In these days there are so many startup companies failed because of lack of funding and so difficult to acquire funding from the centralized system. Furthermore, the quantity of little quickly developing organizations is higher than at any other time. With the convergence of these quickly developing organizations, the requirement for satisfactory financing is basic to fuel extension and advancement. Be that as it may, financing has neglected to keep up to the development bend. The subsidizing market today is incorporated, divided, out of to retail financial specialists, and comes up short on the adequate capital expected to help the development of the tech biological system. Around the world, this had prompted an early-development capital hole of over a $100 billion, which keeps on developing every year. To determine this capital hole, financial specialists and business people are rethinking how capital is raised today, which is confirmed from the over $3 billion raised amid Initial Coin Offerings (ICOs) in 2017.

Corl’s vision not only to solve the funding problem for every startup but also a way of passive income for every early investor as dividends on a quarterly premise in view of a settled level of the organization’s benefits. Through the token offering, financial specialists from around the globe will have the chance to partake in the income the development of beginning period organizations, without the disservices related with customary venture alternatives. In short, Corl going to provide Capital-as-a-Service.

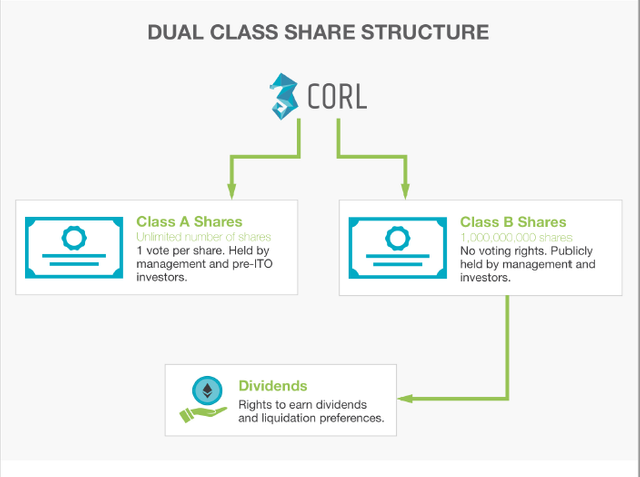

Company Structure:

Corl is a federally-registered limited-liability corporation in Canada. The company adheres to national securities laws and is subject to international financial reporting standards (IFRS) accounting regulation. Company CORL is structured into the following type of shares:

Class A shares for founders, advisors, employees, and early investors of Corl. Class B shares for us i.e “CORL token” token holders have the right to ownership and dividends.

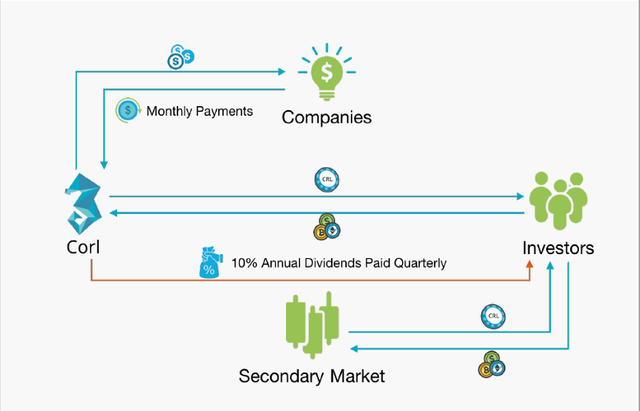

Profit Distribution:

Investors are compensated with 10% of quarterly net benefits. These quarterly benefits will be similarly disseminated over the number of extraordinary tokens and sent to general society keys of record, where the tokens are put away. Since the profit rate will be proportional for every single token holder, holders with a bigger offer of tokens will gather a higher offer of the profits. All profits will be paid in the CADequivalent measure of Ether (ETH) at the season of the profit payout, relating to the most recent day of January, April, July, and October. To develop the organization after some time, the staying 90% of quarterly net benefits will be reinvested over into the organization.

The essential job of reinvested capital is for subsidizing new concurrences with organizations and proportionately scaling tasks. The present focal point of the organization is the issuance of income offering understandings to early-income innovation organizations, yet this is just one part of the long haul vision of Corl. The oddity of income sharing is that it tends to be connected to any advantage that produces income, most eminently land, online business (e.g. Amazon FBA), and ‘new economy’ organizations that work with high volume or potential for scale (e.g. Airbnb, Uber). Guaranteeing that capital is reinvested into the organization will empower the group to grow activities into other income sharing verticals while protecting the center the matter of the organization.

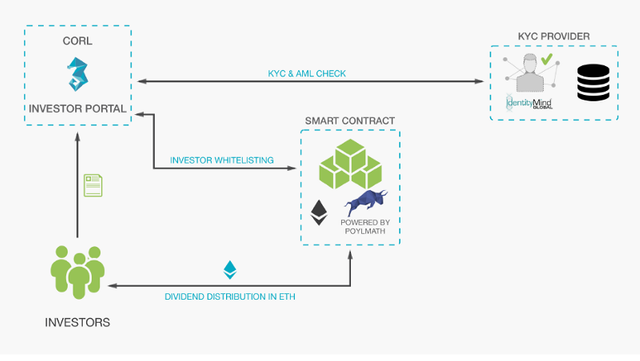

CORL Token:

CORL will be created utilizing the Ethereum (ERC20) and Polymath (ST20) convention. The Ethereum convention gives the numerous alluring properties that blockchain resources have, for example, decentralized accord, restriction obstruction, operational execution, and a widespread stockpiling standard, though the Polymath convention gives the system for guaranteeing administrative consistency with securities law, for example, Anti-Illegal tax avoidance (AML) and Know-Your-Customer (KYC) direction. Speculator onboarding is overseen by the Corl financial specialist stage, though evidence of consistency, token issuance, dissemination, and resale are represented by the Corl and Polymath keen contracts. By building up the Corl savvy contract on the Ethereum and 20 Polymath conventions, a lawful agent can ensure that securities law are followed both amid and after the token offering with numerical assurance. For more information please connect to CORL

Website-Click here

Whitepaper-Click here

Telegram-Click here

Twitter-Click here

Medium-Click here

Facebook-Click here

“This article was created in exchange for a potential token reward through Bounty0x”

Bounty0x username-jiten123321

DISCLAIMER: All the information above are my opinion this article is only for your knowledge before investment do your own research no one will responsible for your loss and profit.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by jiten from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit