Summary - Get success with volume trading

I would like to start this post with a quote from a book that I have read many times. The book is called "Reminiscences" of a Stock Operator written by Edwin Lefévre and was released for the first time in 1923. It is a biography about one of the most iconic traders of the past: Jesse Livermore. It is as relevant now as it was about 100 years ago, and a quote is printed in my consciousness:

"There is nothing new in Wall Street. There can not be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again "

This quote summarizes exactly what volume analysis is about. So, if you're looking for a new and smart way to shop, I'm sorry to disappoint you.

The volume is deep in the financial markets and the financial investors can not hide when they are trading. Therefore, I wonder that no more users use volume in their analysis of the market. However, I will try to fix this post.

I've learned that the volume is the gasoline that drives all markets up and down. When I judge whether a market is going up or down, I look for three things:

- Price

- Volume

- Position of the close

In other words, price-action combined with volume.

In addition, I use trendlines, trend channels, resistor and support levels (accumulation and distribution areas), and what my mentor calls 'ease of movement', which, in comparison with the three points, gives me a clear picture of where the market moves in the moment. How far I never know about it, but it always tells me the things above (in the present), so I never worry about it. Therefore, I have never used profit target levels.

To show how I use volume in my daily trading, I'll review trading setups, as I've all acted as 'live'. I always look at many different charts (ticks, daily, minuts, P & F) when I shop. In this way, I get an overall picture of where the large and smaller levels of resistance and support lie.

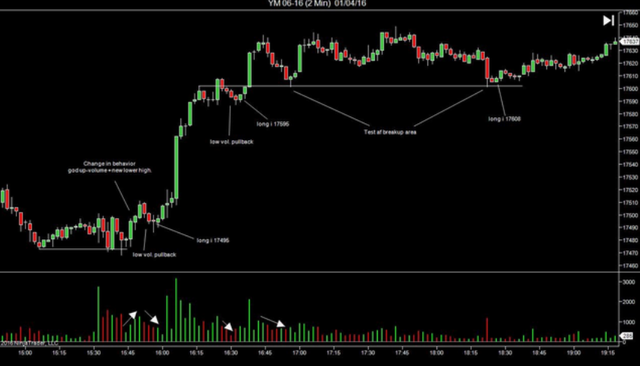

The Dow (YM) Friday, April 1, 2016

In this example, the market is falling from the morning to the US session. .

15:44 - 15:50

The market begins to rise on good volume (largest up-vol. Since morning time). Priceaction and volume compliment each individual candles in this upwave. Here I'm immediately on duty about a turnaround in the market. I'm waiting now to see if the market will go down or whether this is actually a turnaround in the market.

15:52 - 15:56

The market is unable to make a new low, and the volume drops steadily. In addition, this decline concludes with divergent priceaction (doji candle). This is more than enough information for me, and I go long in 17495, with a stop below the previous low (17468).

Do I know at the moment whether the market is on its way? Of course not with full security, but as I usually say, "Let the market prove I'm wrong", which of course happens once in a while.

16:26 - 16:32

After a sharp increase (why I do not know and I do not care), the market has a weak pull-back. Take a look at the volume - it drops over the entire time range and finishes the downwave with "stopping volume" on the last candle. With "stopping volume" I think the price does not move quite much, compared to the amount of volume that goes through the individual candle - so there is a lot of buying in this candle. As soon as the market goes back to "north", it is possible to add. However, I did not do that when I was down in the kitchen to make an espresso (you're just a human being). In return, this pivot low provides an excellent starting point for moving my stop up, at a later date.

16:44 - 16:56

The market again has a pull-back in this - now powerful - bulltrend. Again, it is a low volume pullback that ends in a hammer candle (bullish priceaction). As the price simultaneously tests the previous breakup area, this is a great place to add to its trade - which I do. Subsequently, the market moves into a congestion zone, after which the price at 18:24 again tests the powerful breakup area from earlier in the day. Notice here again the priceaction and volume that tells the "true" story.

18:22

Now the market is accelerating with high volume and it seems as if we are going to go further down. But what happens then? There is no 'follow through' - the market simply stops falling. Here there is apparently a large number of buyers entering the market - this is a perfect place to add, which I do in 17608.

I now have three positions and am satisfied with it. The rest of the evening goes by following the market while moving my stops.

22:32

Here I close my positions in 17703, as the market is unable to make a new high, despite massive up volume. - In addition, the family is finished watching X-factor, and it's time to spend time together.

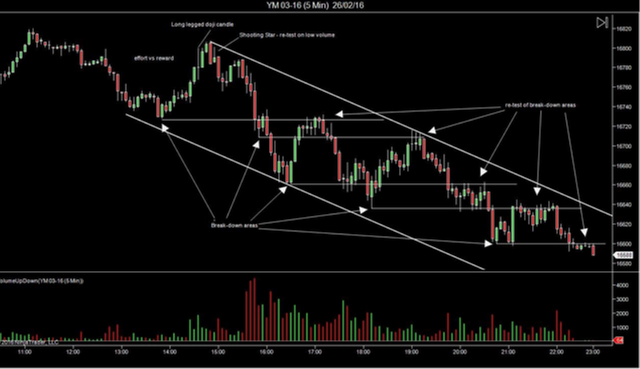

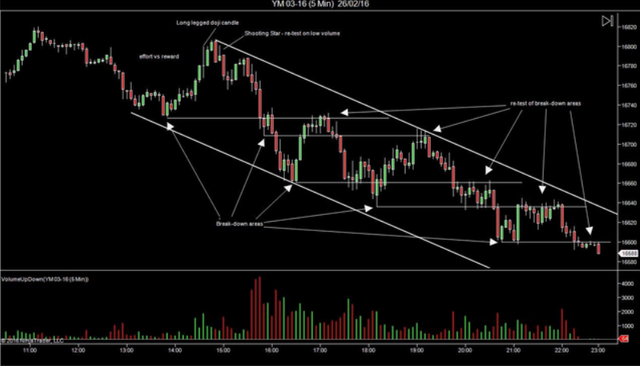

The Dow (YM) February 26, 2016

As can be seen in Example 1, the market tends to "visit" old break-down areas. When the market does, I look at how the volume behaves. I'm looking very much for what is called "effort vs. rewards "- so how far the price moves relative to how much volume is behind. It tells a lot about how much buying and selling hides in the individual candle - and throughout the "wave" that candle is a part of.

11:10 - 13:45

Here I see for the first time a tendency for the market to come down. There is a lot of volume coming into this down-move.

13:50 - 14:45

Now the market is moving again. Again, there is a lot of volume behind this up move, but it does not crystallize in a new high. This is to me the first sign that the market is about to turn - here we see again 'effort vs. rewards', which is one of my favorite setups.

14:50 - 15:05

Again good down-volume and a shooting star scandal, which is always a confirmation that bull-moves can be reversed.

15:10 - 15:25

Here are Bull's last convulsions. A move up, but almost no volume behind this up move. In addition, there is a hanging man scandal at the top of this up move, which is another sign that the market may be reversing.

This is followed by an "outside reversal" scandal to the downside, which for me is more than enough to shorte. In fact, I had gone short already after the shooting star scandal, but here is definitely an opportunity to add - which I do.

Subsequent is a classic day in DOW. The market is falling all day, and only increases to the previous support levels, after which it falls again. These lifts allow everyone to shorte as the volume falls on them all.

As seen from the two above examples, this technique goes on to follow the market when it turns. I sometimes need more than one attempt before I catch the new move up or down.

You've probably heard the phrase "try not to grab a falling knife" or "it's better to jump on a trend when it's in motion." Throughout my time as a trader, I have not gone on a trend when it was well on its way, but on the other hand I have caught many tops and bottoms. This can be done if you teach yourself to read priceaction combined with volume.

It also has the advantage that your stops do not have to be particularly big. My stops when I trade YM intraday are typically between 10 and 30 points. The three trades I made in Example 1 gave a return of 411 points. Here I have not at any time had a risk of more than 30 points. As a rule, my risk is 20 points or less - usually uses 2 min. and 700 tick charts to time my entry (intraday trading).

Once you have learned to read the market using priceaction and volume, yes, you can trade all markets. I've traded bonds, indexes, commodities, stocks, and currencies (however, are a little more complicated) this way, and they all behave more or less alike.

If you are new, I would suggest you start trading YM in a 1 min. graph. That way for you a lot of action, you can easily see how volume helps you read the market's movements.