Why I am doing this daily report.

The research and reading I do everyday yields a surprisingly significant amount of information, providing an overview of sentiment, major news details, confluence factors, and insight into our cryptospace.

Due to the encouragement of friends I decided to start making my personal blog, that I had been using to archive this information I aggregate, public.

As a result I've found that by publishing I've been receiving support for the time and effort I spend formatting and sharing out this information.

What is the Daily Dimes?

The Daily Dimes is a publish where I post an aggregate of news information that I come across in the cryptospace every day. There are two sections found below:

- A news bulletin section, where I cover brief descriptions of noteworthy news and developments with sources for further reading.

-and-

- A trading report section, where I release signals and information from my paid memberships, private groups, and personal trades that I'm monitoring, as well as my own market analysis.

Today

- 6 Bulletins

- 2 Trading Section Reports

- 0 Updates

- What's going on with the Tether double-spend vulnerability? In case you haven't been inundated by it yet, there was a report published by a Chinese security group scrutinizing Tether claiming to have found a double-spend vulnerability. You can check out their tweet here that started it.

Basic recap says, there was worry that Tether was being spent twice, the issue went under immediate scrutiny and it was discovered that Tether (the blockchain stable coin) was solid, exchanges just weren't checking to see if the transaction they were receiving and approving was labeled as valid=true or valid=false, as a result it appears to be an exchange integration related issue.

OKEx already released a statement exempting itself as a problem, others are to follow I am sure.

Source

- Jonathan Wheeler, former Goldman Sachs engineer, is planning to airdrop 300m worth of BTC onto Venezuelan residents. Interesting because this is a clear adoption play and residents of Venezuela are very interested in finding hedge use cases against their local Bolivian Dollar which is skyrocketing due to gov't printing inflation. (btw the gov't has gots debts to pay so they've been massively printing for a while now)

Outside of this we don't know much more because the process has to be conducted in a somewhat reserved fashion as the Venezuelan gov't has been taking steps to arrest individuals that are trying to change the current circumstance and tech available to it's citizens. Source

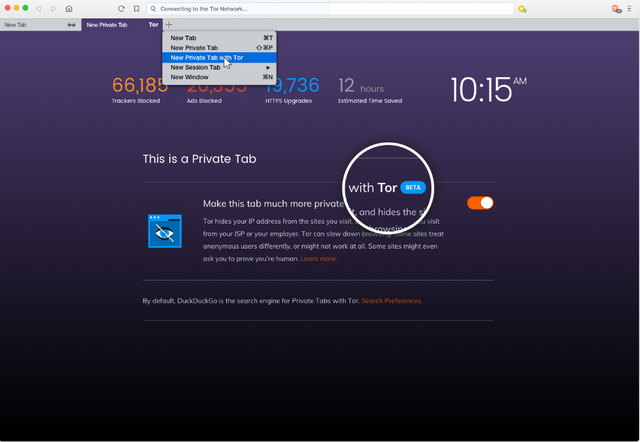

- Brave browser has released Tor tabs for privacy usage, which is just making the Brave browser associated with the BAT coin better and better. I'm bullish long term on any project with working tech in the crypto space and BAT is one of those projects where you could use it and not even be interested in crypto. You can check out more about it's release detailed in the source as a great reddit submission.

Source

- A legal step forward in precedents set for blockchain, we're shown that in China one court system declared that blockchain can be used as an authentically viable source to legitimize information presented in a court hearing. The quote given by the judge goes as such,

"The court thinks it should maintain an open and neutral stance on using blockchain to analyze individual cases. We can't exclude it just because it's a complex technology. Nor can we lower the standard just because it is tamper-proof and traceable. ... In this case, the usage of a third-party blockchain platform that is reliable without conflict of interests provides the legal ground for proving the intellectual infringement."

Source

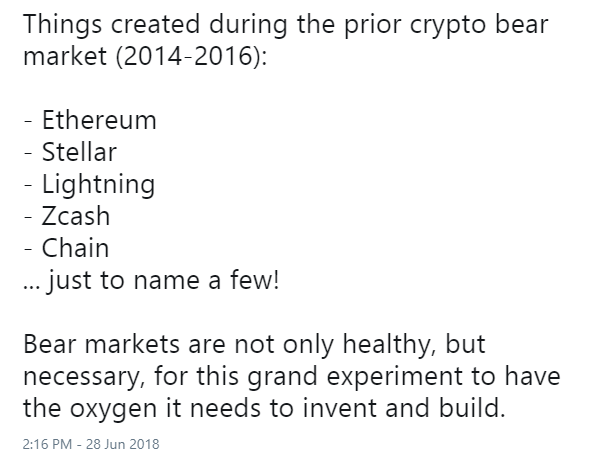

- A great reminder as to the benefits of bear markets many of which we experienced the effect of during our last bullish run in 2017. Source

- Today is the last day of CME futures contracts as well, which means that those who opened short contracts in December are looking for their final chance to max our their profits.

This means that the coming days until July 2nd (and beyond) are going to give us some great insight into the next batch futures to be release and what the effects of this expiry looks like.

Some Sources about CME futures

Trading Section

- BTC Macro: Looking at the 3day chart seeing some serious StochRSI oversold values, we're watching for CME future expires today and will likely learn a fair amount on BTC's response to this event. Still currently holding above the resistance range. (Two support lines ranging from 5900 to 5000)

- BTC Local: Looking at the local area (t=12hrs on this chart) there's a fairly interesting oppertunity for a hidden Bullish divergence that could make a move if sell pressure relieved itself some, or buy pressure increased. Short term it looks like we have signs pointing at a rebound from this range to go back up and check for an upper resistance area in the high 6000's again.

Thank you for taking the time to read.

If you'd like to support the Daily Dimes news publish please upvote me on STEEMIT.

Or you may drop 20 cents to either of the ETH or BTC addresses below to support today's publish.

BTC: 19kL29drp1gun7CSpJRL6XKYUZJbPWMP3r

ETH: 0x1D04D21C53211c336F703ddf11be4B53FF8F8358

Followed. I really like your digest. Your hint with the cme futures seems to be spot on as it explains the sudden spike and short squeeze.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks I appreciate it. I've been operating lightly in a public sense since mid 2017, however I just recently made the switch to steemit and started sharing it out more since crypto in general has been more quiet lately.

I've received a fair amount of positive feedback so it must be helping in some way. It's good to hear items that are particularly useful like what you shared, thanks for taking the time to read it. : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit