Content

Blue Fox Notes paid attention to Balancer last month. It is equivalent to the universal version of Uniswap. The main difference between it and Uniswap is that it can customize the token ratio of the liquidity pool. There is also a big difference in that it has a governance code. Currency BAL.

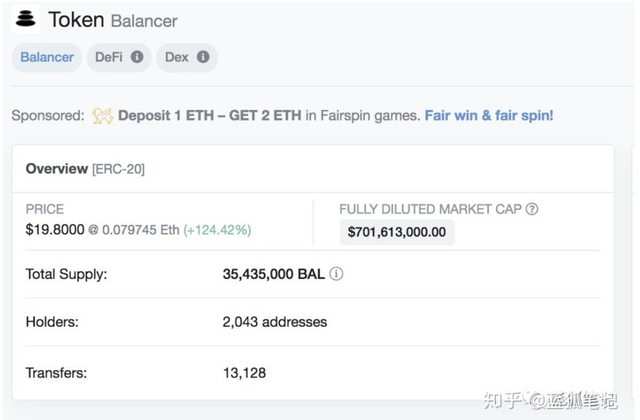

For more information about Balancer, please refer to the previous article "Balancer: Universal Uniswap" by Blue Fox Notes. Balancer surpassed Compound to become the DeFi project with the highest market value. As of the writing of Blue Fox Notes, the price of BAL reached $19.8, the total amount of BAL was 100 million, 35,435,000 had been issued, and the number of holders reached 2,043, considering the early mining users Approximately more than 1,000 users, then after BAL went on the market, about 1,000 users were purchased. Taking into account the small user scale of DeFi, this shows that it has a certain user base.

(BAL's token situation, Source: etherscan)

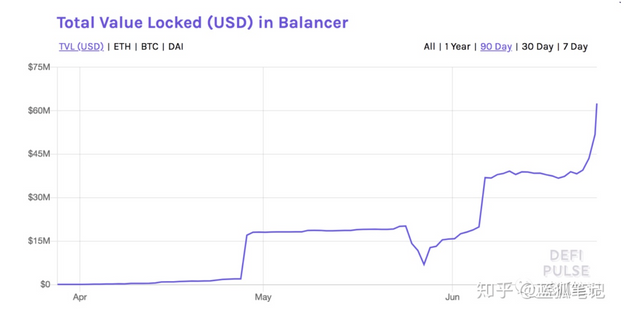

The price of the BAL seed round is $0.6, so according to the seed round, its price has increased by 33 times. According to the amount issued, the market value of Balancer has exceeded 700 million US dollars, while the current market value of Compound is 599 million US dollars. In other words, at this point in time, Balancer surpassed Compound to become the project with the highest market value in the DeFi field. Of course, considering the issue of depth, this is more of a game of numbers. In addition, DeFi is a long-term game. Temporary transcendence is nothing. There are enough users and business support, there is a moat, and there is ecology to last. However, this also represents a comparison between DEX and lending. How the market evaluates the relationship between lending and DEX will be a very interesting topic for some time to come. Judging from the current market reaction, the valuation of future DEX projects may be higher than that of decentralized lending projects. In addition, derivatives will also join the battle. From the perspective of Blue Fox Notes, DEX, lending and derivatives will be the three core value capturers in the DeFi field. The real market circulation of BAL is 100 million BAL tokens, of which 65% is planned to be allocated to liquidity providers, and 35% is allocated to the founding team, consultants, early investors, team core members, ecological funds and financing funds. From the above token circulation diagram, we can see that the total amount of issued tokens is 35,435,000 BAL. However, not all tokens have flowed to the market. 435,000 BAL has been distributed to early liquidity providers and has entered market circulation. Among the 35,000,000 BAL, 5,000,000 is used as an ecological fund to attract strategic partners to develop the ecology. The use of this part of funds is determined by the BAL holder through governance in the future, and this part of BAL has not yet flowed to the market. 5,000,000 as a financing fund, this part is used as the future financing of the project to support the operation of Balancer Lab. This part has not yet flowed to the market. The remaining 25,000,000 BAL is allocated to the founding team, advisors and early investors, as well as 10% option incentives, that is, 2.5 million will be used as incentives for future core members. Excluding the 10% option incentive, there is still 22,500,000 BAL remaining. Of this part of the BAL, 25% have been unlocked, and 75% will be unlocked gradually over the next three years. This means that in this part of the BAL, there are now 5,625,000 tokens that can flow to the market. Then, according to the above token distribution, the current real market circulation of BAL is 6,060,000, and its current market value is about 119 million US dollars. The future distribution plan of BAL depends on governance in its overall tokens, of which 65% will be allocated to liquidity providers, the main purpose is to achieve sufficient decentralization of its tokens. According to the current plan, out of 65,000,000 BAL, approximately 7,500,000 BAL will be distributed every year, and it will take about 8.6 years to complete the distribution. Since the follow-up is governed by BAL, the distribution plan may be changed according to the wishes of the governor. Fundamentals of Balancer From the previous article "Balancer: Universal Uniswap" in Blue Fox Notes, it can be seen that Balancer is a universal Uniswap, which can realize decentralized token transactions without custodial, and it can also help users to achieve it automatically The rebalancing of assets is also a good asset management tool. However, compared with the advantages of the product, one of the important reasons why it can lead to liquidity after it goes online is BAL. BAL brings liquidity providers. Three weeks ago, in early June, BAL launched the mining plan of its liquidity provider, and its liquidity saw its first major climb, as shown in the figure below. The second big climb was today, with a rise of 41.6%. It is expected that there will be growth in the next few days. In terms of liquidity, Balancer has basically the same level as Uniswap, and Uniswap's current liquidity is more than $63 million.

(Balancer's locked assets, Source: defipulse)

In addition to the increase in liquidity, its trading volume is also rising. As shown in the figure below, in the past 24 hours, Balancer's trading volume reached US$6,789,983, occupying a 10.6% market share. It is second only to Uniswap, Curve, and Kyber, ranking fourth.

Airdrop March 31st - How to Earn up to $1500 USD in Crypto Absoluty Free.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit