Due to the volatility of the crypto currency market, a lot of individuals prefer to play it safe when trading in the crypto market. This is because of price uncertainty of the world’s largest coins, which makes it non-viable for global commerce, which has made mass-adoption and acceptance a bit slow or almost impossible. The good news today is that in spite of these pitfalls, these crypto-currencies have created the platform for a new and improved innovation called the KINESIS Monetary System.

What is KINESIS monetary system?

It is a system that influences people to participate in the crypto market. Through participation, individuals enhance their money as both a stored value and a medium of exchange which is beneficial to everyone. KINESIS will make individuals willingly trade in their crypto currency, which they value more than the conventional fiat currency. When people buy tokens in the KINESIS system, each unit of the fiat currency is valued as 1:1 of gold or silver which is then keyed into a yield system that promotes trading as well as creating a platform for dispatching the wealth generated by members of its trading economy.

It is an economy that deals in primary elements of

a. Gold and silver: KINESIS has primary currencies backed 1:1 with allocated physical gold and silver. Gold and silver was selected due to their great definable stores of value for use in the commercial and private transactions. In this case KAU (which is the gold currency of KINESIS is equal to 1 fine gram of gold cast bars of minimum fineness of 995 and identifying stamp of a refiner as per ABX quality assurance framework’s table of approved refiner list, which I would later talk about in this article) and KAG (which is the silver currency of KINESIS is equal to 10 grams of silver contract and token, consisting of silver cast bars of a minimum fineness of 999, and bearing a serial number and identifying stamp of a refiner as per ABX quality assurance framework’s table of approved refiner list.)

b. Yield: Users are financially rewarded based on their participation and the overall velocity at which money changes hands in the crypto market. This element is derived purely from economic output (spending) rather than debt (borrowing) that comes with fiat currency in fractional banking. It is more like you get paid interest for using the currency within the KINESIS system, (More emphasis on this later)

c. Block chain and Crypto currency technology: It would attract capital for the Block chain and crypto currency market by offering an enhanced asset-backed currency and multifaceted yield system. It would achieve this through liquidating the assets (gold and silver) into digital form, making it a medium of exchange.

KINESIS could also be used to transact any asset that can be standardized, traded and stored as value by attaching a yield to currency or asset tokens, risk/return ratios can be forecasted and virtually all currency and investment asset market can be targeted and infiltrated. KINESIS main aim is to build capital from markets that are currently undergoing little or no comparatively low yields. These markets include:

Crypto currency markets, Gold and silver markets, Fiat currency markets and investment asset markets

If the first primary element of KINESIS is gold and silver, how would individuals feel comfortable to trade, without fear of being cheated or robbed?

You would agree with me that in the old times, people have been victims of multiple cases of fraud when it comes to the use of precious metals and other assets as payment solutions. This has led to the overcautious approach of investors to avoid losing out in the end. This issue is also seen in asset backed crypto-currency markets, with KINESIS however, there is safety of your assets because KINESIS as a group are in partnership with Allocated Bullion Exchange (ABX).

ABX is a world-leading and trusted institutional exchange for allocated precious metal. Since operation is 2013, they have seven trading, pricing and vaulting hubs across the globe and are recently in partnership with Deutsche Borse Group entity and European Commodity Clearing (ECC) for clearing and settlement services. The physical handling, clearing, storage and delivery process are being integrated into DBS regulated commodity clearing house and the ECC which must also maintain approval and acceptance from German financial regulator.

All bullion in the KINESIS market has a verified audit trail with the above listed companies which work with a multilayered third-party audit and verification process which projects a transparent holding system. These way individuals who deal in the gold and silver elements are rest assured that their assets come from a table of approved refiner list.

The Benefits of KINESIS

A. It would address Crypt currency market problems: The problem of volatility in terms of unstable crypt currencies which makes it unsuitable for real-time commerce. Money was not created to sit at a place and do nothing, so if it must move, it must be widely adopted and accepted, which is not always the case for crypto currencies. KINESIS would pave the way in making sure that coins in the crypto economy get spent and widely accepted.

B. It would address fiat currency issues: Fiat currencies are a poor source of value because they lose value as inflation increases. This phenomenon happens because the Central Banks of countries print and devalue money, which would keep commercial banks’ lending continuously to customers, and customers will continually spend to maintain economic growth only in nominal terms. KINESIS would solve this issue through creating a decentralized system, where by the power to devalue and create money will not rest on one platform.

C. It would address the issue of asset-backed currency: When people in the crypto currency market do not wish to use their currency for everyday transactions. It defeats the Gresham’s law that states that bad money drives out good by highly incentivizing people to utilize a valuable currency through a multifaceted reward system based on participation. The KINESIS monetary system would also give yield to gold and silver by attaching multiple returns on them whether an individual decides to actively or passively participate in trade. These metals also have long term security because of the ABX partnership as I earlier mentioned.

D. It would also address bullion market problems: KINESIS would take away the tight-knit way of trade within markets which makes them disconnected from one another. It would create an effective interface that will aggregate global physical utility. There would be no more barriers of entry for bullion traders and manufacturers such that it eliminates the series of intermediaries that slow down their entry into the market. It would take away the Over-the-Counter feature in physical markets, which could either be dealt with via phone, email or in person. The OTC is costly and involves manually booking a trade, placing an order or hedging a trade. This feature is outdated and does not suit the global trading system. With KINESIS , via its integration with ABX, and its operationally segregated wholesale contracts, will offer serial numbers and bar hallmark which will provide an ideal solution for bi-lateral wholesale trading through block chain. It would be made possible with ABX, ECC, DBS and the German Financial Regulator.

FEATURES OF THE KINESIS SYSTEM

KINESIS CURRENCY SUITE: This was generated off the Stellar block chain network. They include:

Gold currency (KAU) AND Silver Currency (KAG)

KINESIS WHOLESALE SEGREGATED CURRENCY SPECIFICATIONS

Gold Wholesale Currency (KWG): 1 fine kg gold contract and tokens consisting of gold cast bars and fineness of 9999 and bearing a serial number and identifying stamp of a refiner by ABX Quality Assurance Framework, table of Approved Refiner List.

Silver Wholesale Contract: 1000 troy ounces of silver contract and token, consisting of silver cast bars of minimum fineness of 999, and identifying stamp of a refiner as per ABX Quality Assurance Framework, table of Approved Refiner List.

KINESIS CURRENCY EXCHANGES (KCE): A wholesale market where the currency is created and minted with the help of ABX.

KINESIS BLOCK CHAIN NETWORK (KBN): The Block chain on which the suite of KINESIS Tokens is built

KINESIS BLOCK CHAIN EXCHANGE (KBE): A Block chain digital currency exchange where the tokens representing physical assets can be traded.

KINESIS FINANCIAL NETWORK (KFN): A mobile banking system where the currencies can be used for savings, payments, remittances, and money movement; also includes Master card and Visa debit access

KINESIS COMMERCIAL CENTRE (KCC): An online aggregator platform of goods and service providers which accept KINESIS tokens (KAG and KAU) as a means of payment.

VELOCITY-BASED YIELD SYSTEM

“KINESIS users are financially rewarded based on their participation and the overall velocity (rate that the money changes hands) of the KINESIS currency).” This creates an interest-based return from economic output as opposed to debt-financing. Debt-financing creates a system that continually devalues the currency it is using by inflating the prices of the goods those currencies purchase. As a benchmark to stabilize the price of the KVT, the KINESIS team has followed the example of Tether (a token backed the US dollar, which has the highest consistent velocity in the crypto currency market). KINESIS offers all the advantages of Tether, but without the counter party risk of the fractional reserve banking system as all of the KINESIS transactions (and therefore the yield on KVT) is done through bullion exchange networks.

YIELD SYSTEM PARTICIPANTS

MINTER YIELD: This system rewards users who create (mint) the currency in primary markets (by submitting gold/ silver for tokens) and spending it in secondary markets. Minters receive a proportional share of the transaction fees as a yield forever on the KINESIS coins they create. The more coins created, transacted, or the higher the velocity, the higher the yield

HOLDER YIELD: Provides a yield on passive participation in KINESIS currency while holding the currency. Designed to compete with bank deposits, stock dividend yields, and rental property yields

AFFILIATE YIELD: Rewards users who refer new users.

DEPOSITORS YIELD: Applicable on user’s initial deposit directly into their KINESIS Wallet Incentivizes large initial deposits and further use of the currency. Depositors receive a share of the transaction fees as a yield forever on the KINESIS coins they bought and used. Higher velocity equals higher yield.

REAL LIFE APPLICATION OF KINESIS

Let’s say Brian, a 30 year old serial investor seeks to increase his investment portfolio decides to increase his investments by buying bullion. Part of his stock portfolio includes a huge interest in Crypto-currency investments. His love for crypto investments was as a result of the decentralized system that keeps it away from one governing body, and makes it anti-inflatory. He loves the idea of being the sole access to his funds. While searching for bullion assets, he had issues with where to store and how to liquidate his bullion assets. While attending a seminar hosted by a crypto currency organization in his town, he heard of KINESIS . With KINESIS , his investments in bullion are safe and solely managed by him because of the security block chain provides. He is also impressed with fact that whether he decides to participate actively or passively, he would be rewarded via the yield. Today, he is an active Affiliate yielder.

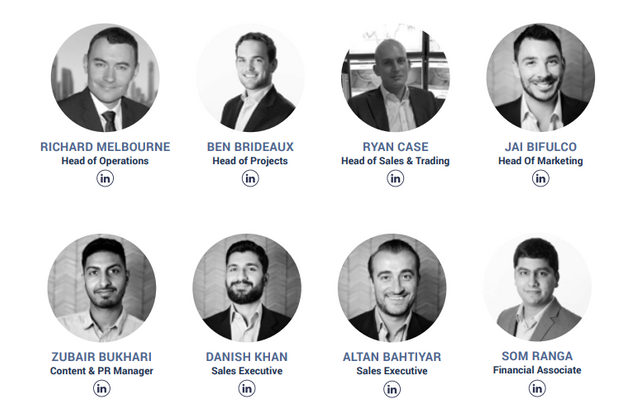

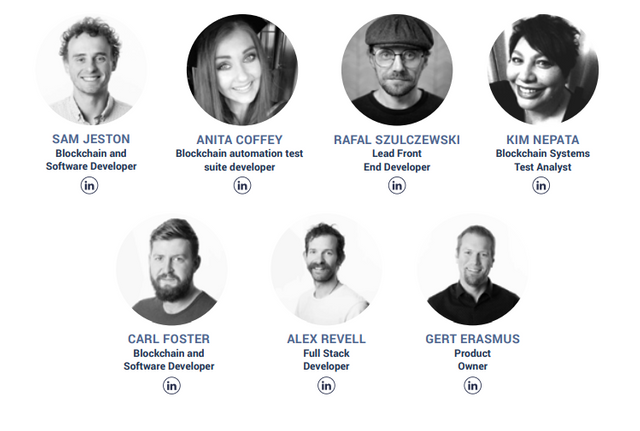

The Team

Road Map

For More Information

Kinesis.Money

Kinesis.Money WhitePaper

Kinesis.Money OnePager

Kinesis.Money YouTube

Kinesis.Money Telegram

Kinesis.Money Linkedin

Kinesis.Money Github

Kinesis.Money Steemit

Kinesis.Money Twitter

References

Kinesis.Money

Kinesis.Money WhitePaper

Kinesis.Money OnePager

this contest is sponsored by @originalworks click to participate

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit