Planning your asset movements is vital to get the biggest gains out of any investment, and with crypto is exactly the same. As it appears on my previous article, ROI analysis have the huge advantage of being a leveling field on different kinds of assets - as it gets real price out of the equation - using market developments to form a profit/loss probability chart based on historical data. Comparing many of these charts will give you a glimpse of an ideal holding portfolio for a deteminate period of time.

But this advantage comes at a cost: Trying to time the market using these charts won't work as this method is probabilistic and not predictive (making it prone to the effects of unforeseen events), so it is way better to create several portfolio strategies in order to keep estimated gains or losses for a certain period - something that should be top priority when investing.

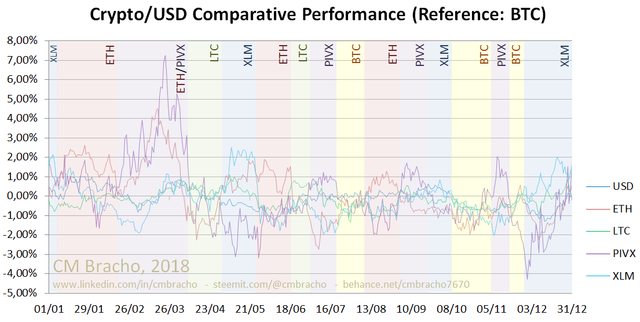

So, doing a comparative chart of several asset performances will give you a good hint of where to put your investments. In order to show how this would look like, let's use the same currencies given in our last post (ETH, PIVX, LTC, XLM, and USD) and compare their developments using bitcoin as a reference.

There you go: a simple annual portfolio, which could be expanded to accommodate other promising coins. Notice USD isn't your best option when pondering against up and coming assets, as it tends to be relatively stable during the analyzed periods.

But, how could you diversify your portfolio from here? Don't worry, here comes the tips.

Some coins are more equal than others

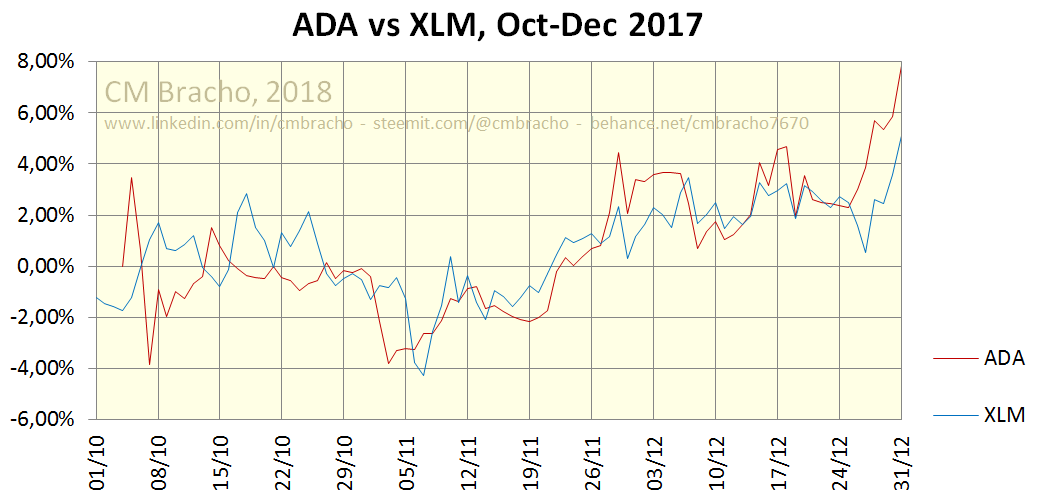

There is a curious pattern on alt-coins: Some of them seem to be "tied" to others during a certain amount of time - One should identify such trends and benefit on any existing delay. If you HODL, put more weight on promising alt-coins in your portfolio, as they tend to perform the best.

Clustering means power playing

Analyzing the right amount of alt-coins, you can find there's investor clustering in the market, which involve a group of coins with similar tendencies on performance. Our duty is to sway from one cluster to another opportunely, which is the main reason one should research and make its portfolio composition considering the bigger picture.

Think dynamically

Earlier there was a phrase about keeping many portfolio strategies - that's because we must consider the volatile nature of most crypto assets. Also, let's have in mind all strategies must change over time, in order to maintain a profitable portfolio. Finally, let's consider space for opportunities like ICOs, re-brands and whatnot, doing a continuous research of the market and adjusting your investment amounts with proper time left. Hanging on your planned assets will improve your sanity, your finances, and reduce bandwagon losses.

Crypto on this article

ADA: ฿0.00002157, 7 day trend: -13.16%ETH: ฿0.05548910, 7 day trend: -23.61%

LTC: ฿0.01704210, 7 day trend: -23.87%

PIVX: ฿0.00053305, 7 day trend: -6.50%

XLM: ฿0.00003056, 7 day trend: -8.78%

BTC: $7068.5, 7 day trend: -15.53%

Congratulations @cmbracho! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cmbracho! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit