Still new here and just want to spread information. Is this considered plagiarism? I have a link at the bottom directing to the original post

What is a 'Blockchain'

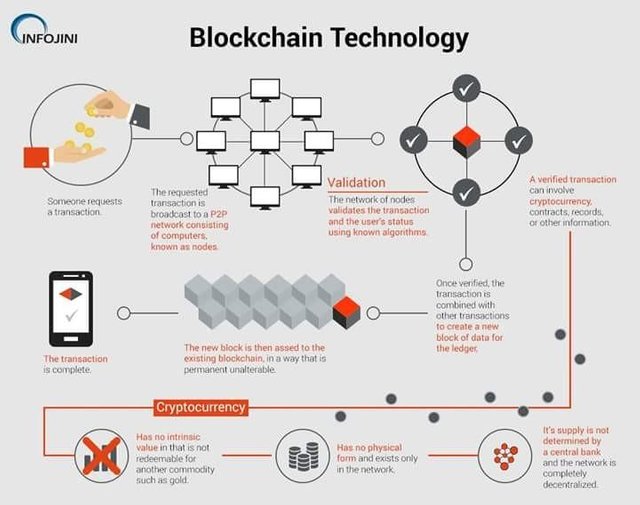

A blockchain is a digitized, decentralized, public ledger of all cryptocurrency transactions. Constantly growing as ‘completed’ blocks (the most recent transactions) are recorded and added to it in chronological order, it allows market participants to keep track of digital currency transactions without central recordkeeping. Each node (a computer connected to the network) gets a copy of the blockchain, which is downloaded automatically.

Originally developed as the accounting method for the virtual currency Bitcoin, blockchains – which use what's known as distributed ledger technology (DLT) – are appearing in a variety of commercial applications today. Currently, the technology is primarily used to verify transactions, within digital currencies though it is possible to digitize, code and insert practically any document into the blockchain. Doing so creates an indelible record that cannot be changed; furthermore, the record’s authenticity can be verified by the entire community using the blockchain instead of a single centralized authority.

BREAKING DOWN 'Blockchain'

A block is the ‘current’ part of a blockchain, which records some or all of the recent transactions. Once completed, a block goes into the blockchain as a permanent database. Each time a block gets completed, a new one is generated. There is a countless number of such blocks in the blockchain, connected to each other (like links in a chain) in proper linear, chronological order. Every block contains a hash of the previous block. The blockchain has complete information about different user addresses and their balances right from the genesis block to the most recently completed block.

The blockchain was designed so these transactions are immutable, meaning they cannot be deleted. The blocks are added through cryptography, ensuring that they remain meddle-proof: The data can be distributed, but not copied. However, the ever-growing size of the blockchain is considered by some to be a problem, creating issues of storage and synchronization.

Blockchains and Bitcoin

The blockchain is perhaps the main technological innovation of Bitcoin. Bitcoin isn’t regulated by a central authority. Instead, its users dictate and validate transactions when one person pays another for goods or services, eliminating the need for a third party to process or store payments. The completed transaction is publicly recorded into blocks and eventually into the blockchain, where it’s verified and relayed by other Bitcoin users. On average, a new block is appended to the blockchain every 10 minutes, through mining.

Based on the Bitcoin protocol, the blockchain database is shared by all nodes participating in a system. Upon joining the network, each connected computer receives a copy of the blockchain, which has records, and stands as proof of, every transaction ever executed. It can thus provide insight about facts like how much value belonged a particular address at any point in the past. Blockchain.info provides access to the entire Bitcoin blockchain.

Extensions of Blockchains

To use conventional banking as an analogy, the blockchain is like a full history of a financial institution's transactions, and each block is like an individual bank statement. But because it's a distributed database system, serving as an open electronic ledger, a blockchain can simplify business operations for all parties. For these reasons, the technology is attracting not only financial institutions and stock exchanges, but many others in the fields of music, diamonds, insurance, and Internet of Things (IOT) devices. Advocates have also suggested that this kind of electronic ledger system could be usefully applied to voting systems, weapon or vehicle registrations by state governments, medical records, or even to confirm ownership of antiquities or artwork.

Given the potential of this distributed ledger technology (DLT) to simplify current business operations, new models based on blockchain have already begun to replace the expensive and inefficient accounting and payment networks of the financial industry. Blockchain technology could free up billions of dollars: A recent Goldman Sachs report suggested that it could save stock market operators up to $6 billion a year.

While banks were initially hesitant to explore these technologies because of their concerns about potential fraud, they have started looking into how the blockchain might provide generous cost savings by allowing back-office settlement systems to process trades, transfers and other transactions much faster.

In fact, the first international blockchain transaction was completed on October 24, 2016. Brokered by the Commonwealth Bank of Australia and Wells Fargo & Co (WFC), the $35,000 deal involved Australian cotton trader Brighann Cotton Marketing, which purchased 88 bales cotton from its U.S. division in Texas and sent it to Qingdao, China.

Blockchains and Tech Companies

Attracted by the idea of removing the middleman and moving towards democratization and decentralization, tech startups are adopting blockchain technology with the goal of disrupting a variety of industries.

Among the startups leveraging blockchain technology for IOT devices is 21 Inc. The Silicon Valley-based startup received a total of $116 million in funding in 2015. According to the firm, the funding will be used to embed Bitcoin mining chips into connected IOT devices and cell phones.

BTCJam, a P2P lending platform headquartered in San Francisco, specializes in providing Bitcoin-based loans. Over the last year, the company has lent more than $15 million.

Storj is just one company that is currently beta-testing the concept of developing cloud storage based on a blockchain-powered network, with the goal of improving security while decreasing users' dependency on a single storage provider's centralized system. The company even offers users the opportunity to rent out storage capacity they do not need, similar to the way that property owners rent out extra rooms on Airbnb.

ProofofExistence one of the first non-financial companies to utilize blockchains, is a platform for executing contracts. It uses DLT to store encrypted information, thus enabling a transaction that cannot be replicated to be linked to a unique document.

Even established firms are interested. Microsoft Corporation (MSFT) has also expressed interest in blockchain technology, having recently formed a partnership with blockchain firm ConsenSys. In December 2015, Microsoft and ConsenSys announced Ethereum Blockchain as a Service (EBaaS) on Azure — Microsoft’s cloud computing platform — to provide a single-click, cloud-based environment to clients and developers. In June 2016, the two companies started developing an open source, blockchain-based identity system for people, products, apps and services.

Advantages of Blockchains

Efficiencies resulting from DLT can add up to some serious cost savings. DLT systems make it possible for businesses and banks to streamline internal operations, dramatically reducing the expense, mistakes, and delays caused by traditional methods for reconciliation of records.

The widespread adoption of DLT will bring enormous cost savings in three areas, advocates say:

Electronic ledgers are much cheaper to maintain than traditional accounting systems; the employee headcount in back offices can be greatly reduced.

Nearly fully automated DLT systems result in far fewer errors and the elimination of repetitive confirmation steps.

Minimizing the processing delay also means less capital being held against the risks of pending transactions.

In addition, some smaller number of millions will be saved by shrinking the amount of capital that broker/dealers are required to put up to back unsettled, outstanding trades. Greater transparency and ease of auditing should lead to savings in anti-money laundering regulatory compliance costs, too.

Blockchain's removal of almost all human involvement in processing is particularly beneficial in cross-border trades, which usually take much longer because of time-zone issues and the fact that all parties must confirm payment processing. Blockchain systems can set up smart contracts or payments triggered when certain conditions are met. The blockchain cotton transaction mentioned above, for example, used a smart contract that automatically made partial payments when the cotton shipment reached specific geographic milestones.

Financial Industry Blockchain Initiatives

R3 CEV,a fintech innovation company, and a consortium of more than 80 of the world’s biggest financial institutions is bankrolling research into methods to harness the speed, accuracy, and efficiency of the blockchain. In 2016, it successfully trialed five distinct blockchain technologies in parallel, using multiple cloud technology providers in a first-of-its-kind test, and is currently marketing its Corda, a "financial-grade" distributed ledger platform for commercial use.

In 2017, after three years of work, Goldman Sachs Group Inc. (NYSE: GS) received a patent for the SETLcoin, which would create near instantaneous trade settlement times (see Here's How the SETLcoin Trade System Will Work).

In 2016, four major banks came together to develop the utility settlement coin (USC), a new digital currency whose use (mainly to buy securities) would be recorded via blockchain. Led by UBS Group AG (NYSE: UBS), they include Bank of New York Mellon Corporation (NYSE: BK), Deutsche Bank AG (NYSE: DB) and Banco Santander S.A. (NYSE: SAN), along with broker ICAP PLC (LON: IAP). In 2017, six more banks joined them: Barclays Bank, Credit Suisse Group AG (CS), Canadian Imperial Bank of Commerce, HSBC Holdings PLC (HSBC), MUFG and State Street Corp (NYSE: STT). The consortium is aiming for a 2018 commercial release.

However, for that to happen, a USC-based system or its competitor would need to obtain the approval of commercial institutions, central banks and regulators. And, although it is clearly almost there, blockchain technology is not quite ready for prime time.

Hurdles in Adopting Blockchain Technology

The roadblocks to DLT today are not just technical. The real challenge is politics, regulatory approval, and the many thousands of hours of custom software design and front and back-end programming still required to link up the new blockchain ledgers to current business networks.

Problems that still need to be addressed include:

DLT must interface with other parts of the operational processes seamlessly. Blockchain should enable more rapid setup, training, and reduce problem resolution time. Achieving the efficiency gains must be easy enough/cheap enough for all parties involved to grasp and leverage.

Security also remains a concern. Several central banks, including the Federal Reserve, the Bank of Canada and the Bank of England, have launched investigations into digital currencies. According to a February 2015 Bank of England research report: “Further research would also be required to devise a system which could utilize distributed ledger technology without compromising a central bank’s ability to control its currency and secure the system against systemic attack.”

Banks are not interested in an open-source model for identity. Both banks and regulators want to maintain close control. The development of a single digital identity passport authorizer is a critical next step.

Regulation is also critical in creating an open digital environment for commerce and financial transactions. Current physical certificates must be digitized to gain the full benefits of a fully electronic system. Other questions to be answered include: Who is responsible for maintaining and managing the blockchain? Who admits new participants to the blockchain? Who validates transactions? and who determines who sees which transactions?

Investing in Blockchains

Investors interested in getting on the blockchain technology bandwagon will find it is now easier than ever to do so. In 2015, the venture capital concern Digital Currency Group launched, intending to build what it refers to as "the largest early-stage investment portfolio in the digital currency and blockchain ecosystem." Additionally, according to a report published by the American Software-as-a-Service (SaaS) company NASDAQ Private Market, the amount of venture capital being funneled into cryptocurrency-using firms was anticipated to exceed $1 billion. Companies have even become so interested in the technology that many have begun to play around with the idea of creating their own private blockchains.

Nevertheless, blockchain startups are not without challenges. Among the most significant is the fact that most consumers simply do not understand the extremely complicated concept of blockchain technology. In order to overcome this challenge, companies will need to find ways to precisely explain what they do in easily understandable language – and how they intend to deal with issues like secure online transactions and consumer privacy.

The Bottom Line

Given the incredible opportunity for decentralization, blockchain technology offers the ability to create businesses and operations that are both flexible and secure. Whether companies will succeed in deploying blockchain technology to create products and services consumers will trust and adopt remains to be seen. Nevertheless, this is definitely a space investors should watch. The demand for blockchain-based services is on the rise, and the technology is maturing and advancing at a rapid pace.

The potential applications for blockchain technology are almost without limit. At the moment, several of these applications are still either in the development stage or in beta testing. With more money being poured into blockchain-based startups, consumers should not be surprised to see DLT services and products becoming more mainstream in the near future.

Read more: Blockchain Definition | Investopedia https://www.investopedia.com/terms/b/blockchain.asp#ixzz53Esih6et

Follow us: Investopedia on Facebook

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://oduberinvestments.jimdo.com/what-is-blockchain/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit