Welcome to Chapter 2 of Cryptocurrency Investment Tips for beginners, this chapter will cover investment strategies, profit tracking, profit taking and how to find the best opportunities.

This chapter is part of a free ongoing and continuous guide on how to invest in, research and profit from cryptocurrencies, this chapter includes affiliate links so if you find my guidance helpful please use the referral links in this article so I can continue to create these free guides.

Before we get started, cryptocurrencies are very volatile and it is not uncommon to see 20% fluctuations in a single day, this is one of the reasons why it is always advised to only invest what you can afford to lose.

On the other hand volatility is also the reason why cryptocurrencies can be a very lucrative investment, for example, compare a 20% rise in one day to the 7% average ANNUAL return in the stock market and I haven’t even mentioned the 1000% and 10,000% returns early investors have made, but we will come to those stories in future chapters.

Basic Advice:

Only invest what you can afford to lose

Invest according to your risk tolerance

Always do your own additional research

The best time to buy bitcoin was almost 10 years ago, the second best time is today

Keep your coins safe (referral link): https://www.ledgerwallet.com/r/4c54?path=/products/

First you might want to start with “Blue Chip” cryptocurrencies, these are the cryptocurrencies with a market cap of over $2 Billion. At the time of me writing this there are currently 7 blue chip cryptocurrencies which are:

Bitcoin - https://coinmarketcap.com/currencies/bitcoin/

Ethereum - https://coinmarketcap.com/currencies/ethereum/

Ripple - https://coinmarketcap.com/currencies/ripple/

Litecoin - https://coinmarketcap.com/currencies/litecoin/

NEM - https://coinmarketcap.com/currencies/nem/

Dash - https://coinmarketcap.com/currencies/dash/

Ethereum Classic - https://coinmarketcap.com/currencies/ethereum-classic/

Some sources claim that cryptocurrencies with a market cap greater than $30m qualify as blue chip cryptocurrencies so if you want a broader perspective you go to Coinmarketcap.com at look at the cryptocurrencies with market caps above $30m. I prefer to stick with the $2 Billion qualifier since that sets the bar higher therefore making the investments safer in my opinion.

To making investing into altcoins easier you can first buy bitcoins and then trade them for your favourite coins.

Buy Bitcoins from Coinbase (Referral link – Global, you get $10 in FREE Bitcoin after buying $100 in total): https://www.coinbase.com/join/592b7d7f64a015a3716ebdad

Buy Bitcoins from Bitpanda (Referral link - Europe only): https://www.bitpanda.com/?ref=3127933809251797450

Buy Bitcoins from Coinmama (Referral link – Global, No verification): https://www.Coinmama.com/?ref=cryptonite

LocalBitcoins (Referral link – Global, Verification needed for some purchases, Peer-to-Peer): https://localbitcoins.com/?ch=d7ch

Buy Bitcoins from Cex.io (Referral link – Global): https://cex.io/r/0/up106280379/0/

Note: You can also buy Ethereum and Litecoin from Coinbase and Bitpanda.

No one can tell for sure what the price will be in the future so if you feel confident about the coin you have chosen then buy a small amount to set your foundations. As long as you have picked a good coin then it is better to get in now and hold for the long term, if you try to time the market, you risk the chances of buying the coin at a higher price later.

If you want to wait for a better price you should buy a coin when it is being “dumped” (investors are selling which causes the price to go down), if you have picked a good coin do not worry the price will soon recover and could even go beyond the current All Time High (ATH).

You can setup buy orders on an exchange if you anticipate further price drops, you can also add the coin to a price tracking app like Blockfolio and setup some price alerts (this will be described in detail further down).

Ideally you want to get in early on a coin when it is nice and cheap and sell it after the price has gone up substantially, for example if you bought 300,000 Stratis at $0.01 on August 12th 2016 you would now be a millionaire, having have gained over $1.5m from an initial $3,000 investment at the current price of $5.06 per coin.

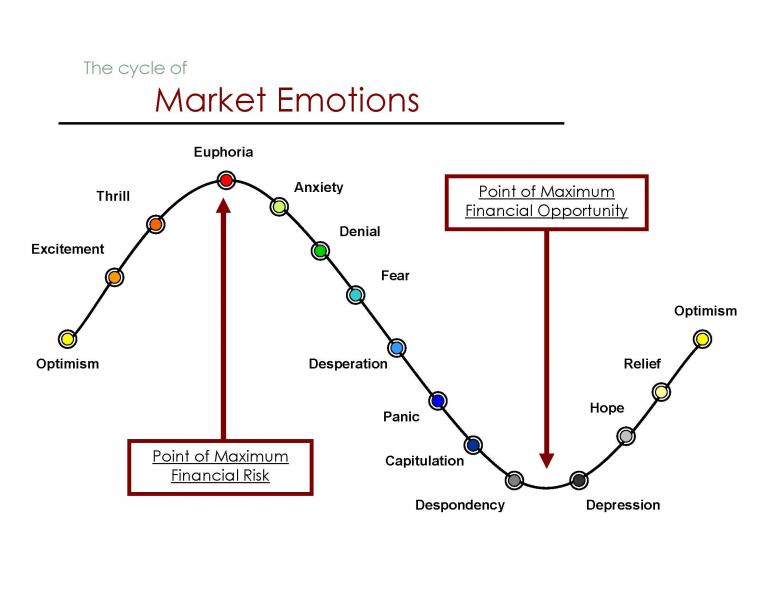

If you are not an early adopter and missed out on the bottom prices you can still buy the occasional dips. Let’s go back to Rule 2: “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”. This refers to waiting when everyone else is buying and buying when everyone else is selling.

When everyone else is greedy and buying, this causes the price of the coin to keep rising and you risk overpaying for the coin, especially if there is a later price correction (a temporary price reduction). If you are seeing a pump without any solid reasoning behind it (no new developments, no partnerships, no important news or updates) then you could be better off waiting for the price to dip again before buying.

Yes, you read that right, hodling. This is the practice of holding on to a long term investment without giving in to the urge to sell, it is misspelled deliberately for dramatic effect to mimic an investor frantically trying to type the word “HOLD!” If you plan to join the legion of cryptocurrency hodlers then here are some useful terms you should know:

• Sats – Short for Satoshis, a division of Bitcoin, 1 Satoshi = 0.00000001 Bitcoin. I have added a link for a convertor at the end of this chapter.

• Fiat – Fiat currency, your standard currencies such as USD, GBP, EURO, CNY etc.

• ATH – All Time High, the peak of a coins price.

• Bull Market - a market in which coin prices are rising, encouraging buying

• Bear Market - a market in which coin prices are falling, encouraging selling.

• Feeling Bullish – Feeling positive that an investment will grow in value

• Feeling Bearish – Feeling that an investment will lose its value

• Weak Hands – People who buy a coin then sell as soon as the price dips

• Strong Hands – Investors who hold on to coins not matter how low the price dips.

• Bloodbath – When a large number of coins lose a lot of their value.

• Moon – A swift and very high price increase.

• Shakeout – When a coin price dips so low and many worried investors sell at a loss, this can also be caused by a “whale” artificially reducing the price.

• Whale – A very large coin holder, they can influence the price of a coin through buy walls, sell walls and selling off coins.

• Buy walls – When whales try to encourage the growth of a coins price through massive buy orders.

• Sell walls – When a whale tried to suppress the price of a currency (usually so they can accumulate more for themselves). Example imagine a coin costs $4 and has 5m total supply and there is a sell order for 1m coins at $4.2 each, the price will not likely go above that price.

• FUD – Fear, Uncertainty, Doubt. People who spread bad news about a coin to cause investors to doubt their investments and sell or to prevent other investors from buying into a coin. Can be used by greedy investors seeking to accumulate more coins.

• Pump & Dump – A scheme where groups buy into a coin cheap and spread hype causing unsuspecting investors to buy in, which then causes the price to “pump” up, then the new investors are “dumped” on by the early investors as they take their profits. After a dump the price goes down and the duped investors are known as “bag holders”.

• Bag Holder – An investor who is holding onto a possible bad investment also known as being “left holding the bag”, they could be the victim of a pump & dump scheme or they simply bought into a poor coin at its ATH then is left to hold the coin as its price drops.

• New Blood/Fresh Meat – Another word for noobs or new investors.

• DYOR – Do Your Own Research

• Premine - A premine is where a developer allocates a certain amount of coins to a particular address before releasing the source code to the open community. Usually when this happens the developers have reserved a certain amount of coins for themselves for a particular reason.

Many cryptocurrency investors claim that they have made more money from holding onto an investment long term instead of trading and I would also advise everyone to hold and only trade if you have previous experience, trading is not for noobs.

Just because you are a hodler that does not mean you cannot take profit from your investments.

• To secure your profits in another form such as Fiat currency.

• You can take profits in Bitcoin and then use the Bitcoins to buy into new cryptos or increase your holdings in current altcoins.

• If your investment has pumped a lot (3x-10x) you can take profits into Bitcoin or Fiat and buy more of that same coin when the price inevitability dips.

• To diversify into traditional investments such as gold/silver, index funds, mutual funds, REIT’s etc.

If you want to take profit on an investment I would recommend cashing out no more than 50% if you believe the coins value will continue to increase in the future. Let’s call this the “Rake” method, you take out a certain percentage of profits every time your investment reaches an all-time high, this can be very effective just before a bear market where the prices of most coins will drop as investors sell off their coins, allowing you to buy them cheaper.

• New developments and announcements

• Hitting roadmap deadlines

• Coins getting added to bigger exchanges like Bittrex & Poloniex

• News & hype

• Pump & Dump groups

• Real world application

• Low supply & high demand

One reason for a high increase in a coins price is the supply of the coin, naturally if something has a limited supply and high demand its value will increase since it is not easily accessible. You can use this fact to your advantage by investing in coins with a total or circulating supply lower than 100m coins but preferably less than 50m coins.

You can also use the coins supply and market capitalization to accurately calculate the price using this formula:

Marketcap/Circulating Supply = Price

For example Bitcoins current market cap is $44,971,563,123 and the supply is 16,477,325 BTC, so:

$44,900,359,500/16,478,587 = $2724.77 the price on the 30th of July 2017.

Let’s say on Reddit you came across someone who predicted Bitcoin to have a market cap of 80 Billion by 2018, then again you would calculate it like this:

80,000,000,000/16,477,325 = $4855.15 predicted price by 2018.

You can find out a coins supply and marketcap on coinmarketcap.com.

On the other hand just because a coin has a low supply that does not automatically make it a guaranteed jackpot, you should read the whitepaper, search Bitcointalk.org and Reddit for information regarding that coin and find the slack, telegram and discord channel invites.

Important information to consider:

• Does the coin or platform behind it have a real use case? What is the coins purpose?

• What does the “coin” represent? Ownership? Currency? Is it a Token?

• Was there a premine? If so, why?

• Is the coin being actively developed? (Engage with the developers on slack and find out)

• Reasons behind the circulating and total supply (ask around on slack, reddit or bitcointalk)

• Who is behind the coin?

There are a number of apps you can use to watch the price of your favourite coins and also check how much profit you have made form your investments. Here are my 3 favourites.

Blockfolio Available on Android & iOS.

CoinFolio Available on Android & iOS.

CoinCap.io Available on Android & iOS.

You can also set up price alerts which send you push notifications whenever the price drops or rises above a certain level.

Finally let’s look at how to scout for new investment opportunities.

Bitcointalk.org

Bitcointalk.org is an online forum where cryptocurrency investors can get together and discuss cryptocurrency, blockchain technology, new coins and ICO’s etc. Developers also use the forum to announce the coins that they have been working on, if you do not know what new coins to look for simply type “ANN” in the forums search bar or paste this into your search browser: “site:bitcointalk.org ann”.

Bitcointalk is also a good source to find invite links to slack, telegram and discord channels which also provide a wealth of quality information and direct updates from the developers themselves.

(Low – Medium risk) Reddit – Check the Cryptocurrency sub-reddit: https://www.reddit.com/r/CryptoCurrency/ to find general discussions on altcoins as well as Bitcoin itself. You will find a lot of opinions on Reddit so I class this as low to medium risk, always do your own research and if you discover a coin on reddit, look for it on Bitcointalk.org and look for the coins official sub-reddit for more refined information.

(Medium - High risk) Follow tipsters on twitter: This one is more risky than the previous options since this involves trusting online Twitter accounts and many are anonymous. Tipsters are investors or traders who post price predictions for particular coins as well as announcing opportunities to buy in early before a coins value increases.

Be careful when taking advice because there are active pump and dump groups on twitter and always remember the motto: Do Your Own Research. If you want to find tipsters use hashtags (#crypto, #bitcoin) or price tickers ($btc, $eth, $xvg $xrp etc.). I won’t post any recommendations at this point since I believe every investor should choose whose advice to follow themselves.

This wraps up Chapter 2 of Cryptocurrency Investment Tips for Beginners, I hope you found this Chapter informative enough to help on your crypto investment journey.

I have linked some useful tools below, check them out!

Best of luck

Cryptonite

If you find my information useful, please support this ongoing free guide by using the referral links:

Satoshi to USD convertor: http://www.btcsatoshi.com/

Multi-Password manager (referral link): https://www.roboform.com/?affid=c1623

Keep your coins safe with Ledger Hardware wallets (referral link): https://www.ledgerwallet.com/r/4c54?path=/products/

Buy low market cap coins before they hit major exchanges on Cryptopia! (referral link): https://www.cryptopia.co.nz/Register?referrer=Cryptonite900

Feel free to send me a tip if you feel you that benefited from the information in this chapter:

Bitcoin: 1DU5qrQd5rU6XDfuZJDhrGWfXPEXfkUD18

Ethereum: 0x83Ff3ceda1b3eD498E0acB610aEeaD5bd62A4b41

Litecoin: LLwuy1CBJm6MuH9dfKFYpdn51awtt5tsXk

Follow me :)

Steemit: https://steemit.com/@cj900

Twitter: https://twitter.com/cryptonitetweet

While it may not be a scam in your opinion, it could be considered spam. Spam is not appreciated by the community and could be flagged or may result in action from the cheetah bot..

Some things that can be considered spam:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What about investing in ICO ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great guide, thanks for the post! The definition of abbreviations was really helpful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem, I'm glad you found my post helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great Post! Well written.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@cj900. Great post. Very informative. Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Glad you found it helpful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi. I am a volunteer bot for @resteembot that upvoted you.

Your post was chosen at random, as part of the advertisment campaign for @resteembot.

@resteembot is meant to help minnows get noticed by re-steeming their posts

To use the bot, one must follow it for at least 3 hours, and then make a transaction where the memo is the url of the post.

If you want to learn more - read the introduction post of @resteembot.

If you want help spread the word - read the advertisment program post.

Steem ON!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted by Emma

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

a very useful post. thank you for your contribution

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post received a 3.0% upvote from @randowhale thanks to @cj900! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wonderful article! More like a guide for newbies to cryptocurrencies and the Steemit community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit