Source: FanArt

Source: FanArt

Get rich or die trying — that’s a common mantra among entrepreneurs, gangsters and drug dealers.

I know that was my mindset. How can I hustle my way to a million bucks?

That was the question I asked myself every day, and night.

Looking back, this was the wrong question to ask. But as Kanye says:

“Money ain’t everything, not having it is” — Kanye West

When you’re broke and need a quick buck fast, nothing else matters. Food, shelter, survival… these are all dependent on wealth. And the poor rarely plan in advance — it is all hand to fist.

Short term cash vs. long term success

After graduating college I moved to Southeast Asia to save money. In “digital nomad” hubs like Chiang Mai, Thailand and Ho Chi Minh City, Vietnam, I easily get by on $1000/mo. That drastically increased my runway to figure out what I was doing.

Living among hustlers, I quickly learned the world of internet marketing. I saw the fads, the trends, the ups and downs and the “success” of many lifestyle businesses.

After building the #1 crowdfunding podcast (only to realize that people looking to raise money couldn’t pay), I subsequently sold the business to an agency. They monetized better, dealing with professional creators looking to raise $100k+. As for me, I’m not an agency guy (not a great manager and hate dealing with clients).

The Amazon “pivot”

It wasn’t exactly a pivot, but I followed the money. I saw folks preaching Amazon FBA (fulfilled by amazon) as the business of the future. Just source and manufacture products, sell on Amazon and you’re set — and here is XYZ course on how to make millions.

Like many struggling for dough, I was intrigued. While in China designing a convertible laptop case/standing desk hybrid, I decided to give FBA a go. With weeks between finished prototypes, living on the couch with 3 Chinese roommates I’d met online (that didn’t speak any English), I had some free time. I researched the market, found a niche and got started on Amazon.

Things went fast. Prior to launch I’d listened to every podcast and read every guide about selling on Amazon (this was spring of 2015).

After launching my 1st product and pushing the limit on rules and algorithms, my sales started to take off. I was quickly overwhelmed and needed to scale up. What started as an $8k investment in product quickly became a thriving business, fueled by Amazon. I started the FBA ALLSTARS podcast, an avenue to share my story and strategies and get consulting clients. That quickly grew that to a top 3 show.

And I needed a tagline, so I said “Step One to 7 Figures.” I set a crazy goal of a 7 figure exit after only a year…. And I somehow pulled it off.

There was just one problem….

The shortsighted gold rush

I thought I had it all figured out.

I’d built a successful, profitable business. I’d built a top podcast that more than covered my expenses (allowing me to re-invest 100% into the business). But I was so dumb…

The big money isn’t in the business, it is in the tools.

As a seller and a podcaster, I used tools to run my business and manage a large operation with a small staff. And I profited as an affiliate, recommending the tools I loved — the money was good.

But the better business was the software (or scammy make money online courses which I’d never touch).

Many of my “friends” in the business built very successful SaaS companies, practically overnight. I helped sellers with SaaS products go from beta to 1000s of monthly paying customers, shortsightedly missing the opportunity.

And the Amazon opportunity was and is enormous. But I missed the jackpot, because I couldn’t see the big picture….

$100, $200, $500k MRR — I know and helped at least a dozen startups hit these and higher milestones.

Horse blinders and thinking bigger

How do you forgo fast profit for future success? Life isn’t a race. Bank balance isn’t a score card. Don’t get caught up in the hype.

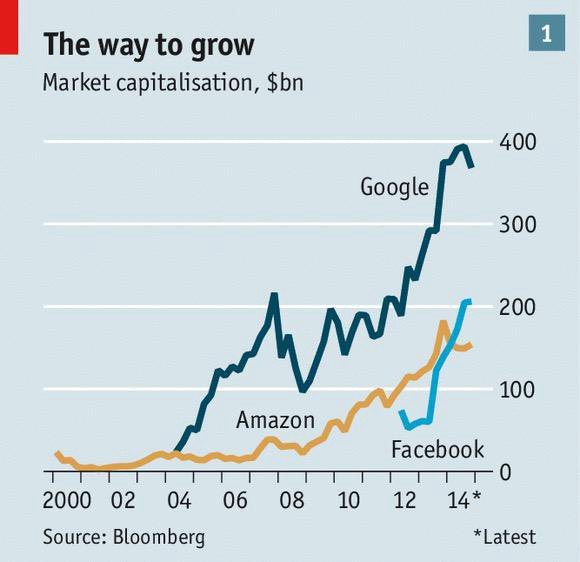

Wealth ALWAYS accrues to the facilitators. Companies that assist entrepreneurs and SMBs are the among the most valuable in the world.

Google and Facebook do ads. Stripe and Square handle payments. Amazon and Etsy empower sellers… there are thousands of examples.

Hindsight being 20/20, it is easy to see what I should have done — but I don’t regret it. Live and learn.

But when you find yourself in the PERFECT opportunity: for instance investing in Bitcoin or ICOs, keep these constants in mind (for more on ICO froth and future of blockchain, check out this post)

Risk, reward and raising money

Going big often means going home. Without enough cash, it is hard to keep transformative businesses afloat. Between dev costs and acquiring customers, it takes time and money to reach profitability.

In the past my network was great, but weak in one sense. As an entrepreneur living/traveling in Southeast Asia, South America and South Africa, I had no connections to the venture world and even less of an idea how to raise money. Today is another story.

Founders need to think things through. They NEED to see both sides of the coin and understand which path puts themselves and their business in the best position to succeed.

There is no one size fits all.

The dynamics of successful picks and shovels startups

As an angel investor and startup advisor, a big part of my job is analyzing founders and their vision. And all investors rely at least in part on pattern matching. What have I seen and how did it go?

In terms of picks and shovels, just building a business serving other businesses isn’t enough.

Timing is everything. Well timing, plus product.

Imagine you are living in SF during the gold rush (no, not the 90s…). Selling picks and shovels years after mining got hot isn’t ideal — competition kills margins and you cannot differentiate.

But being first IS NOT necessary. Adding value almost always wins.

What if you are 1, 2, 5 years late on a trend? How can a startup succeed?

For our example, a map showing previously mined out regions is a good start. Better picks — that’s okay I guess. But what about dynamite, suddenly that is a 10x better solution.

Switching costs are important too. You don’t buy a new shovel if the old one still works — but dynamite is another story.

Differentiation and value is the critical.

Winner take all/most markets

Today selling shovels sucks. There are many brands, and shovels are a commodity — people do not care. If it moves snow, dirt or sand from A to B, it is probably good enough for me.

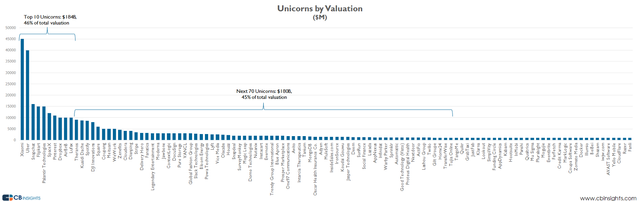

To be a venture scale opportunity, startups MUST be playing in a winner take most (or all) market. Venture capitalists and angel investors have to shoot for the moon — that is the nature of the power law profile of early stage investing. One or two companies returns the portfolio, the majority die or lurk in obscurity.

Source: CBInsights

Source: CBInsights

This is hard. And it is often unfair to startups. Many great companies never get funded because the upside isn’t enough to return the fund. These companies are better off bootstrapping, possibly raising friends and family rounds to help build profitable, scalable businesses.

But this article is about the 1%.

Founders that find picks and shovels success

The best founders are fanatics. They scratch their own itch and build the perfect product for themselves — whether others use it is not important (at least initially).

Finding these founders is key — they are the ones that drive investor returns. The best place to look for outside ROIs: upcoming transformational industries. When you get in early on a trend, you better understand where the world is going and plan accordingly.

Early miners realized quickly that tools trumped mining. Backbreaking work vs selling a shovel, it isn’t rocket science.

And the same is true today with cryptocurrencies and Amazon, among other things.

[LIKE THIS ARTICLE SO FAR? THEN YOU’LL REALLY WANT TO SIGN UP FOR MY NEWSLETTER OVER HERE — AND GET SOME FREE BONUSES!]

Taking the contrarian view

Go with the flow is a great way to be average. And startup investing in particular is all about the outliers. Go big or go home — that drives returns and funds.

So when you are in early on a trend, ask yourself two questions:

1. Is this trend transformational?

2. What is everyone else (in the industry) doing?

If you believe cryptocurrencies, VR, AR, autonomous vehicles etc… are the future, then tie yourself to that trend. Follow your expertise and intuition and you will be ahead of most.

But avoiding the trap of moderate success is more challenging. Watch what experts say and do the opposite. In 2015 starting a SaaS company for sellers would have been dumb. There were hardly any of them, it was a blue ocean. And I knew folks making millions just selling Amazon. Why shouldn’t I?

The answer is human nature. People are followers. Entrepreneurs are fast-followers. They quickly jump on trends and easy money. What today is relatively non-competitive quickly becomes crowded.

I saw this in the Amazon world. It is almost impossible to be top dog and keep profits coming when more and more brands undercut pricing. And undercutting is capitalism. It is the nature of competition. It is what protects consumers from monopolistic pricing.

But in business I like to bet on monopolies. I am not in the business of offering the lowest price. And thus Amazon’s blue ocean was quickly bloodied.

One versus two

Founders in new markets have three options: 1) service consumers, 2) service providers or 3) service both.

I have often thought on the dynamics of this model, is there a right answer? I strongly believe it depends on the situation.

In my case, doing both was doable. Slightly handicapping our brand’s growth to build a SaaS startup would have been smart. But killing two birds with two stones is hard.

Focus becomes key. And after F’ing this up enough times, I cannot in good conscience recommend tackling two projects at once. In fact, I won’t invest in founders with any other side projects.

Starting a business is your life. It is 100% effort all the time. You live, breath and dream business (at least I did). And when you are raising money and scaling fast it is even worse.

Thus my recommendation for founders is to do one and then the other. Start with serving customers (either as a founder or employee) to learn the industry. As you do, brainstorm the pain points in the process. These make perfect products.

Once you are ready, the direction is set and an MVP is in progress, jump ship. Whether selling your startup early or quitting a cushy job, golden handcuffs and responsibilities will stop you from succeeding.

Closing thoughts

You only have so many at bats — both as a founder and as an investor. We have all made mistakes. I for one missed enormous opportunities, you likely have as well.

Hopefully this post provides a framework for thinking about opportunities and emerging markets.

What’s been your experience? Built a B2B startup? Miss out on a massive trend? Share your thoughts in the comments below. We have all done it. There is no right answer. It comes down to risk and opportunity cost.

What are sacrificing? Why?

Understanding your options and their implications helps you make the right choice, even when the world says you are wrong.

So, what trends are you excited about? Where is the world going? What opportunities are on the horizon?

Constantly learning means you are never caught unaware. You are either learning or you are dying… your choice.

Before you go…

If you got something actionable or valuable from this post, share the article on Facebook and Twitter so your friends can benefit from it too. Thanks :)

--

Originally posted on Medium.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/startup-grind/dont-mine-for-gold-when-you-can-sell-shovels-7ad6bc145542

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit