about DGTX

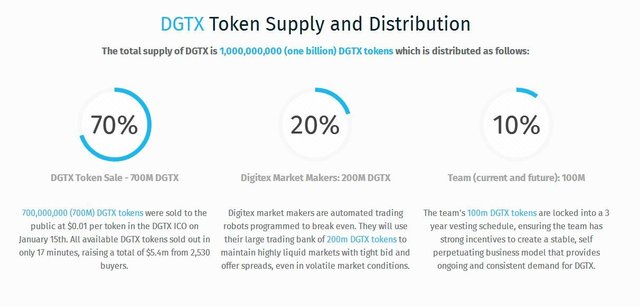

The success of the project is closely linked to its DGTX token, which must be maintained by the merchants to carry out purchase or sale operations of future contracts where profits and losses will be demoninized in DGTX tokens.The Token Offer DGTX / Initial Currency Offer (ICO) creates an initial offer of 1,000,000,000 of DGTX (one billion DGTX tokens), which will generate a demand once the futures market is booming because during the next two years no new tokens will be issued and after this the issuance of the same will be controlled by managing a small margin of inflation, which will be counteracted by the high demand for that moment.

DGTX is an ERC-223 token created in Ethereum where it will be possible to operate with different cryptocurrency pairs such as Bitcoin, Ether, Litecoin and many other cryptocurrencies in the Digitex exchange platform through integration with decentralized token exchange protocols such as swap .tech, 0xproject.com and bancor.com

What is Digitex?

Digitex is a commission-free futures exchange in which traders can buy and sell futures contracts on the price of BTC / USD, ETH / USD and LTC / USD without transaction charges in any transaction. The absence of fees associated with each negotiation combined with a high level of leverage and an intuitive trading interface allows traders to pursue high-volume and short-term trading strategies without their investment being curtailed by commissions. With its own native currency, called the DGTX token, the platform covers its costs by creating and selling a small number of new DGTX tokens each year instead of charging high transaction fees. It should be noted that only after 2 years of the initial sale of token is that they will reissue new tokens.

The problem of tariffs

When contracts are made to futures, the rates associated with the contract in other platforms could make an investment with a low rate of return to a bad investment that generates large losses to users. Only with an ecosystem where they do not exist is it possible to conceive a commercial strategy of a high volume of commercialization and low margin of profit, this type of strategies in another platform would result in losses of money but with The Digitex Futures Exchange the exchange of futures acquires another dimension.

Another feature that needs to be highlighted is that Digitexwill make it possible to reduce costs by increasing the volume of available contracts. This makes Digitex the ideal platform for small investments since they will not have associated costs in each transaction. Small and large investments will have better conditions that will make them more profitable than in other platforms.

The commissions in the blockchain

One of the most popular features within digital platforms that make use of blockchain technology is the charging of commissions for each of the transactions. The fee collection was the mechanism devised by the first ecosystems but this situation transferred the maintenance cost of the platform to the users that gave life to the cryptoactive platforms. With the popularization of cryptoactives and blockchain technology, commission charges have generated great discontent among users, as the increase in the number of transactions due to the growth of the community and the high commission rates make it impossible for that same community to have the opportunity to move your money.

A platform like Digitex where the transactions of the token holders will not have to pay high commission rates is highly attractive and provides the basis for other ecosystems that are based on blockchain technology to cover their maintenance expenses and obtain profits by issuing currency additional fee instead of charging fees.

Now the blockchain offers investors a great tool for the financial world: the Smart Contracts. Smart contracts is one of the last generation options for all those people who wish to invest or make transactions in the cryptographic world. Likewise, for the futures markets trading is one of the fundamental tools.

Why are tariffs problematic for users operating in futures?

Despite the low transaction costs of traditional futures markets, investors lose money with these exponentially as more investments are made, this simply means that if an investor has a large amount of money and decides to operate in the futures markets, the greater the volume of transactions, the more money he will lose for the cost of these, even though he has generated profits, a quite problematic situation since these rewards are not fully exploited and that is what Digitex changes when offering investments with zero cost in their transactions.

.png)

For more information watch te video

https://digitexfutures.com/get-early-access/

https://twitter.com/jerry_nusrat/status/1042015299376013312

Digitextwitter

Digitex2018

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit