LEND Protocol provides solutions to the main problems found in DeFi ecosystems. Arguably, some of the biggest challenges in the DeFi ecosystems are unsustainable revenue share models that only benefit the protocols, lack of use case and real utility for native tokens, sub optimal risk management, and difficult UI / UX. LEND Protocol aims to solve these problems with our ‘real yield’ revenue sharing model that will bring value and utility to the whole of our ecosystem.

This exciting integration with Polygon will enable LEND to support our lending and borrowing markets expansion to a new chain. For our users this will mean they are able to interact and make the most out of the best DeFi opportunities within the vibrant and growing Polygon ecosystem. Including the ability to lend out $MATIC tokens to earn the best APY and even use it as collateral when borrowing from our borrow markets.

LEND establishes pools of algorithmically derived interest rate model, based on current supply and demand of each respective asset. Users can use LEND to lend any supported assets on our markets for others to borrow and earn interest, and also use the provided capital as collateral to borrow another supported asset. LEND opens up the possibility of lending and borrowing crypto assets.

supported assets include BTC, ETH, BNB, USDT, DOT, LTC, renBTC, sETH, SNX, AAVE, COMPOUND and NFTs.

With LEND, our users will be able to know they are safely maximizing the earning potential of their crypto assets and savings.

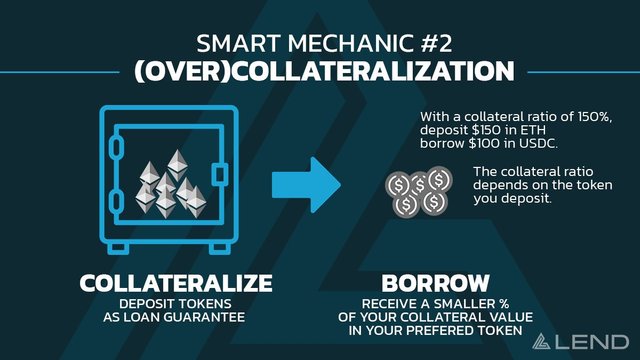

Users can interact with the protocol in a few ways; Deposit crypto assets to earn competitively high interest, similar to a traditional savings account. Or use their crypto assets as collateral to borrow tokens.

- Lending — Supply assets to the protocol to earn interest

- Borrowing — Supply assets as collateral to borrow crypto

- Governance — Vote on important future protocol decisions

- Earning — Earn 25% of all platform revenue with $LEND tokens

- MultiChain — Launching on BNB Chain, Eth & Polygon with framework complete for many other chains. Each chain means an additional stream of revenue to be earned by $LEND token stakers.

When a user supplies assets to the LEND protocol, they will receive a tTokenized version of the asset. For example supply $USDC -> to receive $tUSDC. A tToken is best thought of as a receipt of your original deposit + interest.

Once you have these tTokens, you will automatically start earning interest as your deposited Tokens are used to create borrow balances by other users on the protocol. When supplying tTokens the underlying amount of tTokens will increase in value over time -> Similar to a typical savings account, but for crypto!

At any point the underlying tTokens can be exchanged for the original deposited assets, plus any interest generated from supplying.

Lenders and Borrowers of crypto assets will interact directly with the protocol in either earning or paying a floating interest rate. The benefit of being decentralized means this is all done without the need to negotiate terms of maturity, interest rate or collateral with any peer or counterparty!

USEFUL LINKS

Website: https://www.lend.finance/

Telegram: http://t.me/lendfinance

Twitter: http://twitter.com/lend_finance

Github: https://github.com/tenfinance

Author:

BTT username: lanlinhtinh

BTT Profile Link: https://bitcointalk.org/index.php?action=profile;u=2860965

Bep-20 address: 0x558D6eAC86f9e9641Bf443D4Bcd9f20CdC25C62c