Tools to become a successful HitBTC trader

People`s interest in cryptocurrencies is enormous these days. But investing in crypto coins is a risky business. Prices tend to go up and down in a short time frame, so for anybody who wants to step into this highly volatile market, it is best to rule out emotion and make use of proven tools in order to become a successful coin trader on HitBTC.

In this HitBTC introductory course, we want to explain about the most common instruments used in financial trading in general, and more specifically in relation to cryptocurrencies. In a series of articles we will provide you more information on:

- Technical analysis of HitBTC markets

- Price action strategies to improve trading results on HitBTC

- Japanese candlestick charting and how to work with them

For now, let us start with the basics of trading on HitBTC

What is trend analysis on HitBTC charts?

In its essence, trend analysis on HitBTC charts comes down to the study of market action mainly by using charts in order to forecast future price trends.

The origin of trend analysis on HitBTC comes from the Dow Theory. While the Dow Theory is considered somewhat dated, as it was developed to identify long-term trends in the stock market, many more sophisticated methods being used nowadays are variants of the Dow`s approach.

Technical analysis is based on 3 observations:

- The market discounts everything

- Prices always move in trends

- History tends to repeat itself

The market discounts everything, and HitBTC reflects that

According to technical analysts every political, economic and psychological factor that could affect the price, is indeed reflected in the price of the market. In other words, we are talking about supply and demand here, the economic forces that lead to bullish (rising) and bearish (falling) markets. When demand increases, the price will rise, and if supply exceeds demand, prices fall. This is a fundamental forecasting principle, not only on HitBTC trading markets.Prices move in trends on HitBTC markets

The underlying assumption here is that a trend in motion is much more likely to continue than to reverse. So, if a trend has been established, in technical analysis, the future price is expected to be in the same direction rather than against it. The goal of studying price charts, (more on charts in another post), is to spot trends at an early stage to later trade in the direction of these trends. This trend-following approach bases itself upon the already existing trend until reversal signs are showing up.History repeats itself and forms market trends

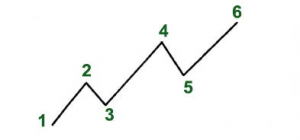

In order to understand the future one must study the past. This is largely derived from human psychology, market participants will react similarly to identical market events. Technical analysts are looking for certain chart patterns in order to analyze movements in the market. Trends represent the most important concept in technical analysis. All tools used by an analysis serve one purpose, that is, help to find the market trend. The definition of a trend is the direction of the market by consecutive peaks (up) and troughs (down). There are 3 types of trends.An uptrend is a series of higher peaks and higher troughs.

Point 2 represents the first peak. It is formed after the price falls from that point. Point 3 is the trough. In an uptrend these peaks and troughs should be continuous, meaning that each following trough should not fall below the previous lowest point.

Consequently, a downtrend on HitBTC trading markets is exactly the opposite. It is determined by lower peaks and lower troughs.

With a sideways trend, there is no clear indication of a trend. It consists of many horizontal peaks and troughs. This type of market direction is mostly referred to as trendless. This is typically a period where the forces of supply and demand are in a relative balance.

The tools being used in technical analysis to determine the market direction on HitBTC, become as good as powerless in a trendless phase.

In a next post, we will pick up further on trend movements and buy and selling price actions on HitBTC.

Source: Technical Analysis Explained (by IFC Markets)

Posted from my blog with SteemPress : http://companywebsolutions.com/introductory-course-on-hitbtc-cryptocurrencies-and-trend-analysis/