Philippines: - Bangko Sentral ng Pilipinas estimated that $2 million worth of remittance transactions per month involved the use of digital currencies. The safety concerns over such use have called for regulations in the cryptocurrency industry.

Pic Credit

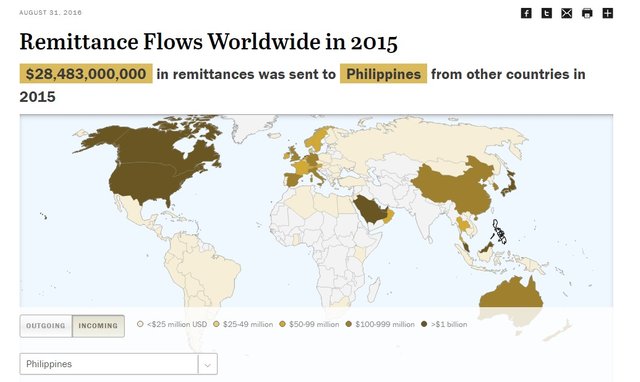

Remittance Industry in the Philippines

The Philippines is one of the top five remittance recipient countries in the World. It accounts for approximately $28 billion of the global remittance in 2015.

Pic Credit

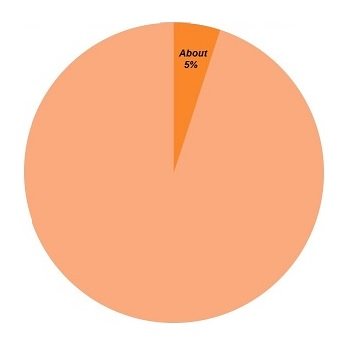

Comparing the country's total remittance volume with those that involved digital currencies, the latter only represent a tiny fraction.

However, Nestor Espenilla, the deputy governor at the central bank, suggested that in time to come, there is a likelihood that more remitters would utilise the cheaper and efficient cryptocurrency remittance services.

Henceforth, regulatory frameworks should be in place.

Heists Scare

In addition to seeing a growing use of cryptocurrency remittance services, Espenilla, also pointed out:

“We are concerned with potential money laundering and consumer protection [...] We are studying putting virtual currency exchange operators under a more formal regulatory framework.”

The formal regulatory frameworks will focus on the operators’ accountability to combat money laundering activities.

The importance of regulatory frameworks was felt especially after the Bangladeshi central bank’s heist earlier this year- a total of $81 million stolen and laundered through remittance company and other counterparts.

KYC and STR

In future, business operators involved with cryptocurrencies would likely be required to conduct Know-Your-Clients (KYC) checks, and also Suspicious Transactions Reporting (STR) to the central bank. Espenilla added:

“In exchange, virtual currency operators get legitimacy. For so long as the regulatory environment is clear, innovation can happen.”

Enhance Cyber-Security

On top of countering money launder issue, the central bank has also announced its plans to expand its cyber-security unit to place financial intermediaries under tighter scrutiny.

Past security breaches which involved cryptocurrency exchanges such as Bitfinex and Mt. Gox has further emphasized that tighter cyber-security measures are necessary to safeguard the people’s assets.

Could They Be More...?

In view of the current war on drugs in the Philippines, perhaps the introduction of regulatory frameworks has a part to play- that is to stub out deal dealers leveraging on the darknet and continue their drug trade over there?

Paresh Nath, The Khaleej Times, UA

~End~

Knowing that no one pleases everyone and there is a flip side to every coin, including Bitcoin. Whether you agree, agree to disagree, or the opposite, do not just take my words for it, be sure to look it up.

Thank You SteemVerify

:))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What... Am I this honored to be in your one & only- thy very first- post...

Merry xmas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not related, but I heard venezuela banned bitcoin completely. Now people are smuggling miners in the country.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit