Capital is the major challenge for alpt of businesses in a bid to expand. New startups are usually the more hit but even already existing businesses also face huge challenges with funds. Banks and other financial institutions have proven not very helpful for starts ups or fund generation.

MSME suffer the most.

It is common that MSMEs find it difficult to get loan or financial support to back their business. Even the few that were opportune to achieve loan do undergo a stressful process, ranging from era of filing of documents, presentation of collateral and your surety. All these are challenges which is battling with MSME ecosystem. Though, there are a lot of peer to peer lending platform but none is reliable nor trusted.

With the blockchain technology, there looks to be hope finally for startups and MSMEs. This is where PNGME comes in.

What is PNGME

Pngme is a blockchain based international lending platform designed to solve the funding challenges that is confronting both individuals and mostly, micro, small and medium enterprises.

Pngme will be developed as a marketplace where business enterprises will have a quick access to lend money in supporting their businesses.

Pngme will be developed in a digital way and serve as a mobile banking system functioning as a lending marketplace for MSME and other financial institutes.

The mission of Pngme is to build a marketplace for people that normally do business to have a quick access to loan, find a means to easily raise funds for startup business and enjoy financial support for their business.

**Problems Facing Lending Ecosystem **

These days lending marketplace has grown beyond what traditional peer to peer lending system is offering. The traditional lending marketplace look cruel because the structure are being determined and controls by the owner of the platform. The methods used in checking the credit score is undermine and unrealistic. The system do the checking and the buyers of the loan or investors have no access or right to checkmate the credit score of the client that want loan.

Another challenge in the lending ecosystem is an issue of currency difference; this make cross border payment become difficult. This has affected many MSME personnel to acquire loans from a lender outside their country. Though, cross border payment can be made but the exchange rate is a thing of concern. There are MSME business personnel that request for a loan of $5000, but because the payment will be made across the border, he might be charge extra fee of $1000 as exchange rate.

The MSME is the grassroots for the growth of any country but the majority does not have access to loan. Even the few that have access to loan are been cheated with an ineffective credit score algorithm which normally place high rate interest on their loan. Despite the rate at which the world is migrating to a digital system, it is still baffles me how there is few or none digital lending marketplace across the globe.

**PNGME Ecosystem **

The Pngme ecosystem is made up of business enterprises that usually needs loan; these are big financial institutes, individuals people with large business, and micro, small and medium sized enterprises; these people are refers as 'borrower' in the platform. The ecosystem also investors i.e the lenders that lend money to the needed business enterprises.

How Pngme work is that the borrowers will initiate a lending process by rendering his digital bonds for sale and will use his digital assets as a collateral. The Pngme lending platform designed a technological collateral system which is more reliable and can cut short the default rate in a lending system. This credit scoring technology will transparently show the credit score of the borrower so that the lenders can access either to render them loan or not. Those with low credit score or defaulters might deny to have access to loan through Pngme platform.

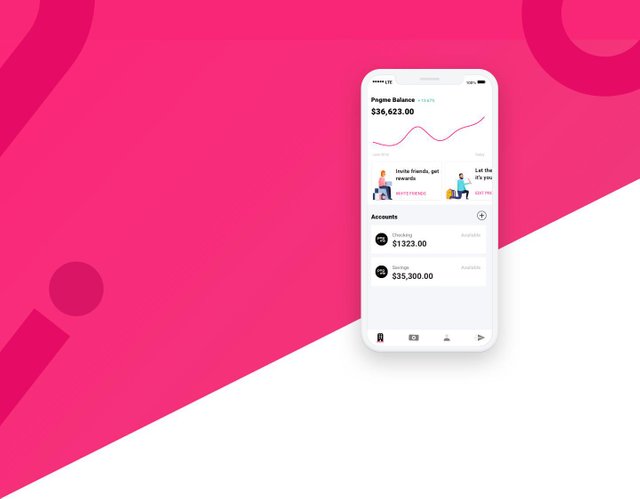

**PNGME Mobile Banking Application **

For the platform to be easily accessible by everybody in a convenient way, Pngme has built a mobile banking application. All the functions of Pngme can be performed with the mobile banking application. This mobile banking application is available for both Android devices and iOS devices respectively.

The core reasons of developing this mobile banking app is to make things easier for business enthusiasts to quickly have access to financial support for their various businesses, which will be utilized by both the owners of business and those people that will consume it. In the Pngme mobile banking app, the users can use it to make a payment, he can use it to save his funds, he can use it to connect to his customers etc. With the Pngme mobile banking app, everybody can build their own credit score. There are lot of things we are going to be enjoying while using the app. Through it, we can be able to lend money to the needed people and earn a lot of rewards.

Why PNGME?

In traditional lending system, loan is not available for everybody, it is for special individuals or big firm with strong background. The entire process and decisions are been anchored by the central body. This type of system is not transparent and not that reliable. The exchange rate for lending is so high and unstable. The lending process are most time diverted and manipulated. However, for that of Pngme lending system, every process are being anchor by an artificial intelligence and a robot. It system has an automatic matching algorithm that determine the exchange rate that suits different types of loan. Everything about the lending process of Pngme is transparent, accurate and no manipulation.

More information is available through the use of the following links.

Website: https://pngme.com/

BitcoinTalk ANN: https://bitcointalk.org/index.php?topic=5140127

Facebook: https://www.facebook.com/pngme

Twitter: https://twitter.com/pngmemobile

Reddit: https://www.reddit.com/r/pngme/

Telegram: https://t.me/pngmecommunity

Medium: https://medium.com/pngme

YouTube: https://www.youtube.com/channel/UCmUPIgu-xfdYijOS7eOwYyg

Instagram: https://www.instagram.com/

Congratulations @aabc! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit