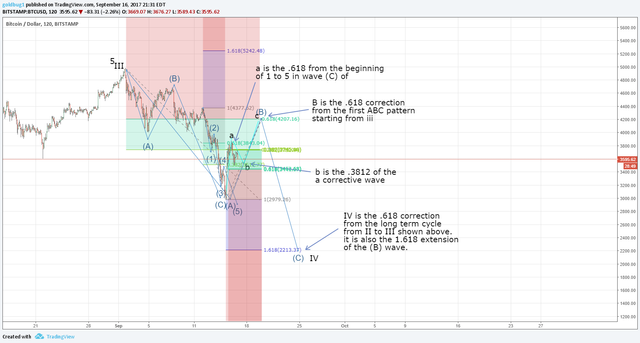

Finally after waking up to dire returns there is a breath of life in our portfolios! Yes, let's back up the truck right? NO. Though we completed the first midterm cycle correction, we in theory just finished the A leg of the longer term cycle. We must keep in the back of our mind, that there are always longer term cycles happening and we need to insure we know where we are in which cycle. On the left side is the long term bitcoin cycle. Note we just finished wave III 0.00% . The (A) correction fibb sequence of $3140 correction has been hit. This is leg A in the larger cycle, and c in the midterm (shown on the right). On the right side I zoomed in on the last leg of III 0.00% and wave 5 plus the correction. Note "c" ($2973) is the 0.618 correction of the 5th wave which has been hit. However if we look at the fibb correction from the longer term cycle, we have the potential to correct to the $2200 area. (B) marks the 0.618 extension from (A) so I would keep my eye on that level if you are active trading as there is the potential for a reversal where you may get the opportunity to go short. But this is for traders. If your investing, I hope you but a 1/4-1/3 position on the dip. If not I feel strongly you will get another opportunity so now is not the time to buy though you may be feeling that impulse. Nothing ever goes straight up, and we are just finding the bottom from a massive rally across the board.

Now is where patience pays off. Again these are only guides and are not definitive. It is important to zoom in at these levels and look for a breakout either up or down. $2900-$3000 was the last level we were looking at and if you were watching for the impulse trade, you could have shaved off a nice 5-10%. Ideally you could have made 20 but that is not something you want to bet on. I'm happy with 1-2% gains on quick trades and you should be too. If your short stack you should be looking to build up some cash for the next dip. I feel it's coming, and the correction is not over yet.

Good luck in the pits today!

Just so you can see the count we are in and the reason we have specific target points. This is a zoom in of the graph on the right.

I want to be PAINFULLY CLEAR to some of the new investors.

- Investments are long term you do NOT SELL them. You hold through the ups and downs.

- Trading should be a totally separate account from your core holdings (investments) this is the money you risk NOT your investments.

- If you want to start trading you must first learn to identify the trend FIRST and FOREMOST!!! If you cannot identify a trend this should be your focus, not EW and Fibb levels.

- Fibonacci is not a crystal ball. They are levels of probability for a trend reversal. This does not mean it will reverse here or there, it's just likely. You MUST be following the trend to see if the level is in play still.

- We could continue straight to $6500 from this point. This is why you do NOT sell Investments. I posted this morning if you invested 1k in the S&P and let it sit for 20 years, you made 10%+ annually on your return. IF you were out only 10 days out of 5000 your return went from 10% to 6%. This is HUGE over a life span.

- You must learn how to graph trends!!! Same as #1.

Trading and investing are two different things, this is for someone that is trading not investing. I would never trade my entire asset portfolio, I trade only 15% of it. So if I have 10k for cryptos. $7,000 is in investments (core holdings) That I NEVER sell period!!! $1500 I trade with, and $1500 I keep in cash for a dip like we expect.

I just do not want to see someone sell and not be able to buy back their entire portfolio and I am concerned with some of the messages and comments that many are intending to do this. I do NOT recommend it. I've been investing and trading for 30 years. I can tell you from experience, trading all your money will result in a loss eventually. no different then if you go all in with pocket aces every time, eventually the 15% chance you would lose breaks you.

Remember this simple math equation. If you have $100 and you lose in a trade 50%, you must now double your money to get back to even!!! The more you lose the harder it is to recover. This is why you trade with a small portion of your account, unless you are a seasoned trader, and I have seen the best take massive losses in an all in or heavily in situation!

This is what I have been watching like a hawk, all day. If you do not have something similar then your trading in the dark! I have specific levels marked on my chart, where I sold, my target turn, and my stop level. I then have my conf levels which I will move down as we go in the event it turns and heads north BEFORE reaching my final target level. If you are following recommendations you should be watching this as well. I also counting waves and will most likely see one more wave up, where I would sell my next position. And I'm dealing with a very very small percentage of my overall portfolio. Less than 5%.

.png)

As it sits wave 5 in this mini cycle would equal wave 1 giving me confidence my count is right. It's more complex than chosing points and buy sell, you have to track the trend. I'm just giving you an example of what I am doing during a trade.

The updated chart and what were looking at. Still in an overall Bearish trend. At no point did we enter bull territory. You can see this clearly in the overall trend line and the RSI.

.png)

Upvote