Corl Financial Technologies Inc. (Corl) is a company that strives to create an alternative approach to financing traditional start-ups through what they call the revenue sharing model. The team will achieve this goal with the help of blockchain technologies. Corl plans to obtain full regulatory approval in relation to the company's overall business model and planned operations. The exciting, innovative and unusual thinking of the team is what prompted me to do more research about Corl.

HISTORY

In recent years, the landscape of funds and regulation surrounding the many ways in which companies choose to raise capital has changed continuously. Traditionally, young companies have been forced to apply for loans, borrow money from friends and family, use personal savings or exchange capital to obtain Venture Capitalist (VC) funds. With the advent of the Internet, we have seen the era of online crowdfunding flourish through organizations like Kickstarter. As many of us know, this method naturally provides the investors with a reward in exchange for a monetary contribution to society.

Traditionally, start-up financing has been presented in the form of debt or equity. By debt I mean a loan, usually with a restrictively high interest rate, and capital is an investment of a VC or a person of high net worth, in exchange for a share of the capital (property) in the company. Although both financing options in the past were a decent option for a young company, they are not always the best and often involve a company in a cycle of high interest payments that do not match a company's financial reality. The advent of the Internet has provided new alternatives to these two options. With a loan, the recipient must not renounce to equity, but the loan must be paid in case of violation of the agreement. Moreover, a loan is an option that is not always available to entrepreneurs, as lenders require borrowers to have a significant level of collateral to qualify for the loan. On the other hand, venture capitalists offer the borrower a lower risk option than the one commonly associated with debt financing, mainly because repayment is not required (cash disbursements). By default, risk capital financing transfers most of the risk capital financing risk if the company has financial problems. The main disadvantage for the small business that receives VC financing is that the company will, to a large extent, lose control of the company, since the capital is transferred to risk capital in return for capital.

Corl is helping to bridge the gap that we usually see when organizations seek to raise capital, through an investor-based monetary group, which provides capital to emerging companies in exchange for a monetary return on an investment.

The distribution of income takes the positive of the two financing options discussed above and allows the investor and the entrepreneur to be at the center of the risk. In the income distribution model, the entrepreneur is provided with funds in exchange for part of the monthly income reimbursements and until the initial investment is reimbursed between 1.5 and 2.5 times. This allows the investor to make money with the investment without forcing the employer to give up the capital and without taking the risk inherently associated with traditional debt financing. Another advantage of income distribution is that it allows companies to grow at their own pace, since payment terms are flexible. Finally, Corl's model will provide those companies that are often overlooked by venture capitalists or traditional lenders, with the opportunity to secure the capital they seek.

CORL TOKEN (CRL)

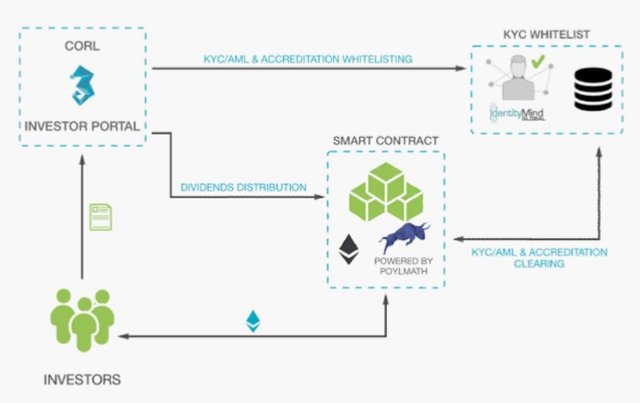

Corl's plan to pay investors through the chain of Ethereum blockchain gives it another advantage. Corl has simplified the process of distributing dividends by paying directly the Ethereum addresses with Corl token. It is important to note that before purchasing capital in the form of Corl token, all investors will have to undergo a rigorous verification/accreditation process and comply with the Anti-Money Laundering Service/Know-Your-Client (AML / KYC). ) requirements. Only at this point, investors will be able to purchase the Corl ERC20 Records, which in turn will be assigned.

THE TEAM

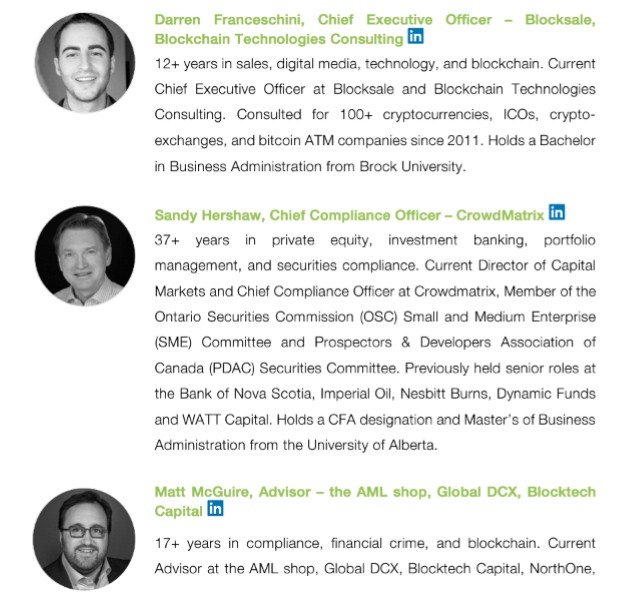

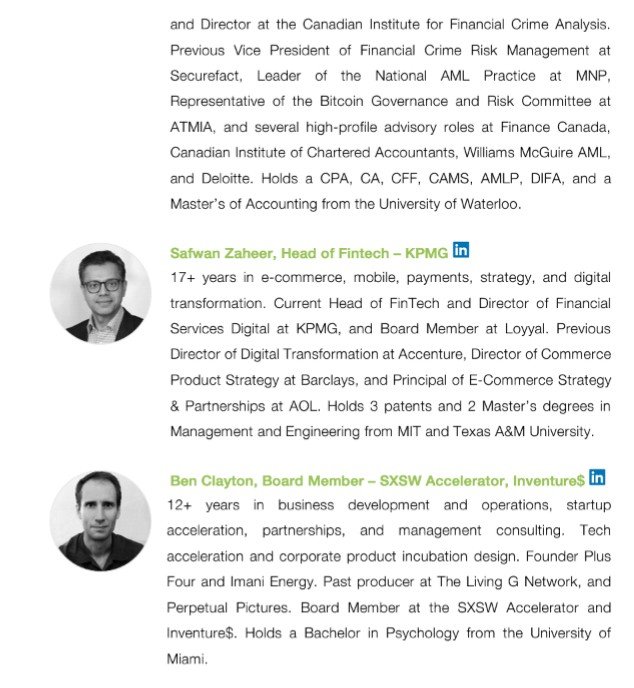

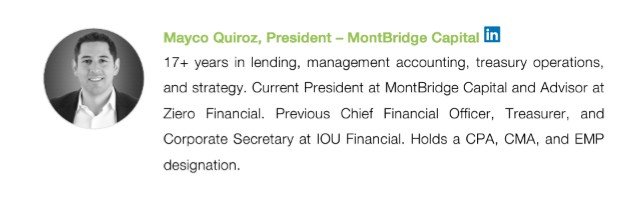

THE ADVISORS

Corl has collaborated with some of the most important leaders and experts in the world. The consultants were selected on the basis of their experience in the sector in the following 8 sectors: Blockchain, Capital Markets, Compliance, FinTech, Royalties, Startups, Treasury and Venture Capital.

For more info, kindly visit the following links

https://www.corl.io

https://corl.io/whitepaper

https://www.twitter.com/getcorl

Partners

Author's BitcoinTalk URL: https://bitcointalk.org/index.php?action=profile;u=1236826

Author's Eth Wallet Address: 0xE685e6Cf844438901496115751D18b952944189e

Amazing write up. Love the project.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This project sounds interesting, hope they won't fail?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is an educative article. Thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A friend told me about this project some days back. They have great partners

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope i can still be part of the token sales?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit