Monero Analysis

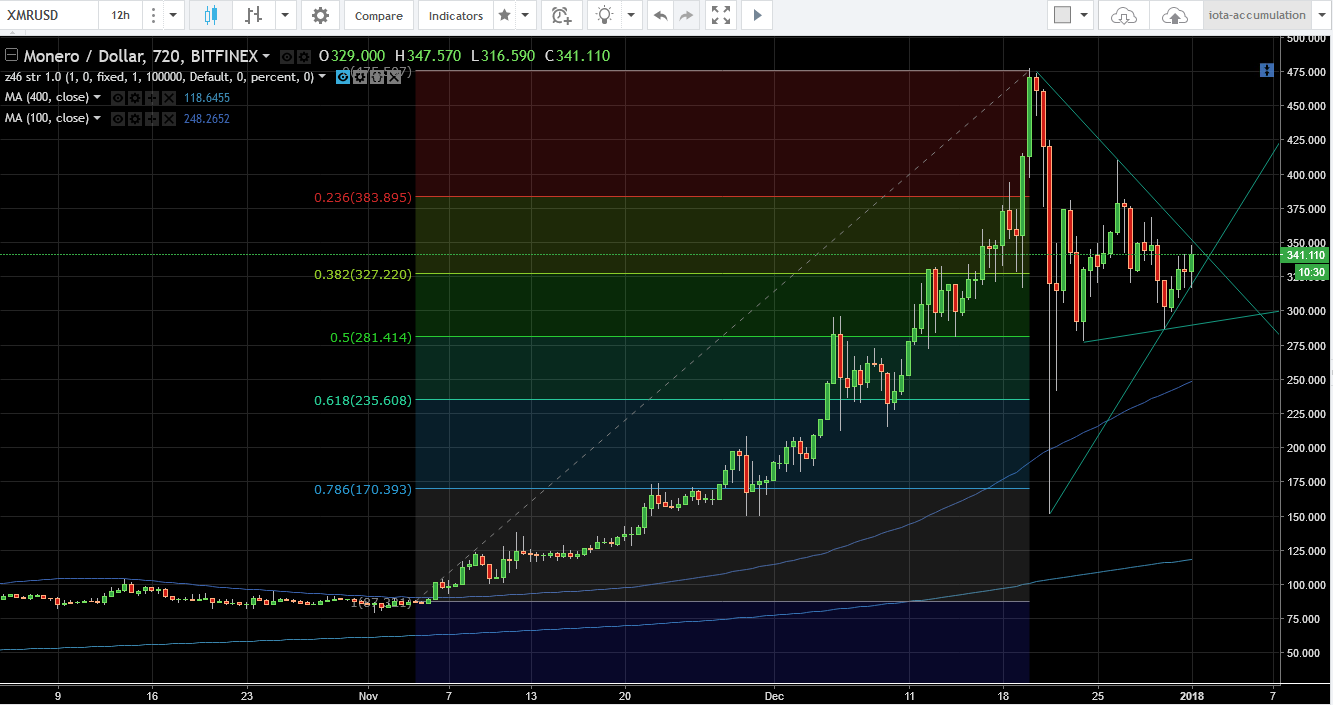

Monero (XMRUSD) has put in quite a move since taking off around the $80 level in November to it's current price levels at $342 at the time of this writing.

XMR after expanding to new highs 6x from it's breakout level around $80 needed a little breather. This is perfectly healthy for price movement, trading down to the 61.8% Fibonacci retracement level.

Any strong market needs a sanity check, the crypto market is the strongest I've ever seen, and until I'm proven wrong I will continue to play the trend.

**Staying above the 50 day moving average and the 200 day moving average are those lines in the sand for me and XMR has not been below it for as long as we've been able to track it on Bitfinex' data feed. **

From here the first quarter of 2018 we are projecting a doubling of current prices.

It is possible that we wear out some of this frenzied buying and trade sideways until mid February before we take off to $650-700 levels. A similar pattern that we had in September/October.

The other possibility is that the floor is in, we've retraced and a pile of new money for the new year will be coming quickly as people return from vacations and start putting that money to work.

The Fibonacci retracement lines up nicely with the Elliot Wave 5th wave down signaling a reversal off that same 50% level.

As analysis starts to pile on top of each other the likelihood becomes higher that the price will increase.

A move down to the low 200's is still bullish and a potential downside, giving us about a 4:1 ratio that we can gain 4x what we can lose on this setup.

This analysis is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. The research utilizes data and information from public, private and internal sources, including data from actual trades. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. The views expressed herein are solely those of the author as of the date of this report and are subject to change without notice. The author may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed.