Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.346%, equivalent to 18.0% APR and 19.7% APY.

Time to simplify these posts.

General Info

New rules and simple explanations can be found here. Please read it, and links within it, before asking the obvious.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the real return per delegated SP.

The new rules started last week, Monday 28th June, 2021. They may change again in the future if the Steem economy warrants such a change.

Bonus Token Winners

As previously announced, we now have two weekly winners of a random draw of MAPR tokens.

@maxuvd wins 1 MAPR token

and

@davidesimoncini wins 1 MAPR token.

Winners MUST CLAIM their bonus token by leaving a comment to this post. Claims expire after 7 days and unclaimed tokens are put back into next week's general fund.

Last week we had 1 MAPR token claimed - the other token prize has now expired.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 24.9% [1a], 14.2% [1b], 13.8% [1c]

Value of Steem author rewards payouts = APR 100.0% (640%!!) [2a], 57.0% [2b], 55.0% [2c]

Distributed MAPR payouts = 0.336% (APR 17.5%) [3]

Projected Compounded APY 19.7% [4]

Average APR 18.9% (26-weeks)

MAPR BUY Price: 1.21 STEEM [5]

MAPR Price increase = +0.0% APR

MAPR SELL Price: 1.24 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3]. We now have enough data to give a better historical picture of progress and have including a 26-week average to give a measure of medium-term returns.

[5, 6] Our BUY and SELL prices are currently fixed until further notice.

Our MAPR distribution [3] is much higher than the average blockchain curation rewards for most users, being half of the values [1a, 1b & 1c].

Profits will be paid today in the new MAPR tokens.

MAPR News

I shall copy this for the last time: all members please see the previous news posts.

The buyback price will now be fixed at 1.21 STEEM. Everybody has had a good ride, I hope this stimulates some token sales; it also means more income going to delegators, who are those that help generate the income in the first place.

Minimum delegation amount is now 100 SP.

Anybody below 100 SP will henceforth receive no token distributions, but they will be eligible for the random bonus token (see above). These bonuses may also be removed if there just a handful of users left.

Our income distribution remains fairly consistent, as is the raw Steem vote-yield, ignoring the SBD uplift. It has been some 2 months now that our income has been in a narrow band between about 17.8% and 18.2%. All this within a crypto market that has seen pumping and dumping like a nodding donkey!

We see a slight increase this week in the reward distribution. Also, don't forget to add the new bonus tokens when looking at totals.

We shall continue to generate yields that are as high as we can given the economic model.

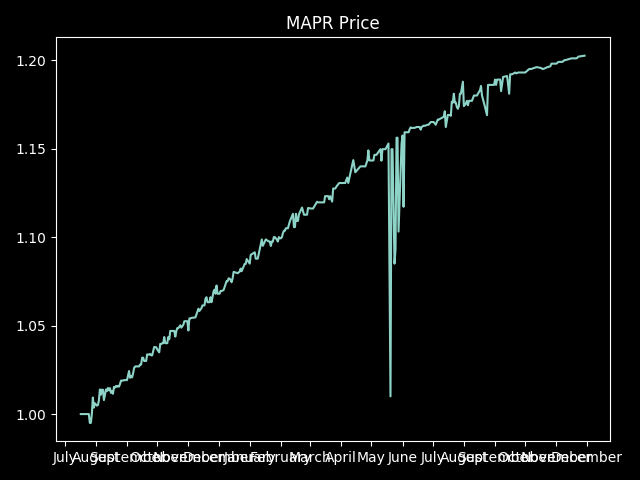

And finally, although our weekly returns are variable, here is a graph of how the token price has been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

As this is now a historical graph, as the app that generates it no longer works, I shall remove this from next week to save further space.

See you next week!

I hope you all survive 2021!

Next rewards distribution will be on Monday 12 July.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

Thanks! claiming my bonus token :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great - sent!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit