluctuations from one source but other sources as well. With more orders, the spread and volatility of each trading pair is expected to be reduced.

QASH

QASH is a utility token for LIQUID Platform. It will have two main functions:

1. Users will be able pay for services on all of QUOINE platforms using QASH. This will cover trading fees, lending fees and participating in trading strategies and be entitled to a TBA discount.

2. Users will be able to trade QASH Token on the open market.

QUOINE will not limit the usage of QASH nor business entities that would like to use QASH for their business as a digital asset.

As the demand for the LIQUID Platform grows, the utility of QASH will increase and this will allow QASH holders to use its value to “pay for” all services and functions QUOINE and its partners will provide.

Additionally, QASH owners will receive periodic promotions, discounted fees, preferential access to new products/services, and opportunities to invest in future ICO/Token Sales that QUOINE will help launch.

The Team

I found QUOINE’s team to be oozing with experience having racked up a combined experience of 250 years in Finance and Technology.

QUOINE will be building the LIQUID Platform based from the experience gained from the development of Quoinex and Qryptos. The proven track record of having a regulated Platform by JFSA and fully aligned with other regulated markets will strengthen their case in their Banking License application.

QUOINE’s management team has worked at the following companies:

• Financial Institutions: Goldman Sachs, Bank of America Merrill Lynch, Credit Suisse, Citigroup, Barclays, UBS, ANZ, Union Bank, Rabobank, Wells Fargo Bank, Bloomberg, Price Waterhouse Coopers, Simplex, Scotty D. Group, Capital Markets Trading, etc.

• Internet and Technology: SoftBank Group Corp., SAMSUNG, SingTel, BSB, Hike, Gungho Online Entertainment, Grab, Luxola, Protiviti, SAP, etc.

• Others: Mitsubishi Corporation, Anderson Consulting, AirAsia, Sephora, etc.

Key Influences for QUOINE

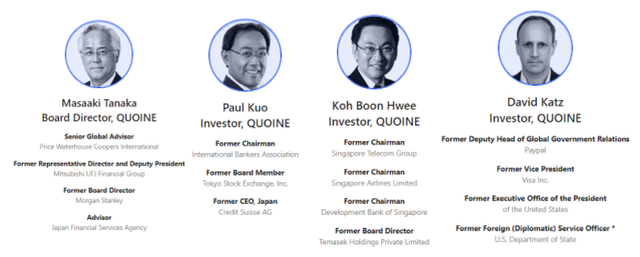

I have shortlisted 4 key investors in QUOINE that could be of significant influence in QUOINE’s development globally.

Namely, Tanaka-San who is the Board Director having major influences within JFSA as an advisor and also holding reputable positions within PWC, Mitsubishi UFJ Financial Group as well as Morgan Stanley. This is complimented with Paul Kuo’s affliation with the TSX and Credit Suisse in Japan.

Mr. Koh Boon Hwee could be a significant influence in the South East Asia Region previously holding Chairman roles in SingTel, Singapore Airlines, DBS as well as Board Director in Temasek Holdings.

For expansion into US, Mr. David Katz could be an influential factor holding previous roles in Paypal, Visa as well as a role within the Office of POTUS.

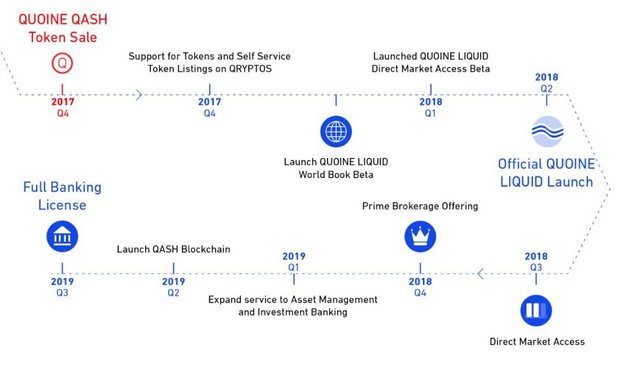

Roadmap

It is important to realise that QUOINE knows what to be done in order to enable LIQUID to succeed. They have been incorporated since 2014 and have been in the exchanges business since then. QUOINE has the know hows of industry and the key things to be done to achieve improvement: Liquidity.

One area of development to note is in 2019 Q1. QUOINE states that they are expanding service to asset management and investment banking. These markets can be pegged to Unit Trusts, ETF and Equities providing stability to the markets.

Token Sale Information

QUOINE will be having their ICO token sale (QASH) starting on 6th November 2017 00:00:01 (Singapore Time / UTC +8 hours) This will last for minimum of 1 week and maximum of 1 month.

Pricing

The nominal rate will be 1 QASH for 0.001 ETH. That makes the price for each QASH at ~0.3 USD each. Minimum purchase is 500 QASH.Up to 500,000,000 QASH will be offered raising an amount in the region of 120M to 150M USD.

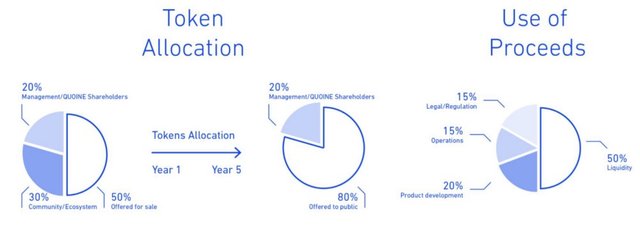

Proceeds of Token Sale

There will be a total of 1,000,000,000 QASH created with 20% reserved for Management and QUOINE Shareholders.

QUOINE has a World Class team with the necessary connections. They realize the bulk of the funds and attention need to be allocated to forming partnerships with other exchanges (50%) and gaining acceptance and compliance with various regulatory bodies. This is especially so in countries where the LIQUID Platform intends to develop. LIQUID Platform currently has bank accounts in Japan, US, EU, Taiwan, Singapore, Philippines, Indonesia. This will increase as LIQUID scales up.

Marketing plays a vital role in promoting the LIQUID Platform thru QASH ICO and also during LIQUID Platform development and rollout phase. 300,000,000 QASH (30% of QASH created) will be used for community engagements and improving the ecosystem. 26,655,000 QASH are attributed to Marketing Bounty Programs during the QASH ICO. In supplement to this, a significant portion of 15% of the amount raised (~120–150 Million USD total) will assigned to Marketing to consistently provide incentives to draw in new users to the LIQUID Platform.

A significant portion of the proceeds will also be attributed to Product Development (20%). This is critical but certainly not the hardest for the likes of QUOINE’s talents.

One area that could be made clearer is how QUOINE segregates the funds raised from this ICO to be strictly invested into LIQUID Platform and not for purposes of scaling up Quoniex and Qryptos. (To be clarified with Mike Kayamori in next #AMA — 1 Nov 2017, 9PM SG Time).

Partnership with Bitfinex

Bitfinex announced its strategic partnership with Quoine on October 16 2017.This is one of the major milestones in LIQUID’s development track. At time of writing, Bitfinex makes up 12.09% of Bitcoin trading volume; twice the volume over the next exchange. This is a fantastic achievement given the fact that there are over a thousand exchanges in the cryptoworld.

This partnership will not only benefit LIQUID but also bring much needed liquidity to Bitfinex and other exchanges once they connect to the World Book. LIQUID will also be connected to 15 other cryptocurrency exchange at the point of ICO.

Economics

When LIQUID Platform is launched, QASH will be used primarily as a utility token. Hence it is expected that investors will need to hold their tokens until Q2 2018 when LIQUID Platform Beta starts. Of course investors are able to trade QASH on QRYPTOS after ICO however I do expect it to be low volume and with the price remaining stable. This may change due to speculations as more exchanges and institutions partners with LIQUID.

There are large similarities with how QASH and Binance Coin (BNB) are used by their various exchanges. Each of the utlitity tokens can be used to discount trading fees on LIQUID. The level of discount is currently TBA.

Binance Coins will be burnt on a regular interval which will drive up the scarcity of BNB. This will in turn drive up value of BNB as the circulation has shrunk.

On contrary, QASH token holders will transact in QASH to QUOINE as trading fee on LIQUID Platform. Likewise, QUOINE will use the QASH earned overtime to “fund operations” by selling it back to ETH or other cryptocurrencies in the open market. It is rather unclear at this point what QUOINE strategies lie in respect to this and how it will impact the economics and value of QASH token. (To be clarified with Mike Kayamori in next #AMA — 1 Nov 2017, 9PM SG Time).

Top 7 Reasons to Invest in QASH

1: Top Incentives to Attract Users to LIQUID Platform

Another Top Incentive of this LIQUID Platform is Prime Brokerage. Users are able to trade directly on any exchange, without having an account or funds on those exchanges. This is a huge benefit as users leave abit of funds on every exchange. This will address the need for consolidation of funds and sending transactions every-time users migrate from one exchange to another. Users are also able to have an overview of positions across multiple exchanges.

2: Reduced Risk

It is important to realise that QUOINE knows what to be done in order to enable LIQUID to succeed. They have been incorporated since 2014 and have been in the exchanges business with the development of Quoniex and Qryptos. QUOINE has the know hows of industry and the key things to be done to achieve improvement.

They also have the necessary endorsement and contacts from the major banks thru QUOINE team’s past working experience. This reduces the investment risk substantially.

3: Existing Support from Regulatory Bodies / Banks

QUOINE is regulated in Japan by the Japan Financial Services Agency (JFSA), one of the strictest regulators in the world. The JFSA officially licensed QUOINE as a Digital Currency Exchange in September 2017.

QUOINE also has multiple bank accounts across Japan, US, EU, Taiwan, Singapore, Philippines, Indonesia. This is not an easy task as Cryptocurrencies Linked Companies do not always obtain the right support from Banks and Regulators.

4: First Of Its Kind

Many ICOs are faced with competition not only from other blockchain technologies venturing into the same space but also existing technology providers who already have the head-start by having a long standing relationship with the users.

What is the value proposition that blockchain technology bring to these adopters? Are these benefits overwhelming and revolutionary to spur these users to adopt blockchain technology for the better? These are some considerations the users will need to make. Market adoption is a critical factor for the success of any company / technology.

This is seemingly irrelevant in LIQUID’s case because QUOINE is developing something new that will bridge the Financial and Cryptocurrency World.

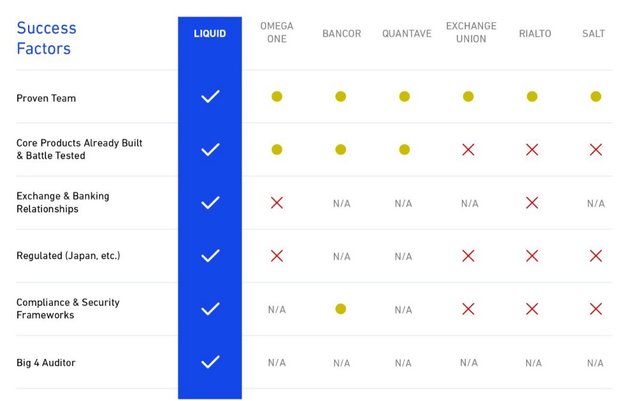

5: Ahead of Competition

Competition is very real between startups and it is inevitable as they are all within the niche industry of FinTech. LIQUID’s vision has been rivaled by a few other competitors. However, LIQUID has been in a few years in the making. Much of the ground work that needs to be done for LIQUID’s success has already been set. This was when QUOINE was developing Quoniex in 2014 and Qryptos in 2016. This provides a tremendous edge for QUOINE over competition.

Competition Matrix

6: Future Proof Solution

The blockchain ecosystem is constantly evolving. At the moment altcoins holders exchange their tokens thru centralised exchanges, peep to peer trading platforms or instant exchanging services.

The way forward is envisioned to be a Decentralised Exchange (DEX) model especially after debacles like Mt. Gox in 2014. Various blockchain companies are said to be building a DEX in their roadmaps and there are already a few DEX appearing in the market. The market may shift towards using a DEX as putting coins on centralised exchanges subject the coins the same risks as Mt. Gox.

LIQUID will not be affected by this macro shift towards DEX. It is able to connect to both leading centralised exchanges and DEX incorporating a World Book that is unrivaled.

7: Long-Term Upside

Bringing liquidity to cryptocurrencies will encourage greater market adoption and reduced volatility in the markets. This stability will turn cryptocurrencies to become a viable investment moat and gain wider market acceptance. LIQUID will take center stage in this transformation.

Conclusion

QUOINE has a focused vision for LIQUID which will go beyond 2020. This is something that will disrupt the way people utilize and exchange currencies. This is something that would also benefit Institutions and FX Brokers.

From an investment standpoint, the value of the QASH token will increase in value as the LIQUID Platform gains more users and connects to other Exchanges and Institutions.

My Verdict: Buy and Hold

For additional information: Head to Liquid.Plus

For signing up thru affiliate program: Head to Link

Disclaimer: This post is written under the QASH Marketing Bounty Program

BTC Donations: 3BymqCeVec5spPPZX2cWcNf4e6baDpqKhW

LTC Donations: 33Q8FsaesMkQaXxPk1ZtyxcmGn55VboX9d