There’s nothing really complicated about investing, though retail investors have a tendency to diminish their returns by overanalyzing the markets. When it comes to the world of investing, more isn’t better:

quality is better, and your best strategy is to buy the best companies and hold them, accumulating more shares as the price becomes more attractive.

This strategy is so simple that most investors discount it as too good to be true, yet they consistently underperform by overcomplicating it. If bought shares of Amazon 10 years ago or Netflix 5 years ago and held on for the ride, then you’ve experienced the power of researching the fundamentals and the management team, buying the best companies, and holding on to the shares until your profit target is reached.

Many of the world’s most successful investors have made billions from this simple plan, and while countless newbie traders try to use complicated strategies, I’ve never seen any of them outperform this buy-and-hold concept over the long term. And with massive corporations like Constellation Brands, Anheuser-Busch InBev, Molson Coors, and Altria taking positions, you’ll be in good company when you apply this methodology to cannabis companies.

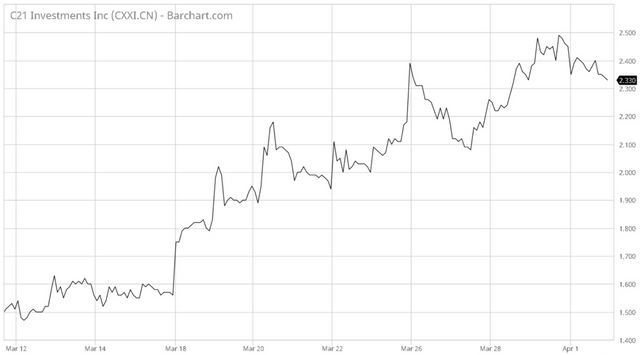

Let me illustrate to you what this concept looks like in an actual market scenario. I sent out a buy signal on Vancouver-based C21 Investments Inc. (CSE:CXXI) when the shares were trading at CAD$1.50, which was a ridiculously low price for this company considering how profitable their U.S. cannabis assets have been. In only a few days, the share price powered its way up to nearly CAD$2.50:

Courtesy: barchart.com

This is one of those rare stocks, like an Amazon or a Netflix, where you can just keep accumulating shares on every little pullback because you know your investment will bring solid returns in due time. 66% returns in a few days is great, to be sure, but I’m nowhere close to selling this underpriced gem.

You see, C21 Investments Inc. has big plans for expansion, and this hasn’t been priced in to the stock yet. They’ve already acquired hugely successful cannabis companies in Oregon and Nevada, with holdings in the consumer branded goods and dispensary markets, but there’s much more growth for this company on the horizon.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

I certainly hope that your investing plan involves growth-oriented companies, because this industry is moving quickly and the biggest gains will only come to the best canna-businesses that can adapt to the rapidly changing landscape of legalized cannabis.

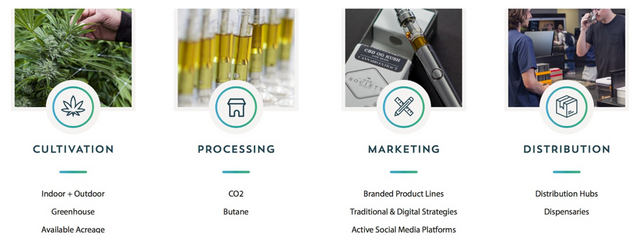

That’s where C21 excels, as this company’s vertically integrated business model enables it to grow right along with the blooming legalized cannabis industry. Currently, C21 owns multiple successful U.S.-based businesses that cultivate, process, manufacture, and distribute quality cannabis and hemp-derived consumer products with strong brand recognition.

From seed to sale, no segment of the cannabis supply chain is left untouched: unlike nearly every marijuana company on the market, C21 and its stockholders benefit from revenue generation at every touch point of the cannabis ecosystem. That’s what I call a powerful business model: something that fits perfectly into a simple yet highly effective plan for any long-term cannabis company investor.

The Canadian exchange ticker is CXXI, but the company is pursuing a U.S. OTC symbol as well, thereby opening the company up to a gigantic pool of American stock market investors. This should prove to be a major catalyst for C21 and for CXXI shares, so I personally wouldn’t recommend waiting – it’s better to get in before C21 gets listed and a potential buying frenzy commences.

And to be completely honest, CXXI doesn’t even need a catalyst to see big gains: it’s just a matter of the share price catching up to the true value of the company and its holdings. C21 has plans for both U.S. and international expansion, and with legalization coming to new states and countries each and every year, it’s easy to envision the stock price going much, much higher from here.

That’s the magic of having a simple investing plan: no need to tinker with it when you’re dealing with the best companies in the business. And there’s no better business to be in right now than legalized cannabis – with C21 in your portfolio, you’ve got an investing plan that’s simply unbeatable.

Best Regards,

Tom Beck

Research Partner, PortfolioWealthGlobal.com

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit